NEW YORK CITY—This month, I had the pleasure of sitting down with Hugh Kelly, principal of Real Estate Economics and director of Fordham University's Real Estate Master's program, to discuss his new book, 24-Hour Cities. As stated in the title, he takes an analytical approach to determine “real investment performance, not just promises” in these cities. His criteria includes patterns of electricity consumption, population density, volume of vehicular traffic between 9am and 5pm, the share of commuters who use public transportation, the number of 24-hour pharmacies within 10 miles of the city center, the restaurant ratings, and more. He concludes that 24-hour cities are not only statistically different than sprawling 9-5 cities, but they also have statistically superior economic returns.

Many of the great 24-hour cities including New York, Los Angeles and Miami have flourished over the last two decades after “hollowing out” in the 1950s through 90s, when many city dwellers left for the suburbs. These outperforming cities have re-established themselves as hubs of innovation, attracting what Kelly believes is the most important demographic – the millennials. They come to the cities to live, work and play. They also offer diversity of population and industry.

Some other resurgent cities—such as Boston; Washington, DC; Chicago; and Philadelphia—have yet to surpass their previous population highs. Chicago and Philadelphia were predominantly manufacturing cities which were slow to rebound but are now reinventing themselves. Since 2010, Chicago's percentage of millennials is 19.1%, above the national average of 13.3%.

Kelly notes that newer cities such as Dallas, Miami, Phoenix, Las Vegas and Seattle have great potential for growth, especially the ones that can expand 360 degrees and are not limited by geography like the coastal cities are. This is countered by these cities expanding too far from the economic center and creating highway congestion. Public transportation infrastructure must be built if these cities are to grow. Nashville recently rejected a plan to finance a $5.4 billion light rail system. The question posed still remains: is the city dense enough to warrant this investment or is a more extensive bus system more suitable?

Density is a distinguishing factor for 24-hour cities. New York City is 30 times as dense in population than Dallas with New York's 8.4 million people concentrated over 309 square miles. New York City's borders are also constrained by its rivers which heightens this effect. Cities like Los Angeles have spread out in a horizontal direction as opposed to vertically. Cities like Phoenix have natural limits to its expansion such as the water supply. This density is what drives value for its real estate.

Population growth can be misleading. Kelly notes that although Dallas has outperformed New York City in the percentage growth with 1.5% over the last 33 years compared to New York City's 0.5%, the total population in New York City has outpaced with 1.3 million new residents compared to the city of Dallas's 1.24 million total population since its founding in 1841. Kelly goes on to say that growth cities are wrongly targeted by percentage growth as opposed to the absolute population growth.

When it comes to the suburbs, Kelly notes that it does not have to be a zero-sum game. A thriving city will support the suburbs. I asked about RXR's $5 billion investment in New Rochelle, a 30-minute train ride north of the city. Kelly did believe the demand was present for it and believed that it in turn could become a 24-hour city of its own.

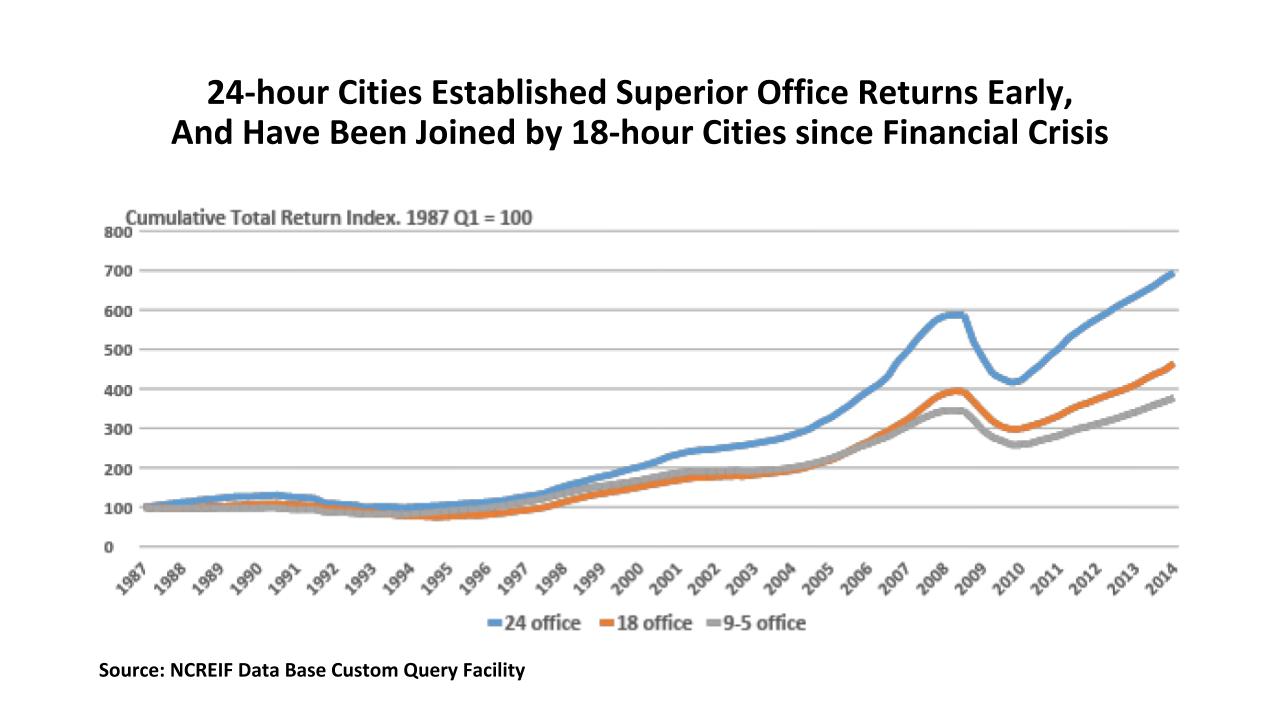

Kelly studied office rents and vacancies and found that population—and, in turn, job growth—have made 24-hour cities a compelling place to invest. Over the last 20 years, 24-hour cities have experienced 85% premiums in office rents over 9-5 cities. This is thanks in part to barriers of entry which have made this market supply constrained: Vacancy rates average 10.3% in 24-hour cities, compared to 16.6% in 9-5s. As a result, based on National Council of Real Estate Investment Fiduciaries statistics, 24-hour cities have experienced cumulative total returns over the last 20 years at a multiple of over six times compared to 9-5's over four times return, which is a 152% difference. With this all of this in mind, it is not a surprise that Real Capital Analytics have tracked that 80.4% of office sale dollar volume have sold in the three largest 24-hour cities.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.