This is an HTML version of an article that ran in Real Estate Forum. To see the story in its original format, click here.

One of the most amazing things about commercial real estate development and investment is its ability to transform. From rehabilitation to adaptive reuse to portfolio realignment, some of the most noteworthy—and satisfying—turnaround efforts in the business are the ones that take an “ugly duckling” and turn it into something better, brighter and more profitable.

The teams behind these Cinderella Stories are some of the savviest, most visionary professionals in the business. They see beyond what others do—not just an eyesore or headache, but an opportunity to polish up rough edges and end up with a valuable diamond. In the following feature, Real Estate Forum explores how 11 properties throughout the nation were reinvented and transformed from underutilized sites into shining stars.

MOB Goes From Brutal to Beautiful

First Hill Medical Pavilion, Seattle

Other parties struggled with how to effectively convert a building with obsolete mechanical infrastructure and no onsite parking into a next-generation healthcare project. Add to that long-term tenants at the base of building and you had an adaptive reuse project that confounded almost everyone—except Trammell Crow Co.

At acquisition, the building was 9% occupied with leases longer than 15 months. The property, located at 1124 Columbia St. in Seattle's First Hill submarket, occupied a city block and consisted of three interconnected structures: the life-sciences building, a 186,288-square-foot, seven-story-plus basement lab built in the mid-1970s with a reinforced concrete structure, designed in the “brutalist” style with exposed-concrete exterior; Eklind Hall, a 43,740-square-foot, six-story-plus basement lab building, originally designed and built in the 1940s as a nurses' dormitory; and Vivarium Annex, a 44,540-square-foot, three-level, below-grade concrete animal facility built in 1982, with eight parking stalls and an entry turnaround. To complicate matters further, the life-sciences building connected to Swedish Hospital via a basement tunnel, and ventilation intake and exhaust structures in Vivarium Annex extended above the parking level.

In addition to developer TCC, the project team consisted of equity partner Washington Capital Management, construction lender Wells Fargo Bank, architect Collins Woerman, general contractor Crutcher Lewis, property manager and leasing broker CBRE, structural/civil engineer DCI Engineers, mechanical engineer/subcontractor McKinstry and electrical subcontractor Prime Electric. The team found a design that optimized the shell and core improvements, added 60,000 square feet, provided a new direct-access elevator core from all levels of the garage to the existing and new portions of the building and determined a construction plan that allowed 70,000 feet of existing tenancy to remain in place during the 18- month renovation.

The finished product was a 225,000-square-foot class A MOB with 411 parking stalls and 45 bicycle spaces—nearly all in subterranean garage. The building is 100% leased, with average expiration of 9.2 years. The results exceeded the team's expectations by reducing operating costs over 21% and achieving rents that were 20% greater than competing assets. The building was leased up 12 months faster than planned and sold two years ahead of pro forma at a market setting price of $884 a foot (a 35% premium to the highest healthcare building in the market).

Sky Bridge Solves Cross-Border Dilemma

Cross Border Xpress, San Diego/Tijuana

For decades, leaders in the San Diego/Baja California region had discussed concepts to leverage Tijuana International Airport—including a cross-border runway and developing a twin airport—to no avail. Otay Tijuana Venture LLC realized that with Tijuana's airport a few steps from the international line and with undeveloped land in a barren, industrial part of San Diego just across the other side of the border, the geographic situation presented an opportunity for a unique solution like CBX. With few shared routes between TIJ and San Diego's airport, they realized an opportunity to strengthen the travel industry on both sides of the border without creating competition between the airports.

This 55-acre parcel immediately north of the US/Mexico border in Otay Mesa, CA, was entitled for industrial use but had languished without a project because of low market demand. In 2007, a bi-national group of investors, Otay Tijuana Venture, bought the land directly north of TIJ with the vision of solving an age-old challenge facing San Diego: better utilizing TIJ to serve the transportation needs of the entire region.

Otay Tijuana Ventures' vision was to create the Cross Border Xpress, a pedestrian toll sky bridge that could serve the two million annual TIJ passengers who already cross the US/Mexico border as part of their travels. CBX, which opened in December 2015, is unique in that it directly connects two countries across an international border into an airport terminal. It operates 24/7 and allows only ticketed passengers to check in on the US side, walk across a 390-foot pedestrian bridge across the border directly into TIJ and then check luggage and board flights.

Along with owners Otay Tijuana Venture, the project team for CBX includes architect of record Stantec; architects Legorreta + Legorreta; civil engineer Fuscoe Engineering; Latitude 33, which handled land entitlements, construction documents and related services; Turner Construction; Harrison Co., construction management; and the Clay Co., public affairs.

As a one-of-a-kind project, CBX had to create the path forward through numerous local, state and Federal approvals and permits in the US and Mexico, including a US presidential permit from the Department of State. In addition, CBX worked closely with US Customs and Border Protection from the inception of the project on building design requirements and equipment, operations and staffing agreements, and construction protocols.

Patronage of CBX is steadily building, and operations are running smoothly. The recent unveiling was a “soft opening,” but the CBX parking lot is consistently full. Given the tremendous challenges and 25-plus year evolution of this concept and the positive reception by the public, CBX is already a success.

Historic Rehab Transforms Life-Sciences Facility

Allen Institute, Seattle

The Allen Institute was once housed in multiple buildings in several neighborhoods in Seattle. After considering a number of options for its new headquarters, the organization selected a site in Seattle's South Lake Union neighborhood. Today, the Allen Institute is a modern life-sciences research facility built on land that once housed vacant warehouses and a surface parking lot.

The 1.2-acre site had been home to a 70,000-square-foot automobile dealership. The historic buildings that had formerly occupied the southeast corner of the parcel had been removed and what remained was a one-story concrete building with no fenestration—an eyesore at a major intersection where 80,000 vehicles per day drive by.

The development includes the historic rehab of the 1900s-era Ford and Pacific McKay Buildings, which had been in the path of a road-improvement project. As a result, developer Vulcan Inc. painstakingly disassembled the buildings and catalogued and stored the pieces for five years.

In addition to Vulcan and Allen Institute, the project team consists of architects Perkins + Will, BOLA Architecture + Planning and Walker Macy; general contractor GLY Construction; engineers Secant Shoring Design, Coughlin Porter Lundeen, McKinstry, AEI and GeoEngineers; and consultants Environmental Economics Inc., Farallon Consulting, Glumac and Middour Consulting LLC.

The team recognized that greater success for the Allen Institute research team would be borne out of locating all scientists in a single facility. The single high-performance life science research facility will allow the organization to grow in staff and also expand its scientific research programs. The team also saw the opportunity to create a 21st-century research facility while honoring the past with the renovation of historic structures on site, creating a hub of activity where formerly there was none.

The result is a seven-story, 271,000-square-foot life-sciences building with four levels of subterranean parking, a ground floor with 9,000 feet of retail space and a 241-seat auditorium and five stories of office and research space. The seventh level houses the mechanical penthouse. At the southeast corner of the site sit the completely restored historic Ford and Pacific McKay Buildings, incorporated into the overall project.

The end result has exceeded expectations of the tenant and the community at large. According to Allan Jones, Ph.D., CEO of the Allen Institute, “Having everyone in one place will greatly facilitate and enhance the kind of close collaboration across disciplines, projects and departments that's essential to the success of the large-scale research initiatives we undertake.” Further, many are thrilled to see the historic structures that they assumed had been demolished, standing again at this prominent intersection.

Affordable Redux Activates Social Change

Northpointe Apartments, Long Beach, CA

Avanath Capital Management immediately recognized the deep potential of Northpointe Apartments in Long Beach, CA as a “diamond-in-the-rough.” Located within a densely populated, ethnically diverse working class neighborhood, this 528-unit affordable multifamily asset on 20 acres of land presented a tremendous opportunity for transformation, both at a property and a social-impact level.

While the infrastructure offered a solid framework, the asset needed renovations and upgrades. The property also offered functional amenities and facilities, but these were underutilized. Additionally, there was a vacant lot in the center of the community that was a source of debate as to how it should be developed and integrated.

The property had the potential to engage the community in ways that would facilitate positive social change and impact the lives of a severely underserved working-class neighborhood by increasing the utilization of facilities that were already in place and bringing new programs and amenities to residents. In addition to Avanath as investor and owner, the project team included DIG Landscaping Construction; COR CDC, a nonprofit partner affiliated with Christ our Redeemer AME Church in Irvine, which provides resident services at Northpointe including arts and crafts, financial literacy courses and computer training; and TEC Constructors and Engineers, a minority-owned general contractor.

One of the challenges the team faced was the lack of programs in place to keep teenage residents engaged. As a whole, many teenagers in working-class urban neighborhoods are largely ignored and subsequently face greater risk for crime and gang-related activities. Avanath developed new programs and amenities that would engage at-risk youth and provide a healthy outlet for social interaction. The installation of the basketball court at the heart of the property, as well as the launch of a mentoring program with retired NFL players, helped create spaces and services that would directly serve at-risk teenagers.

The renovation increased the property's occupancy, bringing it to nearly 100%, and more than tripled attendance at the apartment community's after-school program. Further, the firm strengthened Northpointe's ties to the Long Beach community, with additional support from many local volunteers.

Mixed-Use Challenges Yield New Life

Kato Industrial Park, Fremont, CA

Westcore Properties purchased a four-building campus along the I-880 in Fremont, CA, in 2012. It consisted of a 215,000-square-foot institutional-quality warehouse, a 56,000-square-foot obsolete office building, a 147,000-square-foot spice warehouse with a 67,000-foot mezzanine and a 255,000-foot ancillary warehouse.

While most investors struggled with the mixed-use nature of the site, particularly the obsolete office and spice buildings, Westcore had the vision of what the site could be. The freeway frontage and increasing demand for state-of-the-art industrial product in infill locations made it an ideal redevelopment site.

The project team included, from owner/developer Westcore, president and CEO Don Ankeny and SVP, asset management, Steve McKibben; the brokerage team of Mark Maguire and Kevin Hatcher of Colliers International; contractor Big D Construction; designer Kier & Wright; and lender Wells Fargo.

Westcore was able to negotiate buyout options with the existing tenants for the office and spice manufacturing buildings. This allowed for the near-term demolition and redevelopment of this parcel to build a new 300,000-square-foot warehouse on a spec basis. The new building was pre-leased by Tesla Motors before construction began. The building, along with the adjacent 215,000-foot warehouse, have now been sold to an institutional investor who plans to hold the assets long term. For that facility, Westcore secured a 10-year renewal with the tenant within 30 days of starting renewal discussions, at 10% greater than underwriting and on an as-is basis and subsequently sold the building.

The developer had a clear understanding of the inherent functional challenges with the 255,000-square-foot warehouse. These were rectified by repositioning the asset to include a prominent new storefront entrance, new interior office and widening of the dock doors to meet current user demand. Westcore sold the building to a user within 15 months of acquisition at the same value originally underwritten for disposition in year six.

When Westcore acquired the portfolio, the property was only 58% leased with 100% rollover within four years. With one building sold at its target disposition price several years early and the two other buildings now sold, Westcore achieved more than a 20% IRR and double equity just three years after acquiring the portfolio. The financial results speak to the strong execution. Original underwriting assumed a 9.25% unleveraged IRR over six years, and the actual unleveraged IRR exceeded 18%.

Crumbling Downtown Gets New Life

Rose District Redevelopment, Broken Arrow, OK

In 2011, Wes Smithwick, president and CEO of the Broken Arrow Chamber of Commerce, led a group of leaders from the Chamber of Commerce, Broken Arrow Economic Development Corp., City of Broken Arrow, Broken Arrow Public Schools and business sector on a best-practices trip to create a collective vision for the future of Downtown Broken Arrow, OK.

The Broken Arrow downtown core was a sleepy old town that was losing its relevance in a growing city of 108,000 residents. Over 100 years old, the 12-block core's buildings were falling into disrepair, businesses were struggling to attract customers, and many buildings sat vacant. The primary hurdle in the district's redevelopment was public perception and the existing businesses in the district buying into the vision. The project team had to spend countless hours soliciting significant feedback from the community before initiating the project.

Smithwick guided the visioning and strategic process. The BAEDC's Warren Unsicker, VP, served as the project coordinator and community advocate. Lisa Frein, downtown director, served as the marketing and branding expert. The City of Broken Arrow served as the construction, process management, engineering, and bid-process managers. City Downtown Advisory Board provided guidance and oversight, and R.L. Shears served as landscape architect for the streetscape.

The result of this vision was the complete transformation of the three primary blocks in the rebranded “Rose District,” a now-thriving arts-and-entertainment district that is home to restaurants, bars, art galleries, retail shops, entertainment venues, and employers. Streetscaping included widening the sidewalks and adding mid-block crossings, updated street lights, landscaping and planters adorned with rose bushes and other amenities. It resulted in numerous businesses moving into the district, as well as investment by private developers in the revitalization or rebuilding of dilapidated buildings.

The project is an example of how to revitalize a declining downtown. The city invested roughly $5 million in streetscape renovations and $700,000 in development incentives. In the three years since the renovations were completed, it's seen over $30 million in private investment, a shift in occupancy from 75% to 95% and sales-tax revenue rise from $18,000 per year to over $18,000 per month. More than 30 new businesses have joined the district in the past three years and more are waiting to become a part of it. The Rose District is now an award winning arts and entertainment district, having won honors from the International Economic Development Council, the Oklahoma American Planning Association and Tulsa's Young Professionals.

Healthcare Is Pivotal Anchor for Campus

67 Whippany Rd., Mountain Lakes, NJ

Vision Real Estate Partners' and Rubenstein Partners' 67 Whippany Rd. is one of the last large-scale, master-planned redevelopments in Northern New Jersey. The campus is located in a designated metropolitan planning area, which means that it is within a target growth area on the state's development plan. The owners saw the opportunity to create a project that would be consistent with the New Jersey Smart Growth model. They anticipated that it would serve as a prototype for future redevelopment in the state, illustrating the creative vision, new capital infusion and development expertise required to spearhead second-generation development of once-thriving properties that have run their course both physically and economically.

In 2010, the Vision/Rubenstein venture purchased the property—15 vacant office, lab and support buildings totaling 1.4 million square feet—with the goal to redevelop the 194-acre site into modern product reflecting its highest and best use. From the outset, the partnership focused on sustainability. The team was able to retain some of the original, high-quality institutional infrastructure, including an onsite power substation. It also incorporated a number of ecologically friendly features, with public viewing spaces overlooking landscaped open areas and preserved mature forests and more than 45 acres of wetlands. Vision/Rubenstein also worked closely with the municipality and the Department of Environmental Protection to create a highly efficient, centralized stormwater management system.

In 2012, the JV developed Bayer Healthcare's 675,000-square-foot, LEED-certified East Coast headquarters to anchor the property. That transaction involved the pharmaceutical giant purchasing nearly half the acreage. MetLife Inc. signed a 185,000-square-foot, build-to-suit lease in April 2015 and the Vision/Rubenstein team subsequently designed, executed approvals for and broke ground on a new global headquarters for the company's investments business. Located on 14 acres, the facility places emphasis on sustainability, designed to LEED Gold Core and Shell and LEED Platinum Interiors. It is on target to be completed in mid-2016.

The project team includes: Vision's founder and managing partner Sam Morreale and managing partner Ross Chomik; Rubenstein's founder and senior managing partner David Rubenstein, managing principal and COO Eric Schiela, director of development Rick Furches and regional director of Mid-Atlantic Stephen Card; and for landlord broker Cushman & Wakefield, executive vice chairman Robert Donnelly, Sr., EVP Rob Donnelly and vice chairman Marc Rosenberg.

This project validates the idea that if developer teams can acquire product at a basis that allows for the investment required to redevelop in a first-class manner—working alongside first-class local partners, corporate tenants, and municipalities—that developer can successfully create flagship assets that center on sustainability and quality of life. For years, the Alcatel-Lucent campus served as Whippany's largest tax ratable. The MetLife and Bayer buildings, counting expansion potential, total nearly 1.1 million square feet of corporate space. This effectively replaces the former 1.4 million square feet of obsolete Alcatel-Lucent offices. Bayer and MetLife not only will benefit the town with growing tax ratables for years, but also will impact all local business by together bringing nearly 3,500 employees to the site. Already, new supporting services like drug stores, banks and restaurants have sprung up in the community.

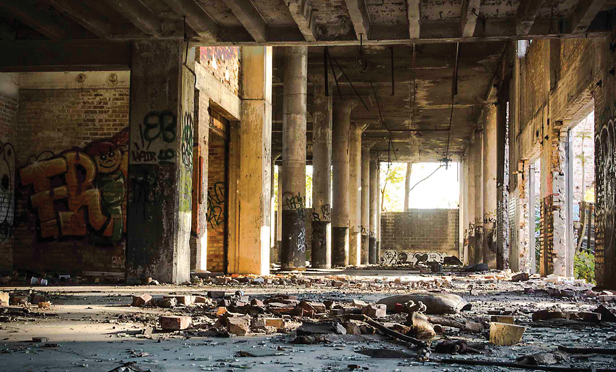

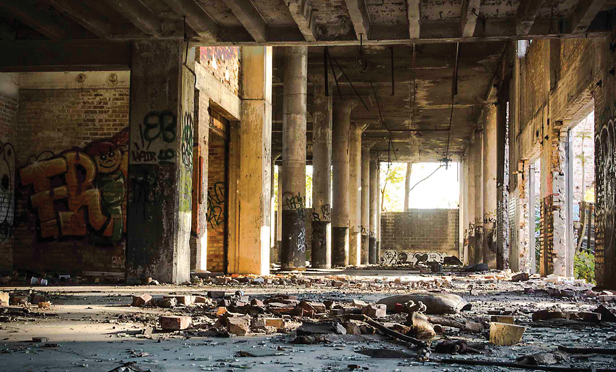

Former Blight Becomes Industrial Hub

Cardinal Health Project, Detroit

Cardinal Health and Henry Ford Health System selected KIRCO Development to act as their development partner for what is intended to be the first component of a $500-million-to-$750-million master-planned community revitalization effort of 300 acres in Detroit. The Cardinal Health Project presented the potential to convert 275,000 square feet of blight to a state-of-the-art, bustling distribution facility in Detroit. The land acquired by KIRCO will accommodate an expansion capability of an additional 135,000 square feet.

The property assemblage contained 18 associated structures that had to be demolished as part of the site-development process. This included vacant residential lots, vacant residential homes, commercial parcels and a variety of industrial buildings and properties. The project also involved significant environmental site remediation and attainment of a $12-million brownfield tax increment financing package.

The project team included developer KIRCO, construction management KIRCO MANIX, architect Heitman Architects, interior designer Purcell Design, financing by Elm Tree, broker CBRE, attorney Jaffe, environmental engineers Surveyor, environmental work by AKT Peerless and property manager JLL. KIRCO MANIX has been performing pre-construction services for the Cardinal Health Project since being assigned the opportunity in June of 2011 and turned the facility over to Cardinal Health on May 1, 2015.

During site preparation and remediation activities, a total of eleven underground storage tanks were removed and adjacent soils mitigated along with the surrounding contaminated soils. Contamination associated with the prior historical industrial use of many of the properties required mitigation of thousands of yards of saturated VOC-contaminated soils. The site also contained six to eight feet of uncontrolled fill under the entire building footprint. The design and construction teams were required to formulate an appropriate combined environmental, geo-technical and structural solutions to address all three conditions simultaneously.

A direct benefit of the project was the removal of the mostly blighted, obsolete and/or contaminated former heavy commercial/light industrial use properties that contained ASTs and USTs/LUSTs, illegally dumped debris and contaminated soil as well as other major impediments to redevelopment.

Henry Ford negotiated a new contract with Cardinal Health to help directly reduce supply-chain-related costs as a result of the changing healthcare reimbursement environment.

In addition, KIRCO and Cardinal Health partnered with Focus Hope, a local job training and skill enhancement program in Detroit, to locate local residents with the skills to apply for open positions within both companies. KIRCO also retained City of Detroit based minority contractors to complete a substantial portion of the building demolition, site preparation and utility installation work on-site.

From Obsolete Industrial to High-Density Housing

Parkway Lofts, Bloomfield, NJ

Prism Capital Partners acquired the 14.5-acre Parkway Lofts in Bloomfield, NJ in 2005, recognizing a great opportunity to transform an obsolete industrial property into a distinctive, high-density residential village. Prism broke ground for Phase I of Parkway Lofts in 2011, demolishing approximately 400,000 square feet of unusable structures and converting a 365,000-square-foot warehouse building into rental housing.

The owner anticipated that the project not only would breathe new life into the main warehouse structure, but turn the entire neighborhood into a thriving, urban-living community. The immediate success of the property—which is located along the Garden State Parkway spanning Bloomfield and East Orange—confirmed that Prism's vision was one that met growing demand for quality rental housing in the immediate market. The project team includes Edwin Cohen and Eugene Diaz, principal partners at Prism.

Phase I of Parkway Lofts included the creation of 365 loft apartments and a 377-car parking facility on five acres. The design takes advantage of the property's 17-foot floor-to-floor ceiling heights and heavy floor loads; Prism added a new intermediate second floor and a penthouse level taking advantage of the strength of the existing structure to naturally support such additions.

Various finishes—including exposed columns, beams and ceilings dressed up with some color—solidified the industrial-type feel. The firm also preserved many of the building's original architectural features including 15-foot, quilt-panel windows that accentuate the property's views of New York City to the east and the Watchung Mountains to the west.

Completing the redevelopment of Parkway Lofts was fraught with complexity. The property spans two towns, which dictated the need for duplicate approvals—including the site's rezoning from industrial to residential. Prism's expertise in working with municipalities in New Jersey enabled the firm to successfully navigate the complex approval processes in both Bloomfield and East Orange. The firm also had to convince lenders that a long-established industrial area could become accepted as a residential location. In one of many efforts to establish the neighborhood's appeal as a residential hub, the firm met with the NJ Department of Transportation and secured $2.5 million for the purpose of upgrading the Watsessing Avenue Rail Station (located less than 100 yards from the development).

This project has reinvented and transformed an area that had until now missed the path of progress and growth, into a thriving and desirable urban-living community. Parkway Lofts Phase I opened in fall 2013 and just 13 months later reached 70% occupancy. In 2015, Prism sold Phase I to Clarion Partners, concluding an advantageous investment and development cycle. Now, Prism is gearing up to launch Phase II at Parkway Lofts. Upon completion, Phase II will feature approximately 170 for-sale townhomes, a clubhouse and other lifestyle amenities on the remaining nine acres. Prism anticipates a Spring 2016 construction launch.

City Comes Together for Downtown's Rebirth

Downtown Tolleson Paseo de Luces, Tolleson, AZ

Tolleson, AZ is a community of approximately 7,000 people located 11 miles west of Downtown Phoenix. Historically, Tolleson was a farming community once known as the “Vegetable Center of the World,” which was located along the old Yuma Highway (now Van Buren Street), with its quaint Downtown serving as a central hub of activity and the heart of the Southwest Valley. Unfortunately, Interstate 10 bypassed the Downtown, resulting in a shift of the “central hub,” and like many American communities, Tolleson's Downtown was no longer the regional epicenter.

Downtown Tolleson, Van Buren from 91st to 94th aves. was the central focus of the rejuvenation project Paseo de Luces. The roadway cross section was five lanes. The sidewalks ranged from four feet to six feet wide, which greatly diminished the pedestrian experience along the Van Buren St. corridor. City staff saw the opportunity for this revitalization effort to build upon a myriad of existing assets, which included a rich history, tradition and culture, and most advantageous, a wide publicly owned right-of-way (mostly asphalt paving) immediately adjacent to equally significant open space. The City wanted the design team to develop a unique sense of place for this downtown environment. The approach needed to include an extensive public-outreach process that would celebrate the essence of what Tolleson was—and was to become. This public-input process resulted in numerous presentations and meetings with Tolleson residents and stakeholders including business owners, resident historians/elders, students, Teen Council, the mayor and City Council.

The City of Tolleson staff's primary role was to carry out the community and city council vision of a revitalized downtown, while J2 Engineering & Environmental Design LLC was the prime design consultant for this one-mile revitalization project. The overall roadway cross section was reduced from five to three lanes, freeing space for bicycle lanes, on-street parallel parking and shorter crosswalk distances. At the crosswalks, a stamped asphalt treatment with a reflective coating was utilized, which reduces surface temperatures of the crosswalk by up to 22 degrees. Expanded sidewalks ranging from 15 feet to 22 feet in width foster pedestrian zones. The pedestrian zone along the corridor incorporates a variety of social seating scenarios, custom-tiled coffee tables, signage/wayfinding/monuments, custom bike racks, space for on-street dining, seat walls and pedestrian and roadway LED lighting. In areas where bump-outs were designed, public pieces of art are featured that were designed and created through an exciting youth art partnership with the West Valley Arts Council's Gallery 37 Program.

This teamwork resulted in the “Paseo de Arte” which means “Path of Art” located throughout the corridor. Other critical elements of the project included open space improvements, a central plaza with water feature and shade structure, festoon and tree lighting, a dense street-tree program with structural soil system connecting the tree grates, a Downtown Wi-Fi network, vending kiosks as new business incubators, a streetscape sound system, roadway and pedestrian LED lighting with accent banners, freeway signage and branding for the Downtown district. Since the completion of Paseo de Luces, Downtown Tolleson has received several awards and recognitions for its innovative approach to economic development, sustainability and support of the arts.

Historic Hospitals Meet Senior Living Needs

Linda Vista Senior Apartments, Los Angeles, CA

Completed in August 2015, the redevelopment of Linda Vista Senior Apartments required the renovation of two historic hospital buildings into senior affordable housing. Located in the historic Los Angeles neighborhood of Boyle Heights, the 3.5-acre campus includes art deco buildings constructed in the 1920s and 1930s as the hospital for the Santa Fe Railroad—a two-story nurses dormitory and the six-story main hospital building. The two buildings are listed as historic-cultural monuments in Los Angeles and on the National Registry of Historic Places.

US Secretary of Interior standards were followed for the renovation of the property. It succeeded after a renovation to market-rate condominiums failed in the mid-2000s—those would have been expensive and of little use to the working-class neighborhood.

The project team included developers AMCAL Multi-Housing and East Los Angeles Community Corp., which also served as managing partner; AMCAL General Contractors and Killefer Flammang Architects. Funding came from the Los Angeles Housing Dept. (now the Housing & Community Investment Dept.), which provided Affordable Housing Trust Fund monies that are required to provide leverage in the tax-credit application, and Neighborhood Stabilization Program funding for the foreclosed property by US HUD. JP Morgan Chase and Union Bank provided equity and construction and permanent financing. Also required were complex entitlements approval by the City of Los Angeles Planning Commission; approval of permits for the complex renovation by City of Los Angeles Building & Safety Dept.; and approval of permits for public improvements in accordance with the property's designation as a Historic-Cultural Monument by the City of Los Angeles Bureau of Engineering.

The historic lobby and living room were rehabilitated to provide comfortable common spaces. The abandoned garden area now provides social and outdoor space with barbecue, picnic areas, patios and garden plots. The remaining hospital systems and waste from movie shoots were removed. With generously scaled corridors preserved, patient rooms were redesigned as apartments because of their essentially residential-scaled spaces with natural light. Patient treatment areas, boiler room and morgue were challenging since they weren't designed as pleasant, habitable spaces.

The renovation removed a portion of the roof in the middle of a rear wing to create a three-story atrium, providing light and windows for surrounding units set deep in the building. All historical surfaces were cleaned and refurbished after decades of neglect and abuse. This refurbishment is most apparent at the building entry, now the lobby, which features golden travertine floors and mahogany paneling.

With this project, affordable housing is matched with social services to ensure that seniors do not become shut-ins and can age “well.” Case workers aid procuring of entitlements for the seniors, who live on low, fixed incomes, and provide nutrition, recreation and financial assistance. The City allows reduced parking ratios of 0.5 spaces for senior housing, eliminating the need to build an expensive parking garage, which also would have hidden the historic art deco facade.

This is an HTML version of an article that ran in Real Estate Forum. To see the story in its original format, click here.

One of the most amazing things about commercial real estate development and investment is its ability to transform. From rehabilitation to adaptive reuse to portfolio realignment, some of the most noteworthy—and satisfying—turnaround efforts in the business are the ones that take an “ugly duckling” and turn it into something better, brighter and more profitable.

The teams behind these Cinderella Stories are some of the savviest, most visionary professionals in the business. They see beyond what others do—not just an eyesore or headache, but an opportunity to polish up rough edges and end up with a valuable diamond. In the following feature, Real Estate Forum explores how 11 properties throughout the nation were reinvented and transformed from underutilized sites into shining stars.

MOB Goes From Brutal to Beautiful

First Hill Medical Pavilion, Seattle

Other parties struggled with how to effectively convert a building with obsolete mechanical infrastructure and no onsite parking into a next-generation healthcare project. Add to that long-term tenants at the base of building and you had an adaptive reuse project that confounded almost everyone—except Trammell Crow Co.

At acquisition, the building was 9% occupied with leases longer than 15 months. The property, located at 1124 Columbia St. in Seattle's First Hill submarket, occupied a city block and consisted of three interconnected structures: the life-sciences building, a 186,288-square-foot, seven-story-plus basement lab built in the mid-1970s with a reinforced concrete structure, designed in the “brutalist” style with exposed-concrete exterior; Eklind Hall, a 43,740-square-foot, six-story-plus basement lab building, originally designed and built in the 1940s as a nurses' dormitory; and Vivarium Annex, a 44,540-square-foot, three-level, below-grade concrete animal facility built in 1982, with eight parking stalls and an entry turnaround. To complicate matters further, the life-sciences building connected to Swedish Hospital via a basement tunnel, and ventilation intake and exhaust structures in Vivarium Annex extended above the parking level.

In addition to developer TCC, the project team consisted of equity partner Washington Capital Management, construction lender

The finished product was a 225,000-square-foot class A MOB with 411 parking stalls and 45 bicycle spaces—nearly all in subterranean garage. The building is 100% leased, with average expiration of 9.2 years. The results exceeded the team's expectations by reducing operating costs over 21% and achieving rents that were 20% greater than competing assets. The building was leased up 12 months faster than planned and sold two years ahead of pro forma at a market setting price of $884 a foot (a 35% premium to the highest healthcare building in the market).

Sky Bridge Solves Cross-Border Dilemma

Cross Border Xpress, San Diego/Tijuana

For decades, leaders in the San Diego/Baja California region had discussed concepts to leverage Tijuana International Airport—including a cross-border runway and developing a twin airport—to no avail. Otay Tijuana Venture LLC realized that with Tijuana's airport a few steps from the international line and with undeveloped land in a barren, industrial part of San Diego just across the other side of the border, the geographic situation presented an opportunity for a unique solution like CBX. With few shared routes between TIJ and San Diego's airport, they realized an opportunity to strengthen the travel industry on both sides of the border without creating competition between the airports.

This 55-acre parcel immediately north of the US/Mexico border in Otay Mesa, CA, was entitled for industrial use but had languished without a project because of low market demand. In 2007, a bi-national group of investors, Otay Tijuana Venture, bought the land directly north of TIJ with the vision of solving an age-old challenge facing San Diego: better utilizing TIJ to serve the transportation needs of the entire region.

Otay Tijuana Ventures' vision was to create the Cross Border Xpress, a pedestrian toll sky bridge that could serve the two million annual TIJ passengers who already cross the US/Mexico border as part of their travels. CBX, which opened in December 2015, is unique in that it directly connects two countries across an international border into an airport terminal. It operates 24/7 and allows only ticketed passengers to check in on the US side, walk across a 390-foot pedestrian bridge across the border directly into TIJ and then check luggage and board flights.

Along with owners Otay Tijuana Venture, the project team for CBX includes architect of record Stantec; architects Legorreta + Legorreta; civil engineer Fuscoe Engineering; Latitude 33, which handled land entitlements, construction documents and related services; Turner Construction; Harrison Co., construction management; and the Clay Co., public affairs.

As a one-of-a-kind project, CBX had to create the path forward through numerous local, state and Federal approvals and permits in the US and Mexico, including a US presidential permit from the Department of State. In addition, CBX worked closely with US Customs and Border Protection from the inception of the project on building design requirements and equipment, operations and staffing agreements, and construction protocols.

Patronage of CBX is steadily building, and operations are running smoothly. The recent unveiling was a “soft opening,” but the CBX parking lot is consistently full. Given the tremendous challenges and 25-plus year evolution of this concept and the positive reception by the public, CBX is already a success.

Historic Rehab Transforms Life-Sciences Facility

Allen Institute, Seattle

The Allen Institute was once housed in multiple buildings in several neighborhoods in Seattle. After considering a number of options for its new headquarters, the organization selected a site in Seattle's South Lake Union neighborhood. Today, the Allen Institute is a modern life-sciences research facility built on land that once housed vacant warehouses and a surface parking lot.

The 1.2-acre site had been home to a 70,000-square-foot automobile dealership. The historic buildings that had formerly occupied the southeast corner of the parcel had been removed and what remained was a one-story concrete building with no fenestration—an eyesore at a major intersection where 80,000 vehicles per day drive by.

The development includes the historic rehab of the 1900s-era Ford and Pacific McKay Buildings, which had been in the path of a road-improvement project. As a result, developer Vulcan Inc. painstakingly disassembled the buildings and catalogued and stored the pieces for five years.

In addition to Vulcan and Allen Institute, the project team consists of architects Perkins + Will, BOLA Architecture + Planning and Walker Macy; general contractor GLY Construction; engineers Secant Shoring Design, Coughlin Porter Lundeen, McKinstry, AEI and GeoEngineers; and consultants Environmental Economics Inc., Farallon Consulting, Glumac and Middour Consulting LLC.

The team recognized that greater success for the Allen Institute research team would be borne out of locating all scientists in a single facility. The single high-performance life science research facility will allow the organization to grow in staff and also expand its scientific research programs. The team also saw the opportunity to create a 21st-century research facility while honoring the past with the renovation of historic structures on site, creating a hub of activity where formerly there was none.

The result is a seven-story, 271,000-square-foot life-sciences building with four levels of subterranean parking, a ground floor with 9,000 feet of retail space and a 241-seat auditorium and five stories of office and research space. The seventh level houses the mechanical penthouse. At the southeast corner of the site sit the completely restored historic Ford and Pacific McKay Buildings, incorporated into the overall project.

The end result has exceeded expectations of the tenant and the community at large. According to Allan Jones, Ph.D., CEO of the Allen Institute, “Having everyone in one place will greatly facilitate and enhance the kind of close collaboration across disciplines, projects and departments that's essential to the success of the large-scale research initiatives we undertake.” Further, many are thrilled to see the historic structures that they assumed had been demolished, standing again at this prominent intersection.

Affordable Redux Activates Social Change

Northpointe Apartments, Long Beach, CA

Avanath Capital Management immediately recognized the deep potential of Northpointe Apartments in Long Beach, CA as a “diamond-in-the-rough.” Located within a densely populated, ethnically diverse working class neighborhood, this 528-unit affordable multifamily asset on 20 acres of land presented a tremendous opportunity for transformation, both at a property and a social-impact level.

While the infrastructure offered a solid framework, the asset needed renovations and upgrades. The property also offered functional amenities and facilities, but these were underutilized. Additionally, there was a vacant lot in the center of the community that was a source of debate as to how it should be developed and integrated.

The property had the potential to engage the community in ways that would facilitate positive social change and impact the lives of a severely underserved working-class neighborhood by increasing the utilization of facilities that were already in place and bringing new programs and amenities to residents. In addition to Avanath as investor and owner, the project team included DIG Landscaping Construction; COR CDC, a nonprofit partner affiliated with Christ our Redeemer AME Church in Irvine, which provides resident services at Northpointe including arts and crafts, financial literacy courses and computer training; and TEC Constructors and Engineers, a minority-owned general contractor.

One of the challenges the team faced was the lack of programs in place to keep teenage residents engaged. As a whole, many teenagers in working-class urban neighborhoods are largely ignored and subsequently face greater risk for crime and gang-related activities. Avanath developed new programs and amenities that would engage at-risk youth and provide a healthy outlet for social interaction. The installation of the basketball court at the heart of the property, as well as the launch of a mentoring program with retired NFL players, helped create spaces and services that would directly serve at-risk teenagers.

The renovation increased the property's occupancy, bringing it to nearly 100%, and more than tripled attendance at the apartment community's after-school program. Further, the firm strengthened Northpointe's ties to the Long Beach community, with additional support from many local volunteers.

Mixed-Use Challenges Yield New Life

Kato Industrial Park, Fremont, CA

Westcore Properties purchased a four-building campus along the I-880 in Fremont, CA, in 2012. It consisted of a 215,000-square-foot institutional-quality warehouse, a 56,000-square-foot obsolete office building, a 147,000-square-foot spice warehouse with a 67,000-foot mezzanine and a 255,000-foot ancillary warehouse.

While most investors struggled with the mixed-use nature of the site, particularly the obsolete office and spice buildings, Westcore had the vision of what the site could be. The freeway frontage and increasing demand for state-of-the-art industrial product in infill locations made it an ideal redevelopment site.

The project team included, from owner/developer Westcore, president and CEO Don Ankeny and SVP, asset management, Steve McKibben; the brokerage team of Mark Maguire and Kevin Hatcher of Colliers International; contractor Big D Construction; designer Kier & Wright; and lender

Westcore was able to negotiate buyout options with the existing tenants for the office and spice manufacturing buildings. This allowed for the near-term demolition and redevelopment of this parcel to build a new 300,000-square-foot warehouse on a spec basis. The new building was pre-leased by Tesla Motors before construction began. The building, along with the adjacent 215,000-foot warehouse, have now been sold to an institutional investor who plans to hold the assets long term. For that facility, Westcore secured a 10-year renewal with the tenant within 30 days of starting renewal discussions, at 10% greater than underwriting and on an as-is basis and subsequently sold the building.

The developer had a clear understanding of the inherent functional challenges with the 255,000-square-foot warehouse. These were rectified by repositioning the asset to include a prominent new storefront entrance, new interior office and widening of the dock doors to meet current user demand. Westcore sold the building to a user within 15 months of acquisition at the same value originally underwritten for disposition in year six.

When Westcore acquired the portfolio, the property was only 58% leased with 100% rollover within four years. With one building sold at its target disposition price several years early and the two other buildings now sold, Westcore achieved more than a 20% IRR and double equity just three years after acquiring the portfolio. The financial results speak to the strong execution. Original underwriting assumed a 9.25% unleveraged IRR over six years, and the actual unleveraged IRR exceeded 18%.

Crumbling Downtown Gets New Life

Rose District Redevelopment, Broken Arrow, OK

In 2011, Wes Smithwick, president and CEO of the Broken Arrow Chamber of Commerce, led a group of leaders from the Chamber of Commerce, Broken Arrow Economic Development Corp., City of Broken Arrow, Broken Arrow Public Schools and business sector on a best-practices trip to create a collective vision for the future of Downtown Broken Arrow, OK.

The Broken Arrow downtown core was a sleepy old town that was losing its relevance in a growing city of 108,000 residents. Over 100 years old, the 12-block core's buildings were falling into disrepair, businesses were struggling to attract customers, and many buildings sat vacant. The primary hurdle in the district's redevelopment was public perception and the existing businesses in the district buying into the vision. The project team had to spend countless hours soliciting significant feedback from the community before initiating the project.

Smithwick guided the visioning and strategic process. The BAEDC's Warren Unsicker, VP, served as the project coordinator and community advocate. Lisa Frein, downtown director, served as the marketing and branding expert. The City of Broken Arrow served as the construction, process management, engineering, and bid-process managers. City Downtown Advisory Board provided guidance and oversight, and R.L. Shears served as landscape architect for the streetscape.

The result of this vision was the complete transformation of the three primary blocks in the rebranded “Rose District,” a now-thriving arts-and-entertainment district that is home to restaurants, bars, art galleries, retail shops, entertainment venues, and employers. Streetscaping included widening the sidewalks and adding mid-block crossings, updated street lights, landscaping and planters adorned with rose bushes and other amenities. It resulted in numerous businesses moving into the district, as well as investment by private developers in the revitalization or rebuilding of dilapidated buildings.

The project is an example of how to revitalize a declining downtown. The city invested roughly $5 million in streetscape renovations and $700,000 in development incentives. In the three years since the renovations were completed, it's seen over $30 million in private investment, a shift in occupancy from 75% to 95% and sales-tax revenue rise from $18,000 per year to over $18,000 per month. More than 30 new businesses have joined the district in the past three years and more are waiting to become a part of it. The Rose District is now an award winning arts and entertainment district, having won honors from the International Economic Development Council, the Oklahoma American Planning Association and Tulsa's Young Professionals.

Healthcare Is Pivotal Anchor for Campus

67 Whippany Rd., Mountain Lakes, NJ

Vision Real Estate Partners' and Rubenstein Partners' 67 Whippany Rd. is one of the last large-scale, master-planned redevelopments in Northern New Jersey. The campus is located in a designated metropolitan planning area, which means that it is within a target growth area on the state's development plan. The owners saw the opportunity to create a project that would be consistent with the New Jersey Smart Growth model. They anticipated that it would serve as a prototype for future redevelopment in the state, illustrating the creative vision, new capital infusion and development expertise required to spearhead second-generation development of once-thriving properties that have run their course both physically and economically.

In 2010, the Vision/Rubenstein venture purchased the property—15 vacant office, lab and support buildings totaling 1.4 million square feet—with the goal to redevelop the 194-acre site into modern product reflecting its highest and best use. From the outset, the partnership focused on sustainability. The team was able to retain some of the original, high-quality institutional infrastructure, including an onsite power substation. It also incorporated a number of ecologically friendly features, with public viewing spaces overlooking landscaped open areas and preserved mature forests and more than 45 acres of wetlands. Vision/Rubenstein also worked closely with the municipality and the Department of Environmental Protection to create a highly efficient, centralized stormwater management system.

In 2012, the JV developed

The project team includes: Vision's founder and managing partner Sam Morreale and managing partner Ross Chomik; Rubenstein's founder and senior managing partner David Rubenstein, managing principal and COO Eric Schiela, director of development Rick Furches and regional director of Mid-Atlantic Stephen Card; and for landlord broker Cushman & Wakefield, executive vice chairman Robert Donnelly, Sr., EVP Rob Donnelly and vice chairman Marc Rosenberg.

This project validates the idea that if developer teams can acquire product at a basis that allows for the investment required to redevelop in a first-class manner—working alongside first-class local partners, corporate tenants, and municipalities—that developer can successfully create flagship assets that center on sustainability and quality of life. For years, the Alcatel-Lucent campus served as Whippany's largest tax ratable. The

Former Blight Becomes Industrial Hub

The property assemblage contained 18 associated structures that had to be demolished as part of the site-development process. This included vacant residential lots, vacant residential homes, commercial parcels and a variety of industrial buildings and properties. The project also involved significant environmental site remediation and attainment of a $12-million brownfield tax increment financing package.

The project team included developer KIRCO, construction management KIRCO MANIX, architect Heitman Architects, interior designer Purcell Design, financing by Elm Tree, broker CBRE, attorney Jaffe, environmental engineers Surveyor, environmental work by AKT Peerless and property manager JLL. KIRCO MANIX has been performing pre-construction services for the

During site preparation and remediation activities, a total of eleven underground storage tanks were removed and adjacent soils mitigated along with the surrounding contaminated soils. Contamination associated with the prior historical industrial use of many of the properties required mitigation of thousands of yards of saturated VOC-contaminated soils. The site also contained six to eight feet of uncontrolled fill under the entire building footprint. The design and construction teams were required to formulate an appropriate combined environmental, geo-technical and structural solutions to address all three conditions simultaneously.

A direct benefit of the project was the removal of the mostly blighted, obsolete and/or contaminated former heavy commercial/light industrial use properties that contained ASTs and USTs/LUSTs, illegally dumped debris and contaminated soil as well as other major impediments to redevelopment.

Henry Ford negotiated a new contract with

In addition, KIRCO and

From Obsolete Industrial to High-Density Housing

Parkway Lofts, Bloomfield, NJ

Prism Capital Partners acquired the 14.5-acre Parkway Lofts in Bloomfield, NJ in 2005, recognizing a great opportunity to transform an obsolete industrial property into a distinctive, high-density residential village. Prism broke ground for Phase I of Parkway Lofts in 2011, demolishing approximately 400,000 square feet of unusable structures and converting a 365,000-square-foot warehouse building into rental housing.

The owner anticipated that the project not only would breathe new life into the main warehouse structure, but turn the entire neighborhood into a thriving, urban-living community. The immediate success of the property—which is located along the Garden State Parkway spanning Bloomfield and East Orange—confirmed that Prism's vision was one that met growing demand for quality rental housing in the immediate market. The project team includes Edwin Cohen and Eugene Diaz, principal partners at Prism.

Phase I of Parkway Lofts included the creation of 365 loft apartments and a 377-car parking facility on five acres. The design takes advantage of the property's 17-foot floor-to-floor ceiling heights and heavy floor loads; Prism added a new intermediate second floor and a penthouse level taking advantage of the strength of the existing structure to naturally support such additions.

Various finishes—including exposed columns, beams and ceilings dressed up with some color—solidified the industrial-type feel. The firm also preserved many of the building's original architectural features including 15-foot, quilt-panel windows that accentuate the property's views of

Completing the redevelopment of Parkway Lofts was fraught with complexity. The property spans two towns, which dictated the need for duplicate approvals—including the site's rezoning from industrial to residential. Prism's expertise in working with municipalities in New Jersey enabled the firm to successfully navigate the complex approval processes in both Bloomfield and East Orange. The firm also had to convince lenders that a long-established industrial area could become accepted as a residential location. In one of many efforts to establish the neighborhood's appeal as a residential hub, the firm met with the NJ Department of Transportation and secured $2.5 million for the purpose of upgrading the Watsessing Avenue Rail Station (located less than 100 yards from the development).

This project has reinvented and transformed an area that had until now missed the path of progress and growth, into a thriving and desirable urban-living community. Parkway Lofts Phase I opened in fall 2013 and just 13 months later reached 70% occupancy. In 2015, Prism sold Phase I to Clarion Partners, concluding an advantageous investment and development cycle. Now, Prism is gearing up to launch Phase II at Parkway Lofts. Upon completion, Phase II will feature approximately 170 for-sale townhomes, a clubhouse and other lifestyle amenities on the remaining nine acres. Prism anticipates a Spring 2016 construction launch.

City Comes Together for Downtown's Rebirth

Downtown Tolleson Paseo de Luces, Tolleson, AZ

Tolleson, AZ is a community of approximately 7,000 people located 11 miles west of Downtown Phoenix. Historically, Tolleson was a farming community once known as the “Vegetable Center of the World,” which was located along the old Yuma Highway (now Van Buren Street), with its quaint Downtown serving as a central hub of activity and the heart of the Southwest Valley. Unfortunately, Interstate 10 bypassed the Downtown, resulting in a shift of the “central hub,” and like many American communities, Tolleson's Downtown was no longer the regional epicenter.

Downtown Tolleson, Van Buren from 91st to 94th aves. was the central focus of the rejuvenation project Paseo de Luces. The roadway cross section was five lanes. The sidewalks ranged from four feet to six feet wide, which greatly diminished the pedestrian experience along the Van Buren St. corridor. City staff saw the opportunity for this revitalization effort to build upon a myriad of existing assets, which included a rich history, tradition and culture, and most advantageous, a wide publicly owned right-of-way (mostly asphalt paving) immediately adjacent to equally significant open space. The City wanted the design team to develop a unique sense of place for this downtown environment. The approach needed to include an extensive public-outreach process that would celebrate the essence of what Tolleson was—and was to become. This public-input process resulted in numerous presentations and meetings with Tolleson residents and stakeholders including business owners, resident historians/elders, students, Teen Council, the mayor and City Council.

The City of Tolleson staff's primary role was to carry out the community and city council vision of a revitalized downtown, while J2 Engineering & Environmental Design LLC was the prime design consultant for this one-mile revitalization project. The overall roadway cross section was reduced from five to three lanes, freeing space for bicycle lanes, on-street parallel parking and shorter crosswalk distances. At the crosswalks, a stamped asphalt treatment with a reflective coating was utilized, which reduces surface temperatures of the crosswalk by up to 22 degrees. Expanded sidewalks ranging from 15 feet to 22 feet in width foster pedestrian zones. The pedestrian zone along the corridor incorporates a variety of social seating scenarios, custom-tiled coffee tables, signage/wayfinding/monuments, custom bike racks, space for on-street dining, seat walls and pedestrian and roadway LED lighting. In areas where bump-outs were designed, public pieces of art are featured that were designed and created through an exciting youth art partnership with the West Valley Arts Council's Gallery 37 Program.

This teamwork resulted in the “Paseo de Arte” which means “Path of Art” located throughout the corridor. Other critical elements of the project included open space improvements, a central plaza with water feature and shade structure, festoon and tree lighting, a dense street-tree program with structural soil system connecting the tree grates, a Downtown Wi-Fi network, vending kiosks as new business incubators, a streetscape sound system, roadway and pedestrian LED lighting with accent banners, freeway signage and branding for the Downtown district. Since the completion of Paseo de Luces, Downtown Tolleson has received several awards and recognitions for its innovative approach to economic development, sustainability and support of the arts.

Historic Hospitals Meet Senior Living Needs

Linda Vista Senior Apartments, Los Angeles, CA

Completed in August 2015, the redevelopment of Linda Vista Senior Apartments required the renovation of two historic hospital buildings into senior affordable housing. Located in the historic Los Angeles neighborhood of Boyle Heights, the 3.5-acre campus includes art deco buildings constructed in the 1920s and 1930s as the hospital for the Santa Fe Railroad—a two-story nurses dormitory and the six-story main hospital building. The two buildings are listed as historic-cultural monuments in Los Angeles and on the National Registry of Historic Places.

US Secretary of Interior standards were followed for the renovation of the property. It succeeded after a renovation to market-rate condominiums failed in the mid-2000s—those would have been expensive and of little use to the working-class neighborhood.

The project team included developers AMCAL Multi-Housing and East Los Angeles Community Corp., which also served as managing partner; AMCAL General Contractors and Killefer Flammang Architects. Funding came from the Los Angeles Housing Dept. (now the Housing & Community Investment Dept.), which provided Affordable Housing Trust Fund monies that are required to provide leverage in the tax-credit application, and Neighborhood Stabilization Program funding for the foreclosed property by US HUD.

The historic lobby and living room were rehabilitated to provide comfortable common spaces. The abandoned garden area now provides social and outdoor space with barbecue, picnic areas, patios and garden plots. The remaining hospital systems and waste from movie shoots were removed. With generously scaled corridors preserved, patient rooms were redesigned as apartments because of their essentially residential-scaled spaces with natural light. Patient treatment areas, boiler room and morgue were challenging since they weren't designed as pleasant, habitable spaces.

The renovation removed a portion of the roof in the middle of a rear wing to create a three-story atrium, providing light and windows for surrounding units set deep in the building. All historical surfaces were cleaned and refurbished after decades of neglect and abuse. This refurbishment is most apparent at the building entry, now the lobby, which features golden travertine floors and mahogany paneling.

With this project, affordable housing is matched with social services to ensure that seniors do not become shut-ins and can age “well.” Case workers aid procuring of entitlements for the seniors, who live on low, fixed incomes, and provide nutrition, recreation and financial assistance. The City allows reduced parking ratios of 0.5 spaces for senior housing, eliminating the need to build an expensive parking garage, which also would have hidden the historic art deco facade.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.