DALLAS—Each year, a team of Weitzman professionals drives each multi-tenant shopping center of 25,000 square feet or more. During the past year, Weitzman surveyed 42 submarkets with 193 million square feet in 1,408 shopping centers. Bob Young, executive managing director, Weitzman recently spoke at the company's annual forecast discussing retail real estate and the survey results.

Young said occupancy is at an all-time high, based on Weitzman's review of a propriety database that spans five decades. Last year ended with a record-high occupancy of 92.6%, a full percent higher than year-end 2015.

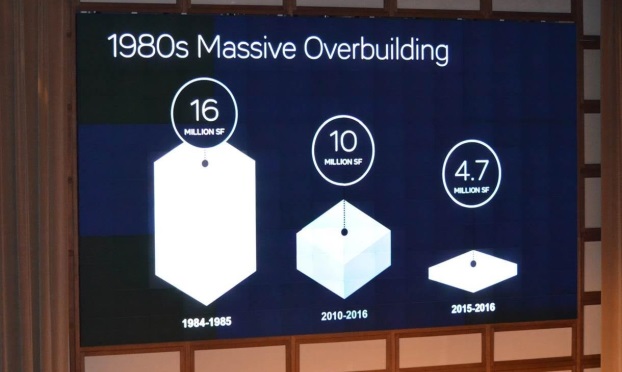

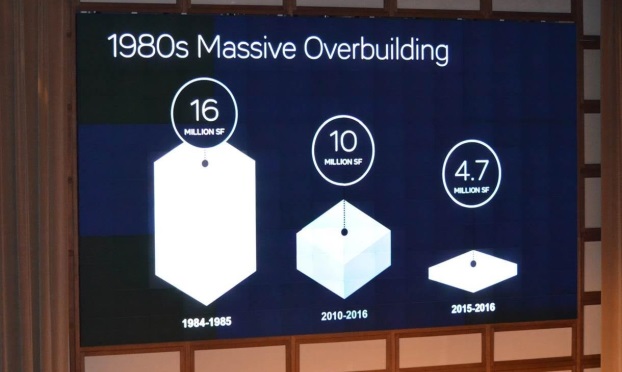

In addition, the market is balanced in a way it never was at the previous peak in 1984, which led to overbuilding and more than a decade of high vacancy. Today, construction remains low, a result of developer restraint combined with retailer contraction–and that is keeping occupancy high and resulting in the strongest existing-center market in memory. The fact that net leasing is nearly double the construction total shows the strength of existing-center leasing, GlobeSt.com learns.

Young indicated that absorption is the second-highest level in 16 years, exceeded only by 2015, also a conservative year with only 2.7 million square feet of new space. Dallas-Fort Worth has virtually no value-added retail, because almost every viable center is well leased. Centers have gone from near-empty to full lease up due to well-planned renovations. In addition, community centers remain robust.

There is an abundance of space in the pipeline, Young said. Major projects such as Legacy West in Plano, The Star in Frisco and Shops at Clearfork in Fort Worth will open soon.

The outlook for 2017 is strong, with a forecast of a repeat performance of 2016, Young predicts. Based on what is in the works, construction forecasts indicate an increase to around 3.4 million square feet in 2017.

Because many projects are phased, leasing will dictate if all of this space is delivered as planned, Young said. For example, Frisco's 600,000-square-foot mixed-use project, Wade Park, was once expected to open this year, but will now open in 2018. Young said for forecast purposes, Weitzman didn't include it in the projected 3.4 million square feet for 2017.

Even with an increase in new space, Weitzman expects 2017 to end with occupancy at 93% or higher and absorption reaching 4 million square feet, Young said.

As previously reported, outlying areas go from limited to plentiful in terms of retail options.

DALLAS—Each year, a team of Weitzman professionals drives each multi-tenant shopping center of 25,000 square feet or more. During the past year, Weitzman surveyed 42 submarkets with 193 million square feet in 1,408 shopping centers. Bob Young, executive managing director, Weitzman recently spoke at the company's annual forecast discussing retail real estate and the survey results.

Young said occupancy is at an all-time high, based on Weitzman's review of a propriety database that spans five decades. Last year ended with a record-high occupancy of 92.6%, a full percent higher than year-end 2015.

In addition, the market is balanced in a way it never was at the previous peak in 1984, which led to overbuilding and more than a decade of high vacancy. Today, construction remains low, a result of developer restraint combined with retailer contraction–and that is keeping occupancy high and resulting in the strongest existing-center market in memory. The fact that net leasing is nearly double the construction total shows the strength of existing-center leasing, GlobeSt.com learns.

Young indicated that absorption is the second-highest level in 16 years, exceeded only by 2015, also a conservative year with only 2.7 million square feet of new space. Dallas-Fort Worth has virtually no value-added retail, because almost every viable center is well leased. Centers have gone from near-empty to full lease up due to well-planned renovations. In addition, community centers remain robust.

There is an abundance of space in the pipeline, Young said. Major projects such as Legacy West in Plano, The Star in Frisco and Shops at Clearfork in Fort Worth will open soon.

The outlook for 2017 is strong, with a forecast of a repeat performance of 2016, Young predicts. Based on what is in the works, construction forecasts indicate an increase to around 3.4 million square feet in 2017.

Because many projects are phased, leasing will dictate if all of this space is delivered as planned, Young said. For example, Frisco's 600,000-square-foot mixed-use project, Wade Park, was once expected to open this year, but will now open in 2018. Young said for forecast purposes, Weitzman didn't include it in the projected 3.4 million square feet for 2017.

Even with an increase in new space, Weitzman expects 2017 to end with occupancy at 93% or higher and absorption reaching 4 million square feet, Young said.

As previously reported, outlying areas go from limited to plentiful in terms of retail options.

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.