Of the major metros, only Atlanta and Washington DC are at a lower volume than Dallas' office market, with a volume of $4.11 billion and $4.14 billion, respectively, compared to Dallas at $4.46 billion, according to data from Real Capital Analytics and CoStar. However, Dallas comes in second only to Los Angeles on the top 10 US cities by transaction volume with Los Angeles at 336 and Dallas at 196. Transwestern says markets with sustainable job creation and industries will continue to see high demand, such as biotech, high tech, education, healthcare, financial services, energy, which Dallas has in spades. According to Transwestern's analysis, Dallas has a diversified economy with growth in multiple industries combined with relatively low cost of living, finance, information technology and healthcare. This attracts major companies to relocate headquarters or regional headquarters, in turn attracting ancillary businesses, which is happening on a widespread basis. Dallas has especially attractive urbanized suburban locations with live/work/ play elements and walkability. Its sound office fundamentals are driving up rent and lowering vacancy.—Lisa Brown

BY THE NUMBERS

AUSTIN, TX—Austin is grappling with the inevitable dilemmas that come with rapid growth, according to Adam Kruger, attorney and counselor, Kruger Carson PLLC. On one hand, the city's traffic problems could be mitigated by increased density and mass transit. On the other, existing neighborhoods usually don't want greater density in their own back yards. The Grove at Shoal Creek, a 75-acre tract at 45th Street and Bull Creek, is the latest case in point. Developers contend the project advances Imagine Austin, a 30-year plan for growing Austin “in a compact and connected way.” The Grove would include 1,700 housing units, 360,000 square feet of office and retail space, and park space. Proponents argue the project would produce badly needed affordable housing for the center of the city. The Grove property, which today is mainly green space, had been owned by the State of Texas until 2014. The project would have about one fourth of the land remain as open space or park land. Predictably, the project has strong opposition. A grassroots neighborhood group says the estimated 19,000 vehicle trips the project would add would be a traffic nightmare. So it's the usual conflict: The need to increase population density in order to improve mobility versus the not-in-my-back-yard mentality, says Carson.

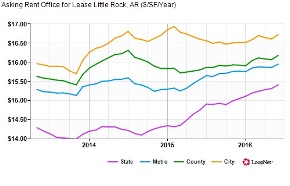

LITTLE ROCK, AR—The average asking rental rate per square foot per year for office properties as of June was $16.72, according to LoopNet. This represents an increase of 0.2% compared to the prior three months, with an increase of 0.7% year-over-year. Countywide average rental rates in Little Rock are 0.4% higher at $16.18 per square foot/year for office properties currently for lease.

NEWS AND NOTABLES

AUSTIN, TX—NAI Partners, one of the largest independently owned commercial real estate firms in Texas, formally announced its entrance into Austin and that it has hired office veteran David Dawkins as managing vice president to develop and lead its expansion into the Austin market. Dawkins comes to NAI Partners from ECR–Equitable Commercial Realty where he helped grow its tenant representation practice. Tim Laine, formerly of Cushman & Wakefield, has joined as senior associate, and rounding out NAI Partners' Austin team is Ryan Clark as an associate.

DALLAS—The Henry S. Miller Companies are pleased to announce the addition of Steve Donosky to its executive leadership team. Donosky has rejoined the company as president of HSM Dalcon Inc., the division specializing in land acquisition and single-family residential lot development.

DEAL TRACKER

PUEBLO, CO—Avalon Realty Advisors is exclusively marketing for sale 1626 and 1638 West 13th St., an approximate 1-acre parcel suited for MJ cultivation development. The property is currently zoned industrial, has multiple water taps, a two-bedroom house, unobstructed sun exposure and is ideal for greenhouse development.

AURORA, CO—Holliday Fenoglio Fowler LP arranged acquisition financing for Alvista Highline, a 90-unit townhome apartment community. HFF worked exclusively on behalf of the borrower, Advenir Inc., to secure the 10-year, floating-rate loan with five years of interest only through Freddie Mac's CME Program. The securitized loan will be serviced by HFF through its Freddie Mac Program Plus seller/servicer program. Advenir will rebrand the property as Advenir@Del Arte Townhomes and operate in conjunction with the neighboring Advenir@Del Arte apartment community.

ALBUQUERQUE—Supportive Housing Coalition of New Mexico was recently awarded grants from the Sandia Foundation and PNM. The Sandia Foundation awarded SHC‐NM a grant of $9,050 to support its Service Coordination Program at Sunport Plaza Apartments. Service coordinators connect residents at those properties with services they need to be successful in housing, that include access to medical resources and psychiatric care, educational opportunities, and economic resources. The grant from Sandia Foundation will enable SHC‐NM to continue this essential program, increase outreach to higher risk residents, and build on collaborative community efforts.

NEW ORLEANS—The issue of whether and how to regulate short-term rentals has caused heated controversy in recent years in New Orleans. The New Orleans City Council approved what were described as landmark short-term rental regulations, legitimizing a practice that has boomed in recent years through listing websites. Most notable in the new regulations is a limit to 90 days per year on whole-home rentals to out-of-town guests, and an outright ban on them in most of the French Quarter. The New Orleans deputy mayor described this as a fair compromise that balances the significant economic impact. Airbnb estimated a revenue of $316 million in New Orleans in the form of short-term rentals last year.

BUILDING BLOCKS

EDMOND, OK—Garage Condos of Oklahoma broke ground recently on a truly unique product: secure, high-end, climate controlled, customized storage space that is owned, not rented. For the classic car collector or RV owner who wants more than a rented metal building, Garage Condos offers a place to keep and care for those treasures in a community with like-minded individuals. Located off of 33rd & Broadway, units come with pre-wired high-speed Internet and cable, a security system, and access to the community clubhouse. Currently in pre-sales, Phase I opens in early spring.

DENVER—A speculative class-A office building at 169 Inverness Dr. in the southeast suburban office market, is underway, according to Artis REIT, advised by Marwest Enterprises and development manager, Trammell Crow Company. This four-story 120,000-square-foot sustainable and efficient project is in a prime transit-oriented location situated along I-25 with convenient light rail access at the Dry Creek Station. Construction has begun with an estimated delivery in late 2017. The site is adjacent to 161 Inverness building, the regional headquarters of AT&T, which Artis purchased in 2010.

DENVER—The development of a third build-to-suit at Crossroads is expected to begin immediately, with an estimated delivery in mid-2017, according to Trammell Crow Company. Inline Distributing Company has entered into an agreement to purchase a new 69,550-square-foot building located along 52nd Avenue just west of Washington Street in unincorporated Adams County.

Of the major metros, only Atlanta and Washington DC are at a lower volume than Dallas' office market, with a volume of $4.11 billion and $4.14 billion, respectively, compared to Dallas at $4.46 billion, according to data from Real Capital Analytics and CoStar. However, Dallas comes in second only to Los Angeles on the top 10 US cities by transaction volume with Los Angeles at 336 and Dallas at 196. Transwestern says markets with sustainable job creation and industries will continue to see high demand, such as biotech, high tech, education, healthcare, financial services, energy, which Dallas has in spades. According to Transwestern's analysis, Dallas has a diversified economy with growth in multiple industries combined with relatively low cost of living, finance, information technology and healthcare. This attracts major companies to relocate headquarters or regional headquarters, in turn attracting ancillary businesses, which is happening on a widespread basis. Dallas has especially attractive urbanized suburban locations with live/work/ play elements and walkability. Its sound office fundamentals are driving up rent and lowering vacancy.—Lisa Brown

BY THE NUMBERS

AUSTIN, TX—Austin is grappling with the inevitable dilemmas that come with rapid growth, according to Adam Kruger, attorney and counselor, Kruger Carson PLLC. On one hand, the city's traffic problems could be mitigated by increased density and mass transit. On the other, existing neighborhoods usually don't want greater density in their own back yards. The Grove at Shoal Creek, a 75-acre tract at 45th Street and Bull Creek, is the latest case in point. Developers contend the project advances Imagine Austin, a 30-year plan for growing Austin “in a compact and connected way.” The Grove would include 1,700 housing units, 360,000 square feet of office and retail space, and park space. Proponents argue the project would produce badly needed affordable housing for the center of the city. The Grove property, which today is mainly green space, had been owned by the State of Texas until 2014. The project would have about one fourth of the land remain as open space or park land. Predictably, the project has strong opposition. A grassroots neighborhood group says the estimated 19,000 vehicle trips the project would add would be a traffic nightmare. So it's the usual conflict: The need to increase population density in order to improve mobility versus the not-in-my-back-yard mentality, says Carson.

LITTLE ROCK, AR—The average asking rental rate per square foot per year for office properties as of June was $16.72, according to LoopNet. This represents an increase of 0.2% compared to the prior three months, with an increase of 0.7% year-over-year. Countywide average rental rates in Little Rock are 0.4% higher at $16.18 per square foot/year for office properties currently for lease.

NEWS AND NOTABLES

AUSTIN, TX—NAI Partners, one of the largest independently owned commercial real estate firms in Texas, formally announced its entrance into Austin and that it has hired office veteran David Dawkins as managing vice president to develop and lead its expansion into the Austin market. Dawkins comes to NAI Partners from ECR–Equitable Commercial Realty where he helped grow its tenant representation practice. Tim Laine, formerly of Cushman & Wakefield, has joined as senior associate, and rounding out NAI Partners' Austin team is Ryan Clark as an associate.

DALLAS—The Henry S. Miller Companies are pleased to announce the addition of Steve Donosky to its executive leadership team. Donosky has rejoined the company as president of HSM Dalcon Inc., the division specializing in land acquisition and single-family residential lot development.

DEAL TRACKER

PUEBLO, CO—Avalon Realty Advisors is exclusively marketing for sale 1626 and 1638 West 13th St., an approximate 1-acre parcel suited for MJ cultivation development. The property is currently zoned industrial, has multiple water taps, a two-bedroom house, unobstructed sun exposure and is ideal for greenhouse development.

AURORA, CO—Holliday Fenoglio Fowler LP arranged acquisition financing for Alvista Highline, a 90-unit townhome apartment community. HFF worked exclusively on behalf of the borrower, Advenir Inc., to secure the 10-year, floating-rate loan with five years of interest only through

ALBUQUERQUE—Supportive Housing Coalition of New Mexico was recently awarded grants from the Sandia Foundation and PNM. The Sandia Foundation awarded SHC‐NM a grant of $9,050 to support its Service Coordination Program at Sunport Plaza Apartments. Service coordinators connect residents at those properties with services they need to be successful in housing, that include access to medical resources and psychiatric care, educational opportunities, and economic resources. The grant from Sandia Foundation will enable SHC‐NM to continue this essential program, increase outreach to higher risk residents, and build on collaborative community efforts.

NEW ORLEANS—The issue of whether and how to regulate short-term rentals has caused heated controversy in recent years in New Orleans. The New Orleans City Council approved what were described as landmark short-term rental regulations, legitimizing a practice that has boomed in recent years through listing websites. Most notable in the new regulations is a limit to 90 days per year on whole-home rentals to out-of-town guests, and an outright ban on them in most of the French Quarter. The New Orleans deputy mayor described this as a fair compromise that balances the significant economic impact. Airbnb estimated a revenue of $316 million in New Orleans in the form of short-term rentals last year.

BUILDING BLOCKS

EDMOND, OK—Garage Condos of Oklahoma broke ground recently on a truly unique product: secure, high-end, climate controlled, customized storage space that is owned, not rented. For the classic car collector or RV owner who wants more than a rented metal building, Garage Condos offers a place to keep and care for those treasures in a community with like-minded individuals. Located off of 33rd & Broadway, units come with pre-wired high-speed Internet and cable, a security system, and access to the community clubhouse. Currently in pre-sales, Phase I opens in early spring.

DENVER—A speculative class-A office building at 169 Inverness Dr. in the southeast suburban office market, is underway, according to Artis REIT, advised by Marwest Enterprises and development manager, Trammell Crow Company. This four-story 120,000-square-foot sustainable and efficient project is in a prime transit-oriented location situated along I-25 with convenient light rail access at the Dry Creek Station. Construction has begun with an estimated delivery in late 2017. The site is adjacent to 161 Inverness building, the regional headquarters of

DENVER—The development of a third build-to-suit at Crossroads is expected to begin immediately, with an estimated delivery in mid-2017, according to Trammell Crow Company. Inline Distributing Company has entered into an agreement to purchase a new 69,550-square-foot building located along 52nd Avenue just west of Washington Street in unincorporated Adams County.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more inforrmation visit Asset & Logo Licensing.