Here is a roundup of the latest leases, sales and other transactions in the Northeast middle markets.

This week by the numbers

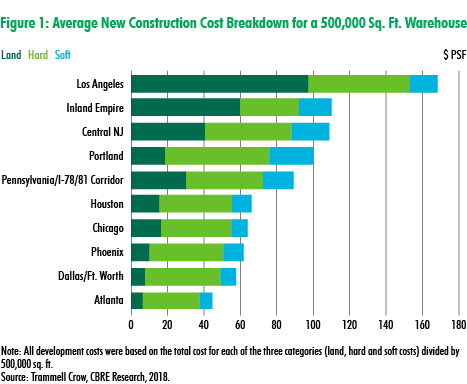

Rising construction costs have not constrained new warehouse development due to strong demand and limited supply of modern logistics facilities, CBRE says. The land cost component of the development process has risen the fastest and can represent more than half of a project's total construction costs, which range from $45 to $170 per square foot.

The pro forma market rent significantly exceeds the break-even rent required for a developer to break ground, often on a speculative basis. This spread between pro forma and breakeven rents currently ranges from approximately 20 percent to more than 40 percent, making warehouse development profitable in 10 leading industrial markets selected for this analysis.

Deal Tracker Daily

EAST ORANGE, NJ—Marcus & Millichap brokered the sale of Robert Towers, a 11-story, 206-unit multifamily asset in East Orange, New Jersey. The property sold for $22 million, or $106,796 per unit. Marcus & Millichap Capital Corp. arranged $19.8 million in acquisition financing. Gatto and Ozturk represented the seller, Metropolitan America, and procured the buyer, EOA 206 LP. Eric Seidel, MMCC senior director, arranged 36 months of interest-only financing for the acquisition. Built in 1950, Robert Towers is located at 60 S Munn Ave. in East Orange near the East Orange and Brick Church train stations, Interstate 280 and the Garden State Parkway. The property is 10 minutes from Newark International Airport.

RIVER EDGE, NJ—Dr. Dan S. Landmann has acquired a 3,112-square-foot office condo at 63 Grand Avenue in River Edge, NJ as a long-term home for his successful surgery practice, currently based in Maywood, NJ. Dr. Landmann's new office in River Edge will enable him to offer care out of an accessible, flexible and modern building for years to come. NAI James E. Hanson's Darren Lizzack, MSRE, Randy Horning, MSRE, and Michael Guerra represented the buyer, and Joe Tormen of Lee & Associates represented the seller, 63 Grand Ave LLC in the transaction. 63 Grand Avenue is a three-story, 10,000-square-foot office building located in the heart of River Edge, NJ.

BABYLON, NY—Marcus & Millichap (NYSE: MMI), a leading commercial real estate investment services firm with offices throughout the United States and Canada, has announced the sale of 101 Deer Park Avenue, a 8,000-square foot building located in one of the most popular spots on Long Island's South Shore. Tim McCaffrey and Michael Tuccillo of Marcus & Millichap's Manhattan office had the exclusive listing to market the property on behalf of the sellers, John, Kevin and Dennis Murphy who have been running the building as a sporting goods store. The building is well known in the Babylon Village community as the Sports Shack, for over 35 years.

POTTSVILLE, PA—Dunham's Sports retail sporting goods chain will open a new, 43,000-square-foot store at Fairlane Village Mall, according to Levin Management Corporation, exclusive leasing and managing agent for the 405,000-square-foot retail property. Formerly located in Frackville, PA, Dunham's Sports will continue its long tradition of providing area consumers with a wide variety of value-priced, name-brand merchandise at the new Fairlane Village Mall location. Founded in 1937, the chain maintains more than 230 stores in 22 states, offering a full line of traditional sporting goods, outdoor and athletic equipment, and active and casual sports apparel and footwear for men, women and children. Shoppers will be able to access Dunham's Sports from both exterior and interior mall entrances. Fairlane Village Mall is co-anchored by Kohl's, Michaels Arts & Crafts and Boscov's department store. The property features a lineup of national, regional and local tenants also including Harbor Freight Tools, T-Mobile, Dollar Tree, Schuylkill Valley Sports, Benigna's Creek Winery, Kay Jewelers, GNC and Super Shoes, among others.

Executive Moves

NEW YORK, NY—The global law firm of Morrison & Foerster named Jay Blaivas a tax partner in its New York office. Blaivas has more than 20 years of experience and will become a member of the firm's Federal Tax Group, providing key support to the firm's REIT, Fund Formation, Real Estate, and Private Equity practices. For the past six years at The Blackstone Group, Blaivas oversaw all tax-related aspects of the Blackstone Real Estate Debt Strategies business, including its draw-down funds, hedge funds and non-traded regulated investment companies, which has originated and acquired over $30 billion in loans since inception. He also managed all tax-related aspects of Blackstone Mortgage Trust, a publicly traded real estate investment trust, which has approximately $11 billion of real estate debt assets under management.

Money Moves

FORT LEE, NJ—SJP Properties says leasing has commenced for Phase II of The Modern at 100 Park Avenue. A mirror image of The Modern's first tower—a sleek 47-story glass building—the second tower completes Fort Lee's iconic new skyline, signaling the borough's arrival as a coveted residential destination along the New Jersey Gold Coast. The Modern's two phases include 900 luxury rental residences and 150,000 square feet of indoor and outdoor resort-style amenities. Like the development's first tower, the 450 residences in the community's newest building feature a mix of spacious studio, one-, two- and three-bedroom layouts that offer breathtaking views of Manhattan, the Hudson River, the George Washington Bridge, and the surrounding cityscape.

SOMERSET, NJ—Bridge Development Partners' Bridgeport I Logistics Center project was named 2018 Industrial Deal of the Year by the New Jersey chapter of NAIOP, the Commercial Real Estate Development Association. Completed in October 2017, the $240 million project was part of a larger, $695 million national core portfolio sale to Duke Realty, one of the largest Industrial REITs in the United States. The deal marked the culmination of a large-scale redevelopment effort by Bridge to transform a 103-acre brownfield site into New Jersey's premier industrial distribution campus. Located at 960-1000 High Street in Perth Amboy, N.J., Bridgeport I Logistics Center is a newly completed three-building campus that includes 1.3 million square feet of Class A industrial distribution space. Bridge acquired the property in 2015 and began work on transforming the blighted brownfield property—the former home of American Smelting and Refining—to create a modern, amenitized facility that could appeal to today's logistics users. After a redevelopment process that included significant environmental and soil remediation efforts as well as extensive geotechnical engineering, Bridge completed work on the campus in 2017. Shortly thereafter, Target Corp. agreed to a long-term lease for 718,500 square feet that will allow for the hiring of approximately 1,500 full-time workers on site. CBRE executive vice president Thomas Monahan represented Bridge and CBRE's Paige Rickert represented Target in the lease negotiations.

PEAPACK-GLADSTONE, NJ—The intersection of food and real estate brought 50 developers, investors, food entrepreneurs and advocates, and other real estate professionals together in May for a ULI NNJ event at the historic 90 Acres Farm in Peapack-Gladstone. “Cultivating Development: Sowing the Seeds for Innovation” featured an examination of trends and related best practices tied to the newest technologies and incentives being employed by the public and private sectors to maximize food production while serving rural and urban communities alike.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.