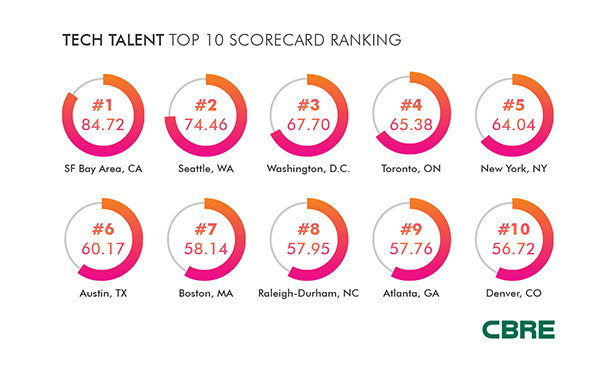

Ranking of top ten cities in the CBRE Tech Talent Scorecard

Ranking of top ten cities in the CBRE Tech Talent Scorecard

ATLANTA, GA—Atlanta remains a Top 10 tech talent market in North America, ranking ninth on CBRE's Tech Talent Scorecard, part of its sixth-annual Scoring Tech Talent Report, which ranks 50 US and Canadian markets according to their ability to attract and grow tech talent.

“Atlanta stands out as a high-growth tech hub with an increasing number of locally based technology companies, like CallRail, and out-of-town technology companies, like Namely and Pandora, choosing Atlanta and growing here in a big way,” says Christian Devlin, first vice president of CBRE's Tech & Media Practice in Atlanta. “With incredible educational institutions like Georgia Tech, a fast-growing pool of highly skilled tech talent, and a relatively low cost of doing business, Atlanta's tech sector is poised for continued significant growth in the months and years to come.”

Atlanta grew its tech talent pool at the third fastest pace of all 50 markets, increasing by 34.7 percent in the last five years (2012-2017), surpassing the San Francisco Bay Area (31 percent) and Vancouver (30.7 percent).

Tech labor concentration—or the percentage of total employment—is an influential factor in how “tech-centric” the market is and its growth potential. Atlanta has a tech talent labor pool of 134,770, or 5.1 percent of its total employment, compared to the national average of 3.5 percent.

The top five markets for tech talent in 2018 were the San Francisco Bay Area, Seattle, Washington, DC, Toronto (the first time a Canadian market made the top five) and New York, all large markets with a tech labor pool of more than 50,000.

The Tech Talent Scorecard is determined based on 13 unique metrics, including tech talent supply, growth, concentration, cost, completed tech degrees, industry outlook for job growth, and market outlook for both office and apartment rent cost growth.

Atlanta stood out in the report in several other key areas:

- Atlanta ranked fourth for educational attainment with 50.5 percent of urban residents 25 years and older holding a bachelor's degree or higher (U.S. average: 31.3 percent).

- With more than 6,000 tech degree completions in 2016, Atlanta is among the top 10 regions in North America for producing graduates in the tech field, a 41.2 percent growth within five years (2011-2016).

- The metro has added 9,157 more tech talent jobs than graduates during the past five years, ranking fifth among only a few markets to report a “brain gain.”

- Atlanta's office rents increased 32 percent to $26.25 and its vacancy rate decreased nearly five percentage points to 17.4 percent from Q1 2013 to Q1 2018.

“Strong economic conditions and tightening labor markets are constraining tech talent job growth and increasing costs,” says Colin Yasukochi, director of research and analysis for CBRE in the San Francisco Bay Area. “This has accelerated the expansion of tech talent pools across the U.S. to meet this demand, starting with increased numbers of tech degree graduates. Accordingly, demand for commercial real estate in large and previously under-utilized regions is on the rise from both start-ups and established companies.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.