MIAMI—Locally-based lender BridgeInvest reports the initial closing of its second specialty credit fund with $80 million in equity commitments and a total target capitalization of $200 million.

BridgeInvest's Specialty Credit Fund II has already committed funding for four transactions in the Southeast, with two deals in Florida, one in Georgia and one in North Carolina. BridgeInvest, a provider of short-term, senior-position CRE bridge loans, says it plans to deploy the fund's capital in the next two years and expects to announce additional closings for the fund through the end of this year.

The company that targets opportunistic and value-add transactions in the Southeast and Texas, established Specialty Credit Fund II to focus on capital preservation and generating attractive, risk-adjusted returns with investments in a diversified portfolio of senior-secured commercial mortgages.

“We are thrilled to launch our second discretionary fund to meet demand in the market for flexible bridge capital.” says Alex Horn, BridgeInvest founder and managing partner.

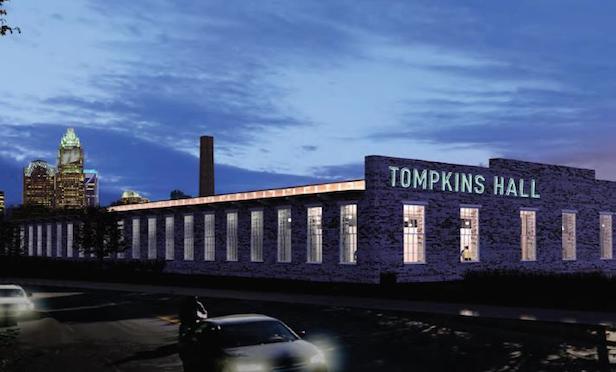

The largest transaction thus far for Fund II is a $40-million first priority mortgage for the redevelopment of the former Highland Park Mill, a 150,000-square-foot mixed-use property in Charlotte, NC. The Tompkins Hall plan calls for 80,000-square-feet of office space to be occupied by Duke Energy and the city's first food hall.

The project being developed by Paces Properties will also involve more than 20 food stall operators as well as traditional retailers including Undercurrent Coffee, Fonta Flora Brewery and Aix Rotisserie, a new concept from the owners of Aix En Provence, according to BridgeInvest officials.

The project to redevelop the circa 1890s textile mill is expected to serve as a catalyst for the redevelopment of the Optimist Park neighborhood in Charlotte as the Blue Line light rail opens its Parkwood Station adjacent to the property.

Another transaction involves a $21.5-million first priority mortgage for the construction of a 259-rooom TRU Hotel by Hilton in Orlando. The fund's other Florida deal is a $1.985-million first priority mortgage for the acquisition of a 1.52-acre infill multifamily land site located in Delray Beach.

Rounding out the fund's commitments thus far is a $2.2-million first priority mortgage for the acquisition of Seaboard Station, a multi-family development site approved for 164 units in Savannah, GA.

The closing of Fund II comes just 18 months after the launch of BridgeInvest's inaugural Specialty Credit Fund. The fund closed with $75 million in equity commitments.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.