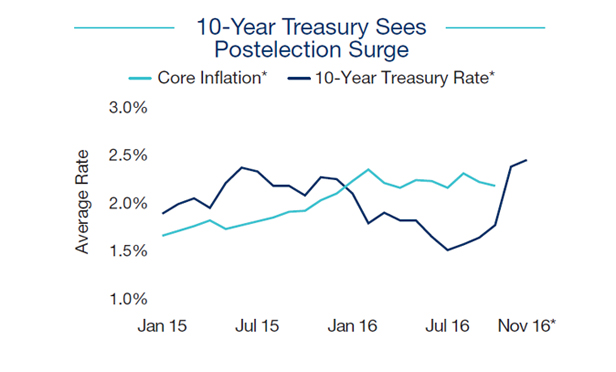

CALABASAS, CA–The results of the presidential election have had impacts that are rippling through the real estate industry and the general market. One of the most dramatic of these has been a “rapid, 60-basis-point jump in the yield on the US 10- year Treasury,” as Marcus & Millichap explains in its “Special Report: Emerging Trends.”

Right now, while there is a bit of a wait-and-see feeling in the air, the outlook is pretty positive, “The unanticipated results of the presidential election sparked a shift in several macro-level dynamics that have begun to ripple through the commercial real estate market,” the Marcus & Millichap researchers explain. The jump in yield, “combines with expectations of changes to the tax code in 2017 to inspire many commercial real estate investors to step back and reassess their strategies.”

Marcus & Millichap anticipates strong property performance for the coming year–but with asterisks. “The proposed policy changes of the new administration have inspired numerous economists to boost their growth forecasts for 2017, which bodes well for commercial real estate performance and fundamentals,” says the paper. And this is true despite the “near-term hurdle” that a strengthening dollar presents to foreign investors.

“Although foreign capital comprises a relatively small portion of the US commercial property buyer pool, a temporary pullback in activity by these investors because of their loss of purchasing power could influence total transactional counts for the fourth quarter and affect asset pricing,” says the report.

But within those policy changes are a bucket-full of renovations to the tax code. In classic good-news-bad-news style, the proposed reduction in capital gains has investors smiling, while the closing of carried-interest loopholes not so much.

“Fiscal policies centered upon reduced taxes could accelerate short-term economic growth and intensify inflationary pressure,” says Marcus & Millichap. “The Federal Reserve will continue to monitor the impact of fiscal policy on economic trends and could initiate a campaign of more frequent and aggressive rate increases to prevent the economy from potential overheating.”

And that is already beginning to happen with the Fed’s decision in December to hike rates by a quarter of a point.

Despite those asterisks, the overall outlook as seen by Marcus & Millichap is optimistic. “A strengthened economic outlook and positive performance outlook will support long-term commercial real estate investor demand,” the paper concludes.

For more detail on commercial real estate trends, please click here.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.