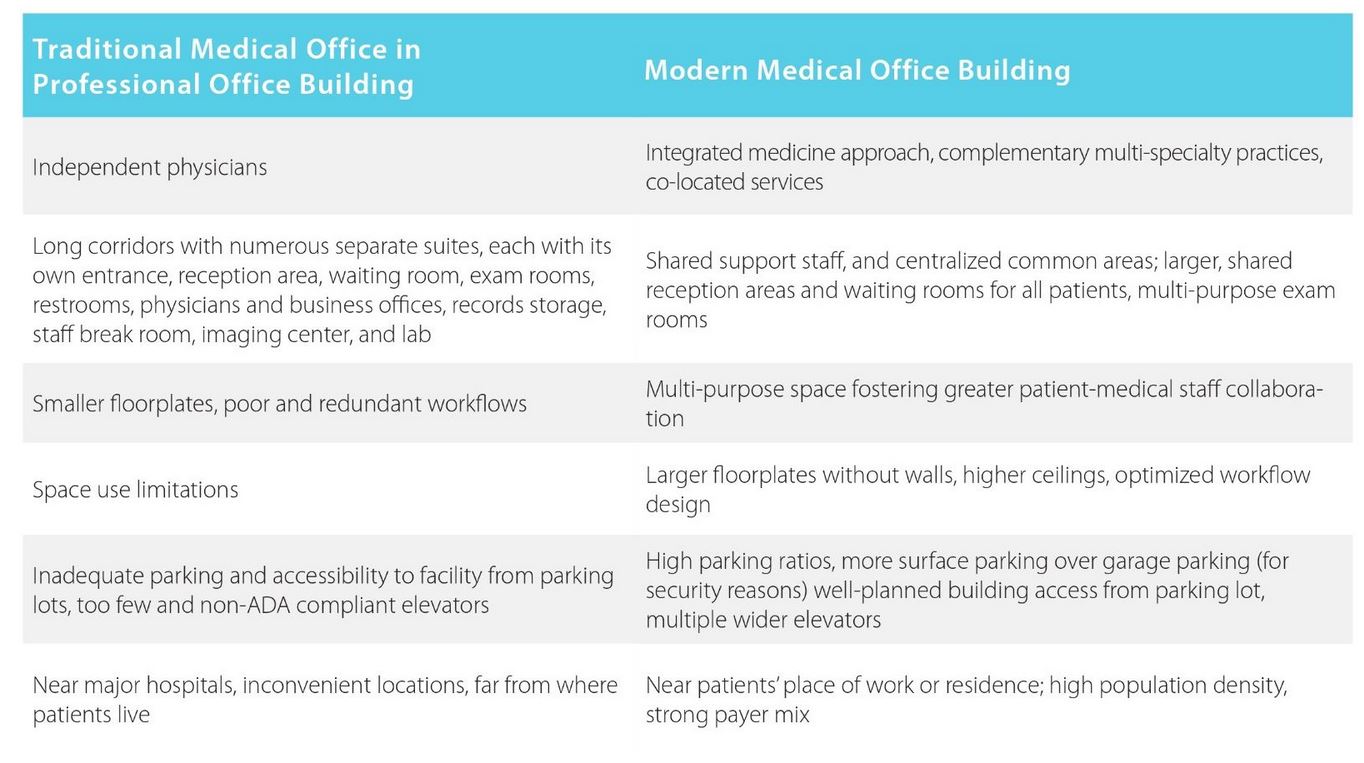

Jim Kornick[/caption]WASHINGTON, DC--There is an evolution underway in the medical office space that is similar to the competition, in some markets at least, between commodity A and A-plus office space and the trophy office space. The requirements expected of a medical office building are becoming more sophisticated and these changes are creating a schism in the market between the older stock and what Avison Young has dubbed in a new report, the modern medical office building. “In the midst of the ongoing transition in the healthcare MOB landscape, a sharpening of the lends on the modern MOB and the traditional MOB reveals differences that are striking,” according to the report “Evolution of Healthcare and its Impact on the Real Estate Landscape in the United States.”Indeed, one doesn't have to look that far in the past to see how much has changed for the medical office space. At one time landlords of professional office buildings were hesitant to accept medical tenants due to a negative perception from other office tenants. Even today certain tenants are deemed to be more desirable -- namely those in “clean” medical practices such as ophthalmology or orthopaedics -- compared with urology, dentistry, dermatology or urgent care practices and other practices that produce clinical wastes.But in terms of pure medical office space the main change of note is the trend of higher-acuity care being pushed off the hospital campus, “transforming the MOB into a hybrid form which integrates urgent care and ambulatory surgical care under one roof, emulating a hospital setting without beds," the report said.In short the new MOBs are more complex, learner, greener, more conveniently located, more digital and aesthetically more pleasing than both the professional office building housing discrete medical practices as well as older MOBs.

Jim Kornick[/caption]WASHINGTON, DC--There is an evolution underway in the medical office space that is similar to the competition, in some markets at least, between commodity A and A-plus office space and the trophy office space. The requirements expected of a medical office building are becoming more sophisticated and these changes are creating a schism in the market between the older stock and what Avison Young has dubbed in a new report, the modern medical office building. “In the midst of the ongoing transition in the healthcare MOB landscape, a sharpening of the lends on the modern MOB and the traditional MOB reveals differences that are striking,” according to the report “Evolution of Healthcare and its Impact on the Real Estate Landscape in the United States.”Indeed, one doesn't have to look that far in the past to see how much has changed for the medical office space. At one time landlords of professional office buildings were hesitant to accept medical tenants due to a negative perception from other office tenants. Even today certain tenants are deemed to be more desirable -- namely those in “clean” medical practices such as ophthalmology or orthopaedics -- compared with urology, dentistry, dermatology or urgent care practices and other practices that produce clinical wastes.But in terms of pure medical office space the main change of note is the trend of higher-acuity care being pushed off the hospital campus, “transforming the MOB into a hybrid form which integrates urgent care and ambulatory surgical care under one roof, emulating a hospital setting without beds," the report said.In short the new MOBs are more complex, learner, greener, more conveniently located, more digital and aesthetically more pleasing than both the professional office building housing discrete medical practices as well as older MOBs. Characteristics of the New MOB

Besides being prettier, the modern MOB has these other characteristics, Avison Young said:- Higher parking ratios than the traditional office building with a minimum of four per 1,000 square feet -- and as high as ten per 1,000 square feet particularly in retail locations.

- Wider elevators, corridors and entryways.

- More stringent requirements and regulations such as higher ceilings, at minimum 13 to 14 feet, to accommodate greater mechanical and electrical needs, air flow and exhaust. It will also have higher HVAC loads to deal with the extra heat produced by the equipment.

- Larger floorplates and open, modular space plans that can be configured as needed.

More Investment

These changes are also spurring more investment in medical office buildings, according to Avison Young Principal Jim Kornick. “They are actually attracting an increasing number of institutional investors -- foreign and domestic -- who are competing with traditional healthcare REITs and private investors,” for these assets.And, as always, the medical office asset offers some compelling fundamentals for investors. Kornick pointed to their relative high yields compared to other asset classes, a stable cash flow and high construction barriers to entry. “That is all keeping demand and pricing near record highs and cap rates near record lows,” he says.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.