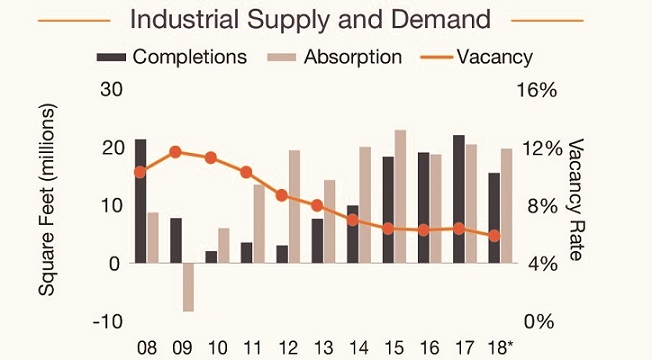

New development will slow down somewhat in 2018, and be outpaced by net absorption. Chart by Marcus & Millichap.

New development will slow down somewhat in 2018, and be outpaced by net absorption. Chart by Marcus & Millichap.

CHICAGO—The road to recovery has been a long one for the Chicago region. But the explosion of demand for industrial product in the past few years, mostly to due to the rise of e-commerce, has fully revived the sector. A new forecast by Marcus & Millichap says the vacancy rate will sink to just 5.9% this year, the lowest in a decade.

What’s remarkable is that will be after developers completed tens of millions of square feet of new product in just three years, including 25 million in the I-55 Corridor near Joliet alone. But this revival has spread far beyond that traditional distribution hub.

“Communities around O’Hare International Airport also remain focal points for developers,” according to the forecast. “Distributors seek space in this part of the metro due to its quick airport access as well as close proximity to some of Chicago’s most traveled thoroughfares.”

As a result, vacancy there sits at just above four percent. “In addition, rents are relatively affordable as they nearly align with the market average. Though tenants sacrifice distance to the market’s most densely populated neighborhoods by setting up shop in WI, they make up for it with rental rates in the mid-$4 per square foot range, almost $7 lower than some parts of North Chicago.”

4050 Rock Creek Blvd. is a 291,728 SF industrial facility in Rock Run Business Park, Joliet, IL, recently built by by IDI.

4050 Rock Creek Blvd. is a 291,728 SF industrial facility in Rock Run Business Park, Joliet, IL, recently built by by IDI.

Kenosha County in WI has also come into its own as an important distribution hub, M&M says. It “should also continue to log tight vacancy through the remainder of the year as rents are significantly lower than some other northern sections of the metro.” The 16 speculative projects totaling 4.8 million square feet completed since 2014 are now 73% leased, and developers currently have five speculative construction projects totaling 1.6 million square feet under construction and will soon break ground on an additional two projects totaling 771,095 square feet.

New industrial development closely tracks job creation, and the Chicago should be relatively healthy this year. M&M forecasts the region will add 43,000 jobs this year and developers will add another 15.5 million square feet to the industrial inventory. That’s a solid number, although somewhat below the previous three-year average of 19.8 million square feet.

Still, the tightening market should keep rental gains strong for the rest of the year, and push the metro’s average asking rent up 5.2% to $5.71 per square foot.

The region should also continue to see an influx of institutional capital, M&M says. “These buyers target larger assets, typically above 100,000 square feet, around O’Hare International Airport as well as properties in the I-55 corridor near Bolingbrook.” The cap rates here sit in the upper-7% band. Private investors, meanwhile, will continue their focus on the region’s many older warehouses, especially in Chicago’s inner-ring suburbs. “Depending on location, yields in the high-9% realm can be achieved for some of these class C assets.”

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.