At the beginning of the year Larry Fink sent out his annual letter to investors, a missive that departed from those of years past with a stark statement from the Blackrock CEO: “a company's ability to manage environmental, social, and governance (ESG) matters demonstrates the leadership and good governance that is so essential to sustainable growth, which is why we are increasingly integrating these issues into our investment process.”

In their fifth annual US Green Building Adoption Index, CBRE and Maastricht University chose to highlight Fink's mission statement and it is little wonder why–it is difficult to find a more telling example of how important ESG has become to the investment community. The environment issue in particular has become a clarion call to lenders, which now realize that green bona fides correlate with stronger performance.

“For investors and lenders in the commercial real estate sector, green building certification affects their cost of capital,” said Dr. Nils Kok, associate professor at Maastricht University, in a prepared statement. “The rationale is that such buildings have a more attractive risk profile, and may be more resilient when economic headwinds arrive.”

CBRE and Maastricht University highlighted this ongoing development in their report on the index, noting that as green certifications reach maturity, the capital markets are increasingly incorporating them into loan pricing and alternative financial instruments such as green bonds. And, according to additional research by Green Building Adoption Index co-author Rogier Holtermans, buildings certified by ENERGY STAR and/or LEED have been shown to transact for about 10.1% more than non-green certified buildings. This is likely a reflection of the fact that green buildings lease for rates that are 2.2% higher, and effective cash flows are, on average, 4.6% higher.

On the lending side Freddie Mac and Fannie Mae are adapting their rates based on the presence or absence of green building certification with the GSEs providing pricing breaks in the range of 10-30 basis points to multifamily assets that are rated by one of eight different green rating schemes, according to the index.

These schemes resulted in a total of $46.6 billion in green commercial mortgages–$19 billion for Freddie Mac and $27.6 billion for Fannie Mae. No other US lender is currently taking green building certification into account in mortgage pricing, according to the report, but some European banks have initiated programs that provide pricing breaks to green-certified Buildings, with ING Bank, ABN AMRO, and Rabobank being notable examples.

An Implicit Relationship

Interestingly the report also noted that it is difficult to pinpoint the extent to which green building certification is systematically integrated into real estate equity investments. “For instance, data providers such as CoStar list the presence of a LEED and/or Energy Star certificate on their platform, but this does not imply integration of the information into financial models used by investors for asset underwriting and valuation,” the report says. Rather the evidence is more implicit: it is through a series of academic studies that we assume that green building certification is taken into account by investors, such as Holtermans' research.

Other research has shown that commercial mortgages collateralized by green-certified buildings have significantly lower default rates, which implies that lenders should reflect the energy and sustainability performance of collateral into mortgage pricing, according to the report.

Green Bonds

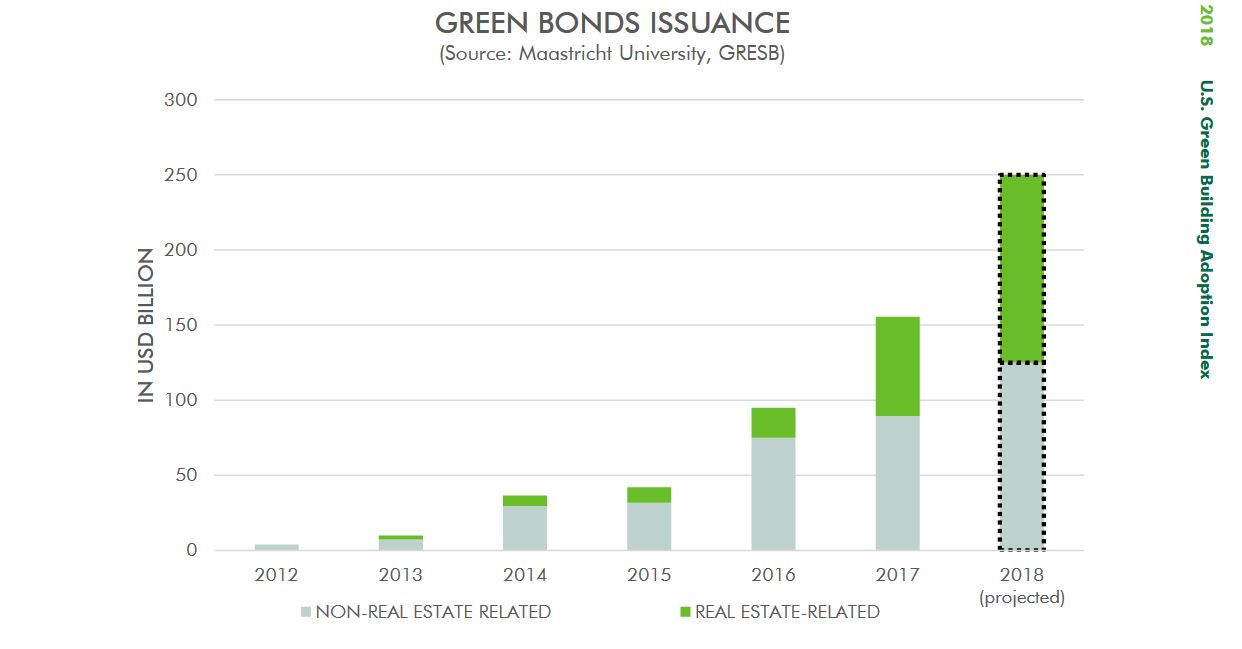

Another sign that the capital markets are taking green buildings seriously: there is a rapidly growing market for green bonds, issued with the specific purpose of investing the bond proceeds into “green” purposes. For example, green bonds issued by Digital Realty, Prologis, Regency Centers, and Vornado as well as by Apple, all use proceeds to either develop or renovate buildings with a high level of green building certification, the report said.

The green bond market started from an issuance volume of $4 billion in 2012 and is projected to grow to $250 billion in 2018. “Over the past years, the importance of real estate for use of proceeds has increased to 42.4% in 2017, relying to a large extent on green building certification as a measure of 'greenness,'” the report noted.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.