NEW YORK CITY–Trepp's overall CMBS delinquency rate resumed its months-long decline in April after a brief blip in March when it rose slightly. In fact the rate fell sharply for the month hitting its lowest level since March 2016, according to Trepp.

The overall CMBS delinquency rate is now 4.36%, a decrease of 19 basis points from March and 116 basis points lower year over year.

Furthermore Trepp continues to stand by its prediction that the delinquency rate could potentially break the post-crisis low set in February 2016 of 4.15% at some point this year, especially as the rate is only 21 basis points away from its post-crisis low.

The percentage of loans that are seriously delinquent — that is, 60 plus days delinquent, in foreclosure, REO or non-performing balloons — is now 4.31%, down eight basis points for the month.

Trep also notes that:

- The industrial delinquency rate fell 78 basis points to 4.5% for the month.

- The lodging delinquency rate dropped 37 basis points to 2.98%.

- The multifamily delinquency rate dropped 13 basis points to 2.26%, and remains the best performing major property type.

- The office delinquency rate was down 23 basis points to 5.5%.

A Drop in Pricing Volume

Separately Kroll Bond Rating Agency reports that private-label CMBS pricing volume fell $4.1 billion in April, the lowest amount since this time last year. That said, the year-to-date volume is up 45% year-over-year. Kroll writes that:

Issuance is expected to remain strong for the duration of the second quarter, with much of it led by single borrower deals; we may see more than two dozen deals launch over the remainder of the quarter. At present we are also aware of as many as eight conduit deals that will announce through the end of June.

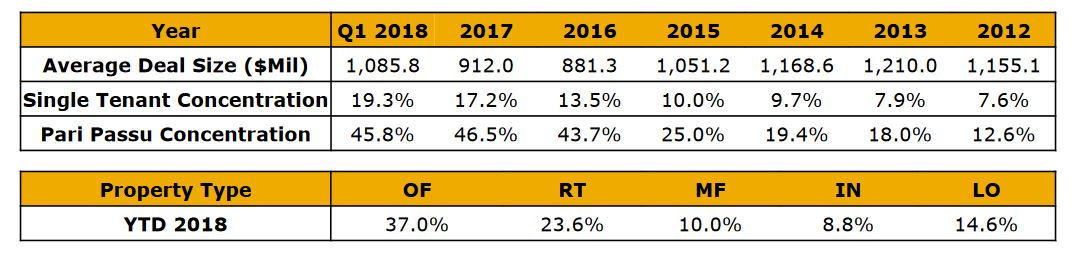

One concern Kroll has is about CMBS' concentration risk.

The average deal size in Q1 was $1.1 billion; in 2017 and 2016 it was usually below $1 billion. Also single tenant exposure continued to rise this quarter to 19.3%, up from 17.2% last year and 13.5% in 2016. Pari Passu levels remain elevated, Kroll also noted, representing 45.8% of Q1 2018 conduit collateral.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.