Absorption and vacancy, New Jersey Industrial Market, First Quarter of 2017

Absorption and vacancy, New Jersey Industrial Market, First Quarter of 2017

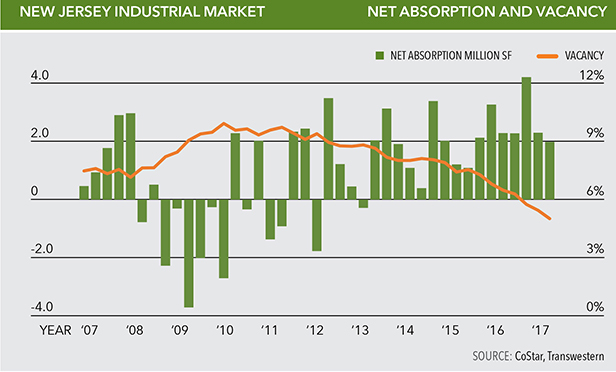

PARSIPPANY, NJ—Following consecutive years of record growth, the Port of New York and New Jersey’s cargo volume for 2016 finished slightly below the record-setting 2015 level, but is ahead of last year’s pace as of February 2017. This rising tide of cargo is driving the New Jersey industrial market’s vacancy rate to its lowest level in nearly 17 years, according to Transwestern’s First-Quarter 2017 Industrial Market Report.

The current vacancy rate of 5.1 percent, a significant improvement from 6.5 percent a year ago, can be attributed to 16 consecutive quarters of positive net absorption – 15 of which saw more than a million square feet absorbed. First quarter 2017 was the third consecutive quarter during which more than 10 million square feet was absorbed over a 12-month period – a feat that hadn’t been achieved since 2003.

“Continued leasing in newly constructed buildings demonstrates the pent up demand for top-quality space,” Transwestern’s New Jersey research director, Matt Dolly, tells GlobeSt.com exclusively. “As the long pipeline of new projects in New Jersey fill up with tenants, its integral that the state continues to address the shortage of qualified workers within its manufacturing industry.”

Because of the high level of leasing activity, industrial rents continue to exceed all-time highs. During the first quarter, rents reached a new peak of $6.98 per square foot – a year-over-year increase of 14 percent.

Lori Zuck, left, Transwestern managing director, and Matthew Dolly, New Jersey research director

Lori Zuck, left, Transwestern managing director, and Matthew Dolly, New Jersey research director

“As New Jersey continues to set new records for port volume, demand for modern warehouse space is as strong as ever, and manufacturing is picking up steam,” said Transwestern managing director Lori Zuck. “In turn, we’re gradually seeing new product being delivered throughout the state, and while the Turnpike remains the primary corridor, development has spread to the outer rings of the region’s industrial market.”

The first quarter saw 10 leases greater than 150,000 square feet, including five new leases – four of which are in newly constructed properties. The largest lease of the quarter was signed by Target, which inked a deal to occupy a 718,000-square-foot building at BridgePort Logistics Center in Perth Amboy, where developer Bridge Development Partners has revived a formerly contaminated site.

“New Jersey’s industrial market is off to a quick start in 2017, as we saw increases in rents in 21 of the 25 submarkets that we track,” says Dolly. “And we expect the high level of activity to continue through the remainder of the year, as consumer confidence is currently at its highest level since December 2000 – a good sign for the retail and wholesale sectors, which are growing rapidly in New Jersey.”

Other market highlights include:

- The market experienced the strongest quarterly improvement in vacancy since fourth-quarter 2015.

- The most active submarkets during the past 12 months were Exit 8A, Exit 10/Edison and the Meadowlands.

- 10.3 million square feet of industrial space are currently under construction in New Jersey.

- The average asking rent for manufacturing buildings averaged $6.52 per square foot, considerably higher than $4.98 per square foot five years ago.

Correction, 4/17/2017, 5:00 p.m.: An earlier version of this story carried a different photo of Lori Zuck. Transwestern provided a new photo, which has replaced the old image.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.