Here is a roundup of the latest leases, sales and other transactions in the Northeast middle markets.

NEWS & NOTABLES

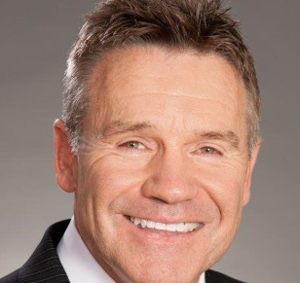

PHILADELPHIA—Mike McCurdy has joined Cushman & Wakefield here as managing principal for the firm’s regional offices, including Central PA, the Delaware Valley, and Southern New Jersey. The industry veteran of more than 25 years joins Cushman from JLL, where he served for nine years, most recently as an international director, and at Trammell Crow, where he managed some of the firm’s top clients in the Northeast firm.

PHILADELPHIA—Mike McCurdy has joined Cushman & Wakefield here as managing principal for the firm’s regional offices, including Central PA, the Delaware Valley, and Southern New Jersey. The industry veteran of more than 25 years joins Cushman from JLL, where he served for nine years, most recently as an international director, and at Trammell Crow, where he managed some of the firm’s top clients in the Northeast firm.

BOSTON—NGKF Capital Markets received Investment Sale of the Year honors at the annual CBA Achievement Awards for the group’s involvement in the sale of One Kendall Square in Cambridge, MA. The team—which is led by US head of capital markets Robert Griffin, vice chairman Edward Maher and executive managing director Matthew Pullen— oversaw the sale of the 11-asset mixed-use campus to Alexandria Real Estate Equities on behalf of DivcoWest. The deal was done in conjunction with NGKF executive managing directors Mark Winters and David Townsend. Trading for $725 million, One Kendall Square set the record for the Boston area’s largest sale of 2016 on a total transaction size and per–foot basis (based on existing building area)

BOSTON—NGKF Capital Markets received Investment Sale of the Year honors at the annual CBA Achievement Awards for the group’s involvement in the sale of One Kendall Square in Cambridge, MA. The team—which is led by US head of capital markets Robert Griffin, vice chairman Edward Maher and executive managing director Matthew Pullen— oversaw the sale of the 11-asset mixed-use campus to Alexandria Real Estate Equities on behalf of DivcoWest. The deal was done in conjunction with NGKF executive managing directors Mark Winters and David Townsend. Trading for $725 million, One Kendall Square set the record for the Boston area’s largest sale of 2016 on a total transaction size and per–foot basis (based on existing building area)

MONEY MOVES

STAMFORD, CT—Hunt Mortgage Group has provided a $28 million first mortgage bridge loan to facilitate the recapitalization and renovation of Park Square West Apartments, a mixed-use multifamily and commercial property here. Located at 101 Summer St., the nine-story property is comprised of 143 residential units. The loan is structured as a 24-month floating rate loan with three options to extend the term of the loan for a period of 12 months each. The residential component is currently 92% occupied and the commercial component is 100% occupied.

STAMFORD, CT—Hunt Mortgage Group has provided a $28 million first mortgage bridge loan to facilitate the recapitalization and renovation of Park Square West Apartments, a mixed-use multifamily and commercial property here. Located at 101 Summer St., the nine-story property is comprised of 143 residential units. The loan is structured as a 24-month floating rate loan with three options to extend the term of the loan for a period of 12 months each. The residential component is currently 92% occupied and the commercial component is 100% occupied.

ACQUISITIONS/DISPOSITIONS

TARRYTOWN, NY—GHP Office Realty has acquired 660 White Plains Rd. here from RA 660 White Plains Rd., an entity controlled by RNY Property Trust. The six-story, Class-A building totals 279,000 square feet and sits on approximately 11 acres in Tarrytown Corporate Center. Cushman & Wakefield’s Andrew Merin headed the transaction with Metropolitan Area Capital Markets Group team members David Bernhaut, Gary Gabriel, Brian Whitmer, Frank DiTommaso and Al Mirin. “The property is 87% leased to a diverse rent roll of over 40 tenants ranging in size from less than 1,000 square feet to nearly 60,000 square feet,” says Merin.

TARRYTOWN, NY—GHP Office Realty has acquired 660 White Plains Rd. here from RA 660 White Plains Rd., an entity controlled by RNY Property Trust. The six-story, Class-A building totals 279,000 square feet and sits on approximately 11 acres in Tarrytown Corporate Center. Cushman & Wakefield’s Andrew Merin headed the transaction with Metropolitan Area Capital Markets Group team members David Bernhaut, Gary Gabriel, Brian Whitmer, Frank DiTommaso and Al Mirin. “The property is 87% leased to a diverse rent roll of over 40 tenants ranging in size from less than 1,000 square feet to nearly 60,000 square feet,” says Merin.

POUGHKEEPSIE, NY—Avanath Capital Managementhas acquired Grand Pointe Park, a 156-unit workforce housing here for 19.3 million. Dmitry Gourkine of CBRE Affordable Housing represented both the buyer and the seller in this deal. The property is 98% occupied and average rent in the area reportedly is under $1,500.

POUGHKEEPSIE, NY—Avanath Capital Managementhas acquired Grand Pointe Park, a 156-unit workforce housing here for 19.3 million. Dmitry Gourkine of CBRE Affordable Housing represented both the buyer and the seller in this deal. The property is 98% occupied and average rent in the area reportedly is under $1,500.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.