HOUSTON—Strong market conditions continue to lead the way across all property types. So say the experts at NAI Partners, which recently held its quarterly breakfast. This year's edition was led by Griff Bandy, John Simons, Jason Gaines, Jim Tainter and Andrew Pappas, who provided insight on a variety of trends and topics across the company's office, industrial, retail, landlord services and investment fund service offerings.

At the outset of the meeting, it was noted that NAI Partners had a very strong 2017. The company has professionals specializing in all three of its product types—office, industrial and retail—representing both tenants and landlords in Houston, Austin and San Antonio. That diversification has paid off, as the leader of investment sales, Joshua Lass-Sughrue, and leader of the retail division, Gaines, both ranked among the company's top 10 producers in 2017 across all product types.

Some of the notable market trends include a dip in the NAI Partners sublease index, following about 450,000 square feet of sublease space in Greenspoint moving to direct space, GlobeSt.com learns. In addition, the industrial market has recorded a 5.5% or lower vacancy rate for more than six years, and a booming retail market has average asking rents at an all-time high and sub-6% vacancy.

Office market:

“Our NAI Partners sublease index—which measures the amount of sublease space as a percentage of total available space—decreased 140 basis points in April to 14%, due in large part to a chunk of sublease space moving over to direct,” said Bandy. “So while we're pleased to see a decline in sublease space, overall vacancy remains at elevated levels. This has resulted in an increasing number of tenant improvement requests from users of office space, with some landlords more motivated to meet certain concessions than others.”

Landlord services:

“We've seen a healthy amount of activity in the sub-20,000-square-foot requirement arena, and continue to hear from our landlord clients and those in the market that they are looking for opportunities to drive value,” Tainter said. “Thankfully we've been able to help them in that regard, as we remain focused on expanding our office project leasing and property management portfolios.”

Industrial market:

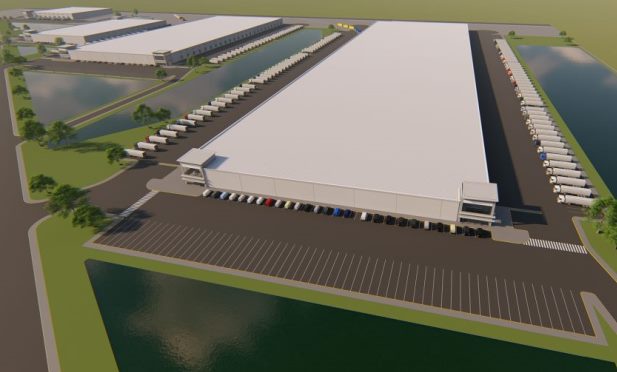

“Houston industrial construction has been very balanced, with demand heading toward spec construction,” said Simons. “One of the projects my team is currently working on is a 540-acre master-planned multi-modal distribution park in El Campo, TX—on which ground will be broken in June—that will be able to accommodate up to 10 million square feet of class-A warehouse, manufacturing and distribution facilities. It will also provide access, visibility and rail service via the Kansas City Southern Railway—the premier carrier for rail traffic to and from Mexico.”

Investment fund:

“We're expecting Fund II—which originally sought to raise $9 million and is officially oversubscribed—to be fully deployed by the end of the year, with the goal of building a strong $50 to $60 million portfolio of office, industrial and retail properties throughout Houston, Austin, San Antonio and Dallas,” said Pappas.

Retail market:

“One of the more interesting trends we've seen in retail is that long-term held assets are increasingly being purchased by non-institutional investors,” said Gaines. “The positive side of this is that these entrepreneurial-leaning entities tend to be nimbler when it comes to getting deals done. On the flip side, there is sometimes less of an incentive to meet prospective tenants in the middle on certain aspects of the negotiating process.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.