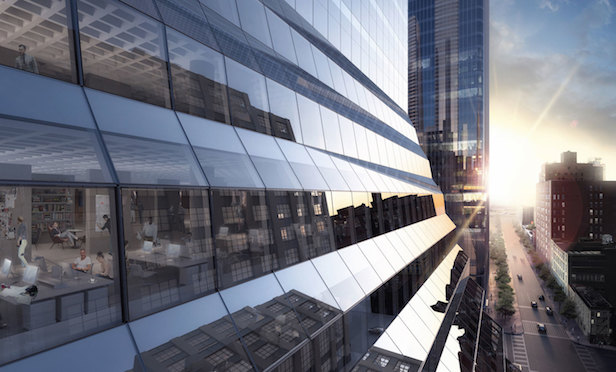

Brookfield’s repositioned 5 Manhattan West will see JP Morgan triple the space occupied by its FinTech platform. (Photo: REX Architecture)

Brookfield’s repositioned 5 Manhattan West will see JP Morgan triple the space occupied by its FinTech platform. (Photo: REX Architecture)

NEW YORK CITY—The TAMI sector (the acronym stands for technology, advertising, media and information) has held pride of place when it comes to office leasing in Manhattan over the past few years. Thus far in 2017, though, the office-using sector that stole the crown from financial services has handed it off to a new ruler. Or more accurately, handed it back to the previous one, but with a twist.

The financial sector’s year-to-date share of office leases measuring 10,000 square feet or more has been 33.5%, compared to an average of 24% between 2014 and 2016, according to data released Thursday by Cushman & Wakefield at its mid-year New York Tri-State Commercial Real Estate Overview & Outlook media briefing. At the same time, TAMI tenants’ share declined from 28.8% over the past three years to 20.4% YTD. Either way, though, the two sectors taken together continue to represent more than half of all Manhattan office leasing volume.

However, principal economist Ken McCarthy pointed out that while the 8,300 financial services jobs added between January and April of this year represented the sector’s best four months on record for hiring in Manhattan, an increasing share of those jobs was in tech-oriented functions. It’s a trend, he said, that bears watching.

And Dale Schlather, executive vice chairman, office leasing, cited the 305,000-square-foot expansion of JP Morgan’s space of its FinTech digital platform at Brookfield Property Partners’ 5 Manhattan West, a deal arranged by Cushman & Wakefield. That June transaction in and of itself represented a 4% portion of financial services’ 33.5% slice of YTD leasing.

More broadly, said Schlather, “Market fundamentals are holding up, but new construction deliveries and continued densification are creating pressure on effective rents.” Manhattan will see 15.2 million square feet of new office space coming on line between 2017 and 2022, much of it now rising on the Far West Side and nearly half of that scheduled for delivery in 2019.

A longer-term trend has been the densification of office space. Whereas space per employee averaged 291 square feet in 2001, today it’s 257 square feet. Manhattan’s office-using employment base is now larger by 120,000 employees compared to 16 years ago, while the borough has lost nearly 14 million square feet of space.

This compression has been especially pronounced in the legal sector, Schlather said. The long-term average for square footage per attorney was 1,100, while today it’s headed in the direction of 600 or even 550 square feet.

The effects have been most pronounced in Midtown’s class A space. Taking rents for new leases in these properties have declined 2% since 2015 to $79.40 per square feet. The drop in net effective rents during this time has been even steeper: a 9.6% decline to $63.65 per square foot, due largely to an increase in tenant improvement allowances.

Schlather and McCarthy presented as part of a panel of leasing and capital markets powerhouses during Thursday’s briefing. They were joined by Joanne Podell, executive vice chairman, retail services; Stan Danzig, vice chairman, industrial; Doug Harmon, chairman, capital markets; and Robert Knakal, chairman, New York investment sales. John Santora, vice chairman and president, New York tri-state region, offered opening and closing comments, highlighting the effects of disruptiveness seen across commercial real estate since Cushman & Wakefield’s year-end briefing six months ago.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.