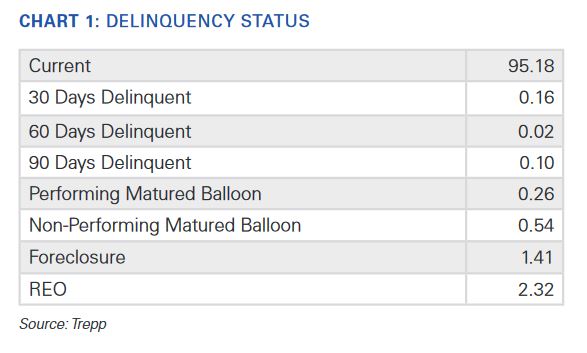

NEW YORK–After falling for eight consecutive months, the overall Trepp CMBS delinquency rate posted an increase in March, the company reports in Trepp Talk. The delinquency rate for US commercial real estate loans in CMBS is now 4.55%, an increase of four basis points from the February level.

As for the loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or non-performing balloons), that percentage is now 4.39%, down five basis points for the month.

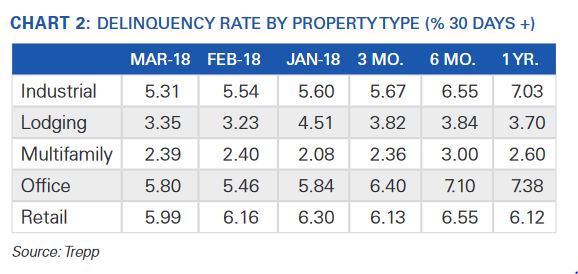

Relatively speaking, the increase is a modest one: The March 2018 rate is 82 basis points lower than the year-ago level, according to Trepp Talk. The reading hit a multi-year low of 4.15% in February 2016, and the all-time high of 10.34% in July 2012. Another way to look at it: the rate is 34 basis points lower in the year to date and 120 basis points down since June 2017.

Last month Trepp predicted that the delinquency rate could break the post-crisis low from February 2016 at some point this year. The company hints that it still thinks that may happen. “The March uptick represented a small speed bump in that prediction,” it says.

***

Another view of the CMBS market comes from a separate report by Morningstar Credit Ratings. For various reasons that are well-known, the industry is watching the $4.05 billion of 2012 vintage retail-backed mortgage-backed securities that were underwritten before the retail defaults began to gain momentum in 2013.

Morningstar writes:

At first glance they are a risky bunch, with higher leverage than their 2013 and 2014 counterparts, including a weighted-average loan-to-value ratio of 61.7% and debt yield of 10.6%. In addition [Morningstar] is concerned that some of these loans may face headwinds as they approach maturity as a result of changes in lender and investor appetites for the property type.

That said, Morningstar concluded with the observation that most mall-backed securitized commercial mortgages issued in 2012 have performed well, with more than 75% posting stable or improving cash flow since underwriting.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.