The property is in a dense infill market, but near the interstates needed by tenants.

The property is in a dense infill market, but near the interstates needed by tenants.

INDIANAPOLIS—Institutional money is flowing into the industrial market, so much so that many potential buyers seek to avoid the intense competition by looking beyond the core metro areas.

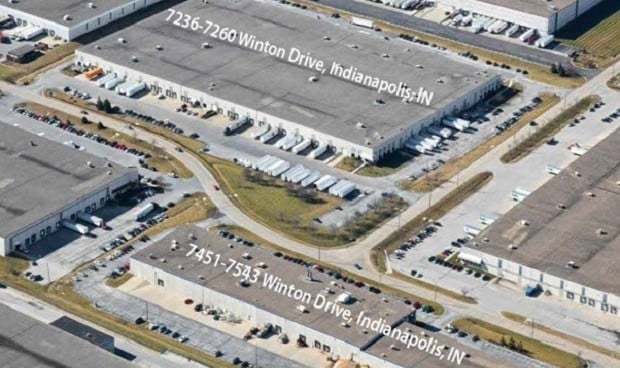

That’s why Avison Young officials have high hopes that they will attract institutional investors, perhaps even from overseas, for an 480,524-square-foot industrial portfolio located in Indianapolis’ Park 100 industrial park. The portfolio includes two multi-tenant, institutional-quality buildings located at 7236-7260 Winton Dr. and 7451-7543 Winton Dr., just northwest of Indianapolis and with easy access to I-465 and I-65.

“It’s a growing trend; investors are looking for solid assets that are a few years old, and not located in major markets,” Avison Young principal Erik Foster tells GlobeSt.com. Foster and Mike Wilson, both based in the company’s Chicago office and members of the firm’s national industrial capital markets group, secured the exclusive listing for the property and will represent the seller, an institutional fund advisor.

Buildings of this kind typically have stronger pricing than core product, especially if they are in markets with strong records of rent growth and absorption. Investors can expect yields between 50 bps and 150 bps higher than comparable properties in the top five core markets, Foster says.

This portfolio is 100% leased, he adds, “and it’s in a market that’s vibrant.”

In late 2015, the vacancy rate in the metro area was at an already-low 5.0%, and by late 2016 it fell another 140 bps to just 3.6%, according to a report from Cushman & Wakefield. That steep decline came after a construction boom that saw developers complete millions of square feet of new buildings, mostly in response to intense demand from distributors and warehouse users.

Furthermore, says Foster, the Winton Dr. portfolio “is institutional-quality construction; it was built by Duke.” And it has also been maintained and renovated over time to meet the specific requirements of the tenants. Among the national corporate tenants are Pitney Bowes, Ryder Integrated Logistics, 3M, and Polaris Laboratories.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.