WASHINGTON, DC–DC-area's law firms are just about finished their rightsizing — specifically, this process is about 75% complete, according to Cushman & Wakefield calculations. Starting in 2011 and continuing to the end of last year, C&W estimates there has been two-million-square feet of give-back by law firms in the area.

Interestingly, there were signs of a backlash against this multi-year push for space efficiency in the last quarter of 2017 when several firms expanded — major deals included Wilmer Hale, Morrison Foerster, K&L Gates, Akin Gump, Goodwin Proctor, and Paul Hastings — indicating that they may have underestimated their space needs.

That said, mergers and acquisitions among law firms are expected to continue into 2018, which will mean further space consolidation, according to Nate Edwards, senior director of Cushman & Wakefield's Washington, DC Region Research Department. “We have seen some select firms overestimate the efficiencies they could get from rightsizing but that is not going to make up for the consolidation we will see from future mergers,” he tells GlobeSt.com.

To the larger point, these M&As coupled with the preference among high-profile firms to relocate to newly built buildings or large-scale renovations, will increase vacancy in the core submarkets through 2020, he says.

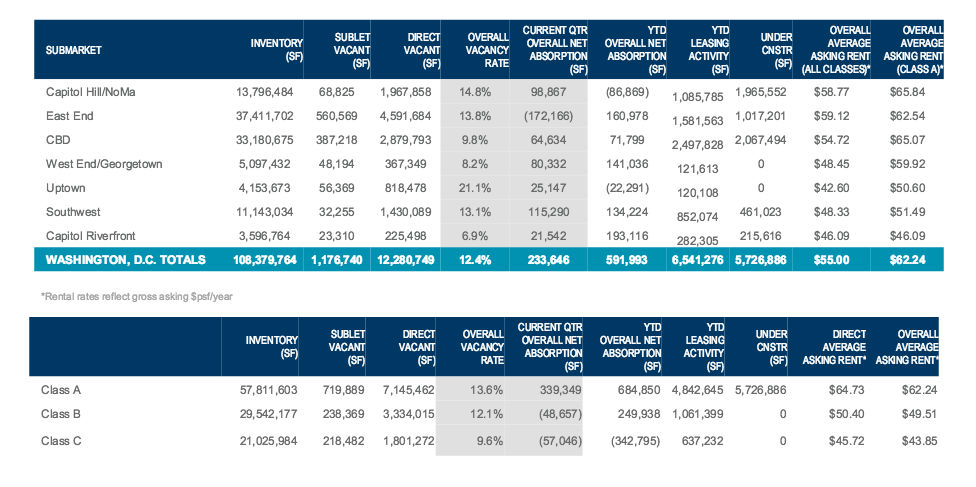

Overall, the fourth quarter of 2017 was the Washington DC office market's largest of the year in terms of new leasing activity, according to a C&W report — registering a total of over 2.1 million square feet and nudging the annual total just over 6.5 million square feet, 23.6% above the ten-year average.

The District registered nearly 600,000 square feet of net move-ins throughout the year, C&W found, approximately 40% of which hit the books in the fourth quarter. It wrote:

While this figure is about 35% below the ten-year average, many of the largest leases to sign in 2017 have not yet landed. This phenomenon, along with deliveries of new supply to the market, resulted in a slight uptick of the DC overall vacancy rate-rising 30 basis points in 2017 to close the year

at 12.4%. Vacancy should continue to rise in 2018 as only 66.3% of the 3.2 msf set to come online throughout the year has been pre-leased.

Save

Save

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.