CALABASAS, CA—The retail segment of the industry is ringing up a lot of good news for investors these days. From an increasingly solid consumer-spending position to new opportunities for redevelopment, retail’s outlook for the remainder of 2017 is looking pretty rosy. This according to Marcus & Millichap’s newly released 2017 US Retail Investment Forecast.

There even seem to be some answers shaping up to the question of e-commerce. “While growth in e-commerce is shifting how consumers shop for goods,” the report states, “a variety of traditional brick-and-mortar stores are expanding their online platforms. Conversely, online retailers such as Amazon are recognizing the importance of a physical storefront as they open pop-up stores and full bookstores, further developing their omni-channel retail efforts.”

Clearly, consumers are telling the industry that the answer is not either/or but rather a nuanced combination of both online and in-store activity. Consumers indeed want both, and they seem to be in a position to demand, given the buying power implied by a healthy employment picture. “Healthy job creation and wage growth will carry through 2017,” says Marcus & Millichap, “boosting retail sales and encouraging retail tenant expansion.”

In those expansion strategies lie yet more positive new for the industry. The report indicates that limited construction points to expansion opportunities in already-existing centers, “further tightening vacancy over the coming year.” And while there have been some major-name store closures, landlords as a result are hungry to re-tenant that space, providing yet more incentive for growing retailers to expand.

“Several big-box retailers that traditionally anchor shopping centers and malls continue to close,” says the report, “presenting some landlords with the opportunity to redevelop these empty spaces and boost yield. As tenant mixes are revamped and customer traffic rises, owners are generating more revenue through higher rents.”

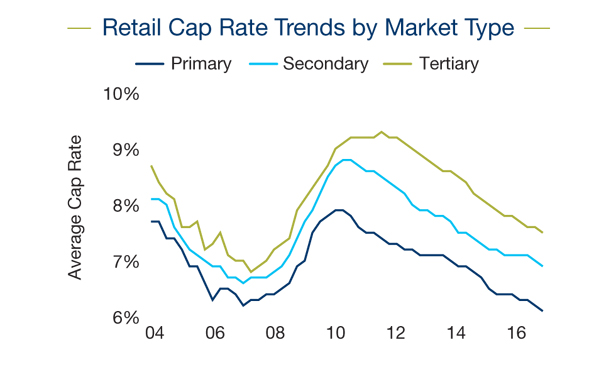

Simultaneously, Marcus & Millichap documents an interesting locational dynamic, this between core markets and secondary and tertiary locales. While primary markets are seeing pricing and cap rates surpassing pre-recession peaks, secondary and tertiary pricing is still at a discount from previous peaks.

“Tertiary markets in particular are gaining traction with investors, evidenced by deal volume nearly doubling in these metros since 2007,” says Marcus & Millichap. “Cap rates in secondary and tertiary metros are often 50 to 100 basis points higher than primary markets and garner strong interest from private buyers seeking higher returns. Healthy job creation and rising incomes in these markets will attract expanding retailers, improving vacancy and boosting NOI growth.”

(The full report can be found by clicking here.)

Copyright © 2024 ALM Global, LLC. All Rights Reserved.

Copyright © 2024 ALM Global, LLC. All Rights Reserved.