SEATTLE–The next US recession will be in 2020 and it will likely be triggered by monetary policy, according to most recent Zillow Home Price Expectations quarterly survey of more than 100 US real estate experts, which is conducted by Pulsenomics.

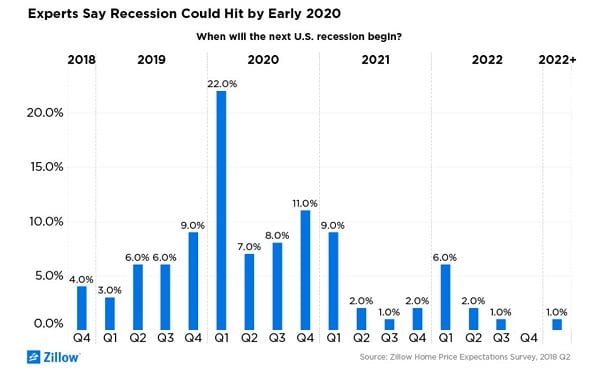

Almost half (48%) of those surveyed said they expected the next recession to occur some time in 2020, with the largest portion of those (22% of all respondents) saying they expected that recession to begin in the first quarter of that year. Roughly a quarter (24%) of all respondents said they expected the next recession some time in 2019, while 14% said they thought 2021 was the year.

The findings are largely in line with previous surveys by Zillow, except for the trigger — nine months ago geopolitical events were cited as the likely factor to tip the economy into recession.

This time, of the 99 panelists forecasting the timing and triggers of the next recession, 55 chose monetary policy as a likely recession trigger. The panel ranked likely triggers as 1, 2 and 3 – and with that weighting, monetary policy came out as by far the most expected catalyst, with a score of 137. That put it well ahead of trade policy (a score of 71), a stock market correction (69), higher-than-expected inflation (68) and fiscal policy (64). A potential geopolitical crisis triggering a recession ranked sixth, with just 26 panelists selecting it as a likely recession spark, for a score of 44 — well below the 67 panelists (and score of 138) recorded previously.

Fed Minutes Suggest June Increase

Separately, the Federal Reserve minutes from the last policy-meeting have been released indicating, to little surprise, that a rate hike would likely occur in June. If the US economy continued on track, “it would likely soon be appropriate for the committee to take another step in removing policy accommodation,” according to the minutes.

The Fed minutes, it should be noted, saw no sign of a recession on the horizon. According to the minutes:

They noted a number of economic fundamentals were currently supporting continued above-trend economic growth; these included a strong labor market, federal tax and spending policies, high levels of household and business confidence, favorable financial conditions, and strong economic growth abroad.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.