Chicago-based HSA Commercial will finish Gateway V, a 262,000-square-foot spec building in Plainfield, IN, by the end of the year.

Chicago-based HSA Commercial will finish Gateway V, a 262,000-square-foot spec building in Plainfield, IN, by the end of the year.

CHICAGO, INDIANAPOLIS—Seemingly every firm that delivers consumer goods needs to reconstruct or expand their national supply chain, and that demand has made the Indianapolis industrial sector into an unstoppable engine.

In the first half of the year, developers delivered another 2.2 million square feet of space, according to a new industrial insight report from JLL. But those big numbers have been more then matched by demand. Tenants are clamoring for space, and have already absorbed more than 2.9 million square feet in in the first half of 2018, a substantial increase over the first two quarters of 2017 when absorption was only 1.2 million square feet.

Tenants recently picked up the pace. More than four million square feet of space was leased over the past three months, leading to 1.6 million square feet of net absorption.

“The Indianapolis market is accelerating into a dynamic third and fourth quarter,” Robert E. Smietana, chief executive officer of Chicago-based HSA Commercial, tells GlobeSt.com. His company is one of the most active in the metro area and recently began work on Gateway V, a 262,000-square-foot industrial spec building at its Gateway Business Park in Plainfield, IN.

Smietana expects the metro area to continue generating impressive numbers. He knows of one firm that needs 1.5 million square feet of space, and another that wants 1.3 million, demand which may require new construction. “That's an indication of the desirability of the Indianapolis market.”

JLL agrees with that observation. According to its new report, in the second half of the year the market “will grow by at least another 1.5 million square feet. Look for that number to increase as more deals get signed. We are already tracking one million square feet of pending transactions for next quarter.”

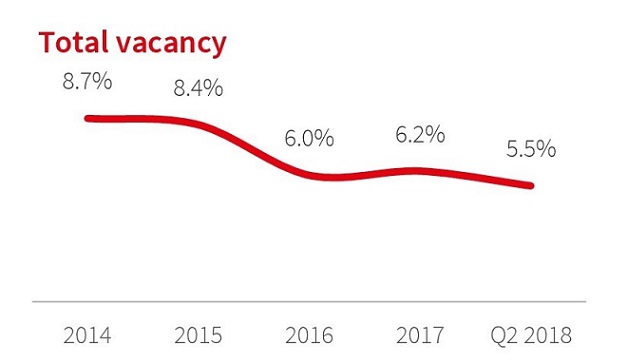

According to JLL statistics, the vacancy rate has plunged even as developers completed millions of square feet of new space.

According to JLL statistics, the vacancy rate has plunged even as developers completed millions of square feet of new space.But the market is not necessarily driven by such mega tenants. HSA has already had great success with its smaller spec projects. Gateway III leased up in less than a year, and Gateway IV, a 151,200-square-foot building completed last summer, was filled in less than six months. “We're seeing a lack of availability for these tenants,” Smietana says. “They don't have a place to land.”

The Gateway buildings were part of a tax abatement plan agreed to by the city of Plainfield, he adds. It takes 10 years for the abatement to fully burn off, and even though the first two buildings in the park have reached that milestone, tenants still line up to occupy that space. “Even with the higher tax bills, buildings I and II are 100% and 90% leased.”

“Indianapolis has been one of the better, more stable, solidly growing markets in the country,” he says. Its central location makes it ideal for class A distribution buildings, and the demand for such product is now greater than ever.

An additional 7.3 million square feet of industrial space remains under construction, according to JLL. Surprisingly, 50% of this space has already been pre-leased. “It's no wonder an additional one million square feet of speculative space is slated to break ground any day now.”

There has been so much construction in the past half-decade that it may be time to start projects in new areas. In Plainfield, a southwest suburb adjacent to Indianapolis International Airport, there is “not much available land,” Smietana says. “Near the airport and highways, most of the land is either spoken for or built upon.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.