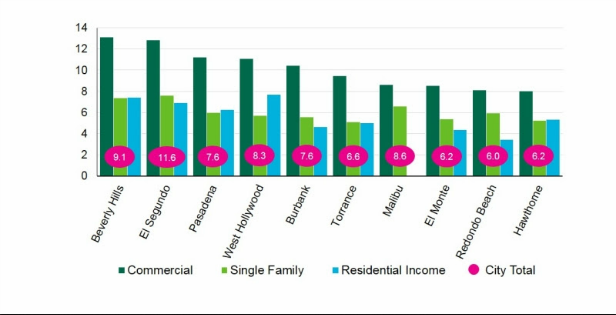

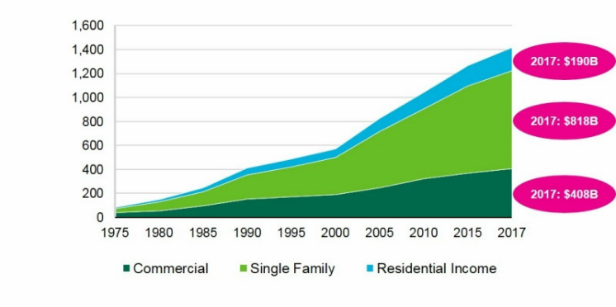

Los Angeles County commercial real estate values grew rapidly in 2017, according to research from CBRE. Commercial values hit $408 billion last year, rising at a faster growth rate than single-family home values. Beverly Hills and El Segundo lead the growth, with Beverly Hills commercial property values growing 13.1% and El Segundo commercial values growing 11.6%. That chart above shows the top L.A. submarkets for property value growth, which includes Torrance, Hawthorne and Redondo Beach. Overall, single-family property values remain double commercial property values at $808 billion. Take a look at the chart above for a closer look at the growth in each sector. To find out more about what is driving the growth of commercial values and why some submarkets made the list while others didn’t, we sat down with David Nusbaum, senior research analyst at CBRE, for interview.

GlobeSt.com: What is driving commercial property values to all-time highs in Los Angeles?

David Nusbaum: There are a number of factors, one of the primary ones being that Los Angeles remains a top target for real estate investors, both domestic and foreign. Our latest Investor Intentions Survey just revealed that LA is at the top of the list for those looking to purchase commercial property. Our metro beat out New York, which was in third place, and Dallas, which came in second. In addition, LA has seen some new construction, which is also helping to buoy values. Property values have been rising for seven straight years.

GlobeSt.com: Is it unusual for commercial properties to increase at a faster pace than residential properties?

Nusbaum: Yes. In general, single-family home values have increased at a faster rate than commercial properties. This could be attributed to several factors. Commercial properties take more time to develop than single-family homes through the acquisition, entitlement and construction process. Yet this latest data shows that in many cities, commercial property increased in value at a higher percentage than single-family homes. LA has been high on the list of investors, which has been driving commercial properties values as well as some new construction that has been underway.

GlobeSt.com: Last year, we saw an abrupt decline in Chinese investment in the US, and L.A. was a top market for that capital. Has that had an impact on L.A. property values, and do you expect it to?

Nusbaum: There is still strong demand for commercial property in L.A. County. Other countries have increased their investments in the LA market and institutional investors have sought new opportunities in cities such as El Segundo and Glendale, which are now being viewed as core markets. Traditionally, these cities were seen as secondary markets and investors wanted prime properties primarily in downtown and West L.A. markets.

GlobeSt.com: Were you surprised at the list of L.A. submarkets to see the biggest increases? I am specifically thinking of markets like Torrance, Hawthorne, Redondo Beach and El Monte. Equally, I was surprised to see that markets like Hollywood and Downtown Los Angeles were not on the list. Tell me about what is driving major increases in some of these less headline-grabbing markets.

Nusbaum: South Bay markets such as El Segundo, Torrance, Redondo Beach and Hawthorne have benefited from construction of the Metro rail line. They have strong live-work-play dynamics that make them attractive to companies seeking lower rents than West L.A. markets such as Santa Monica. Areas such as El Segundo have had lots of creative office conversions that appeal to tech and entertainment tenants. Hollywood and Downtown Los Angeles are not individual cities, so their statistics are included in the overall Los Angeles data.

GlobeSt.com: I was also surprised to that Santa Monica values declined last year. What drove property values in the market down?

Nusbaum: Santa Monica has had very little new construction and very few properties traded hands. Stringent and often times prohibitive zoning regulations and proposed ordinances limit interest from commercial developers in that city.

GlobeSt.com: What is your outlook for commercial property values in 2018?

Nusbaum: Market fundamentals remain strong for the Greater LA region. Our economic outlook projects continued increases in office rents, positive net absorption and declining vacancy. Our area’s economy is very diverse, which bodes well for continued economic expansion. Plus, the convergence of tech and media will continue to drive companies’ thirsty for more space as they build their digital content offerings..

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.