WALNUT CREEK, CA—Large real estate investment firms like Blackstone, Hines, Starwood and others may own billions of dollars of properties and get all the headlines, but the bread and butter of the CRE industry are the small and local real estate investment and development firms. So says Joseph Ori, Executive Managing Director, Paramount Capital Corp. In the exclusive commentary below, he dives deeper into the subject.

The views expressed below are the author's own.

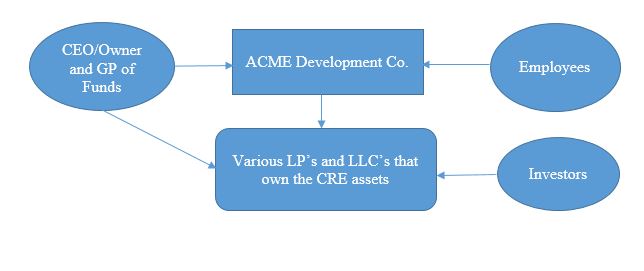

These companies typically have 20 to 100 employees and own $25 million to $100+ million in CRE assets. The business model of most of these firms is structured as an operating entity that employs the workers, a management company that many times is a division of the operating entity and several partnerships or LLC's that own the various real estate investment properties. The flow chart of this structure for a hypothetical CRE investment/development firm, ACME Development Co., is shown below.

The market value ACME Development Co. in the chart above is nominal, as the only realizable value is the real estate equity in each of the limited partnerships and LLC's that own the real estate assets. When a real estate asset is sold, the net proceeds are distributed, first to the investors and second to the general partner or managing member, which is usually an entity owned and controlled by the CEO/Owner of ACME. If ACME puts itself up for sale, it would have minimal enterprise value, because it doesn't have a viable future revenue stream and the real estate value is hidden in the various real estate entities. There is nothing wrong with this arrangement and this is how 98% of small real estate firms are structured. However, there is a better organization and operating structure than can create market value in ACME above and beyond the equity value in the real estate projects.

The first step in restructuring ACME to generate this market value is to create a separate stand-alone entity as a property management company. A separate property management company will allow ACME the autonomy to seek third party management contracts and will be managed as a profit seeking enterprise with the incentive to increase revenue and profits. It will generate management fees from the real estate investment entities and could potentially be sold to a third party. The next step is for the CEO of ACME to form a holding company for all the company's real estate interests. The holding company will be called ACME Holding Co. (AHC) and will be owned 100% by the CEO. A subsidiary of AHC will be the general partner or managing member in the various real estate ownership entities, so that the CEO's former ownership and promote interests will flow up to AHC. Additionally, all fees earned on the real estate deals should be paid to AHC or a sister entity, all under the corporate umbrella of AHC. The CEO should also form a separate brokerage entity that will provide brokerage, financing and leasing services to its real estate entities and third parties, that will also be a wholly owned subsidiary of AHC. The flow chart of the new structure is as follows:

The structure above will allow for all fees, profits, cash flow and equity interests from the real estate portfolio and revenue from brokerage and property management to flow up to and be consolidated into one entity, the parent company, ACH. This will convert ACH into a very profitable holding company that could be sold by the ownership group, taken public (if large enough) or able to attract institutional investment capital. The market value of ACH under this structure will be substantially greater than the equity value in its real estate deals.

The structure above will allow for all fees, profits, cash flow and equity interests from the real estate portfolio and revenue from brokerage and property management to flow up to and be consolidated into one entity, the parent company, ACH. This will convert ACH into a very profitable holding company that could be sold by the ownership group, taken public (if large enough) or able to attract institutional investment capital. The market value of ACH under this structure will be substantially greater than the equity value in its real estate deals.

WALNUT CREEK, CA—Large real estate investment firms like Blackstone, Hines, Starwood and others may own billions of dollars of properties and get all the headlines, but the bread and butter of the CRE industry are the small and local real estate investment and development firms. So says Joseph Ori, Executive Managing Director, Paramount Capital Corp. In the exclusive commentary below, he dives deeper into the subject.

The views expressed below are the author's own.

These companies typically have 20 to 100 employees and own $25 million to $100+ million in CRE assets. The business model of most of these firms is structured as an operating entity that employs the workers, a management company that many times is a division of the operating entity and several partnerships or LLC's that own the various real estate investment properties. The flow chart of this structure for a hypothetical CRE investment/development firm, ACME Development Co., is shown below.

The market value ACME Development Co. in the chart above is nominal, as the only realizable value is the real estate equity in each of the limited partnerships and LLC's that own the real estate assets. When a real estate asset is sold, the net proceeds are distributed, first to the investors and second to the general partner or managing member, which is usually an entity owned and controlled by the CEO/Owner of ACME. If ACME puts itself up for sale, it would have minimal enterprise value, because it doesn't have a viable future revenue stream and the real estate value is hidden in the various real estate entities. There is nothing wrong with this arrangement and this is how 98% of small real estate firms are structured. However, there is a better organization and operating structure than can create market value in ACME above and beyond the equity value in the real estate projects.

The first step in restructuring ACME to generate this market value is to create a separate stand-alone entity as a property management company. A separate property management company will allow ACME the autonomy to seek third party management contracts and will be managed as a profit seeking enterprise with the incentive to increase revenue and profits. It will generate management fees from the real estate investment entities and could potentially be sold to a third party. The next step is for the CEO of ACME to form a holding company for all the company's real estate interests. The holding company will be called ACME Holding Co. (AHC) and will be owned 100% by the CEO. A subsidiary of AHC will be the general partner or managing member in the various real estate ownership entities, so that the CEO's former ownership and promote interests will flow up to AHC. Additionally, all fees earned on the real estate deals should be paid to AHC or a sister entity, all under the corporate umbrella of AHC. The CEO should also form a separate brokerage entity that will provide brokerage, financing and leasing services to its real estate entities and third parties, that will also be a wholly owned subsidiary of AHC. The flow chart of the new structure is as follows:

The structure above will allow for all fees, profits, cash flow and equity interests from the real estate portfolio and revenue from brokerage and property management to flow up to and be consolidated into one entity, the parent company, ACH. This will convert ACH into a very profitable holding company that could be sold by the ownership group, taken public (if large enough) or able to attract institutional investment capital. The market value of ACH under this structure will be substantially greater than the equity value in its real estate deals.

The structure above will allow for all fees, profits, cash flow and equity interests from the real estate portfolio and revenue from brokerage and property management to flow up to and be consolidated into one entity, the parent company, ACH. This will convert ACH into a very profitable holding company that could be sold by the ownership group, taken public (if large enough) or able to attract institutional investment capital. The market value of ACH under this structure will be substantially greater than the equity value in its real estate deals.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.