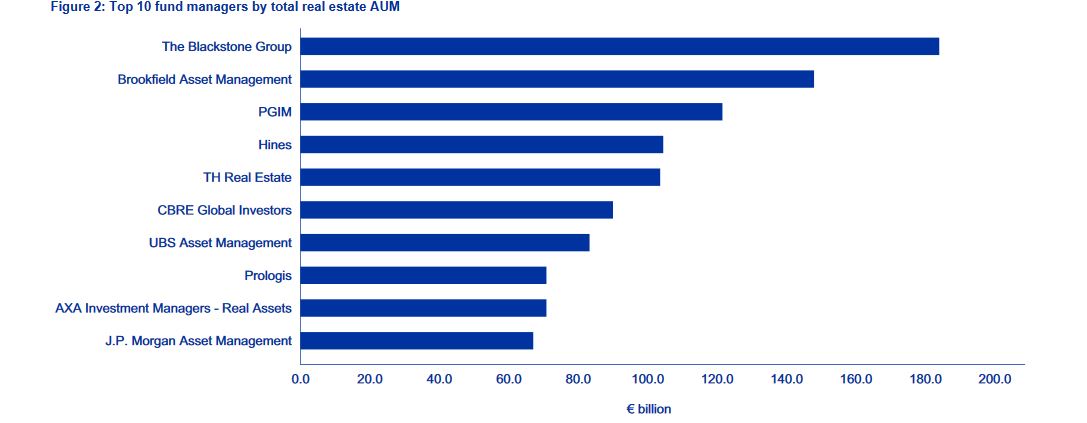

announced it had sold Blackstone Group INREV, ANREV NCREIF CEO Lonneke Löwik Brookfield Asset Management, PGIM, Hines TH Real Estate AXA Investment Managers – Real Assets, CapitaLand Limited Prologis

announced it had sold Blackstone Group INREV, ANREV NCREIF CEO Lonneke Löwik Brookfield Asset Management, PGIM, Hines TH Real Estate AXA Investment Managers – Real Assets, CapitaLand Limited Prologis

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.