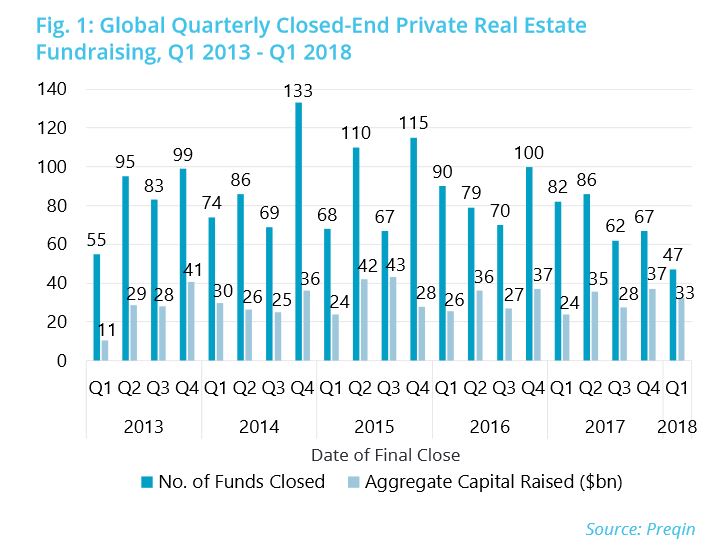

LONDON–Forty-seven private closed-end real estate funds held a final close in Q1 2018, raising an aggregate $33 billion in investor commitments, according to Preqin. The firm expects this amount to increase by 10% as more information becomes available. If that increase materializes, the quarter will surpass the previous record set in Q1 2008 when 79 funds secured $35 billion.

It is a welcome contrast from 2017, when the private real estate industry did not set any new fundraising records. “2018 is off to a very strong start, posting the highest fundraising totals of any opening quarter for the past decade,” Oliver Senchal, head of Real Estate Products, says in a prepared statement. “What Q1 results do illustrate is the demand that investors still have for the asset class — many remain under-allocated amid high distributions from investments.”

Indeed, competition for capital remains strong with a record 642 funds in market, targeting $206 billion. In addition, dry powder has continued to climb from $249 billion at the end of 2017 to $266 billion at the end of March.

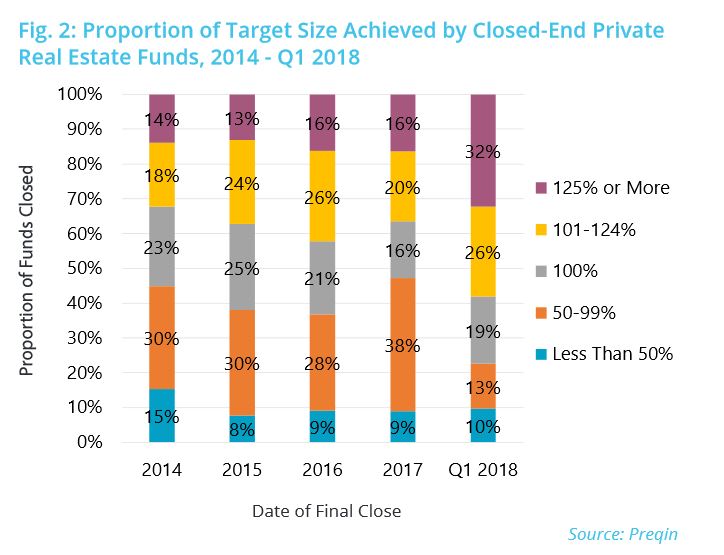

Another performance stat to note: in addition to the strong fundraising levels, record proportions of private real estate funds exceeded their target size in the first quarter. While just 23% of funds closed below their target size, 58% of funds exceeded their initial target size, including 32% which closed on 125% or more of their target.

By contrast, last year 47% of funds failed to reach their target, and just 16% achieved 125% or more of their target. Preqin said that this indicates that although the number of funds closed in the first quarter of 2018 is lower, those funds that do close are generally oversubscribed.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.