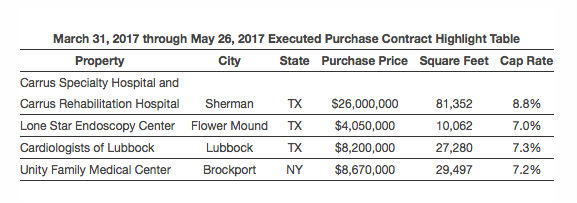

BETHESDA, MD–In April and May Global Medical REIT entered into four purchase contracts that will add some 148,200 square feet to its ever-growing property portfolio.

They are: the Carrus Specialty Hospital and Carrus Rehabilitation Hospital in Sherman, Texas; the Lone Star Endoscopy Center located in Flower Mound, Texas; the Cardiologists of Lubbock facility located in Lubbock, Texas; and the Unity Family Medicine Center located in Brockport, New York.

The REIT had previously announced the Carrus Specialty Hospital and Carrus Rehabilitation Hospital transaction, which is trading for $26 million. The three newly-announced purchase contracts total $20.9 million.

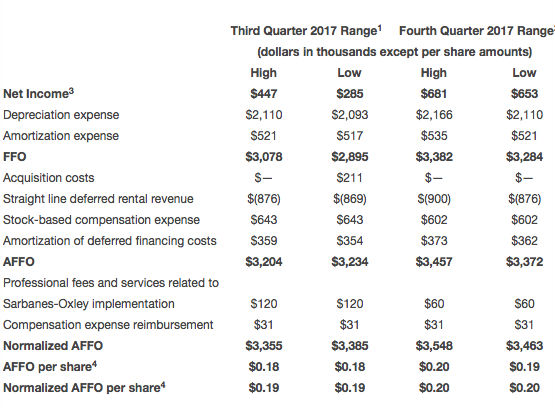

The REIT also released its guidance for the third quarter ending September 30, 2017 and the fourth quarter ending December 31, 2017. Anyone looking for the company to have tipped its hand about further purchases will be disappointed as it didn't provide much clarity about acquisition costs.

In the REIT's recent earnings call executives said that Global Medical REIT has an acquisition goal of $400 million, which it is on track to reach by mid year. It plans to use what is remaining on its credit facility – which has an accordian feature — and it is also looking at mortgage debt and at the capital markets.

BETHESDA, MD–In April and May Global Medical REIT entered into four purchase contracts that will add some 148,200 square feet to its ever-growing property portfolio.

They are: the Carrus Specialty Hospital and Carrus Rehabilitation Hospital in Sherman, Texas; the Lone Star Endoscopy Center located in Flower Mound, Texas; the Cardiologists of Lubbock facility located in Lubbock, Texas; and the Unity Family Medicine Center located in Brockport,

The REIT had previously announced the Carrus Specialty Hospital and Carrus Rehabilitation Hospital transaction, which is trading for $26 million. The three newly-announced purchase contracts total $20.9 million.

The REIT also released its guidance for the third quarter ending September 30, 2017 and the fourth quarter ending December 31, 2017. Anyone looking for the company to have tipped its hand about further purchases will be disappointed as it didn't provide much clarity about acquisition costs.

In the REIT's recent earnings call executives said that Global Medical REIT has an acquisition goal of $400 million, which it is on track to reach by mid year. It plans to use what is remaining on its credit facility – which has an accordian feature — and it is also looking at mortgage debt and at the capital markets.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.