WASHINGTON, DC–The Urban Land Institute's Real Estate Economic Forecast, which includes predictions for the economy and industry through 2020, does not pull punches in its latest report. Not that it needed to, for the news is hardly bad. But the consensus forecast is plain: growth in the US economy and the CRE markets will start to moderate after 2019. GDP growth is projected to stay strong in 2019 at 2.5%, while moderating to 1.7% in 2020.

Meanwhile, expectations for the real estate market are more tempered than the overall economy, with rent growth and return forecasts below trend and surprisingly moderate for late in the cycle, wrote William Maher, director, Americas Strategy & Research at LaSalle Investment Management on behalf of ULI.

This is not to say growth will retract in two years: it is forecast to continue. And if it does, Maher pointed out, “the eleven year real estate expansion that started in 2010 will be one of the longest on record.”

All in all, it is not a bad forecast for a cycle so long in the tooth. Here are the details.

Transaction Volume

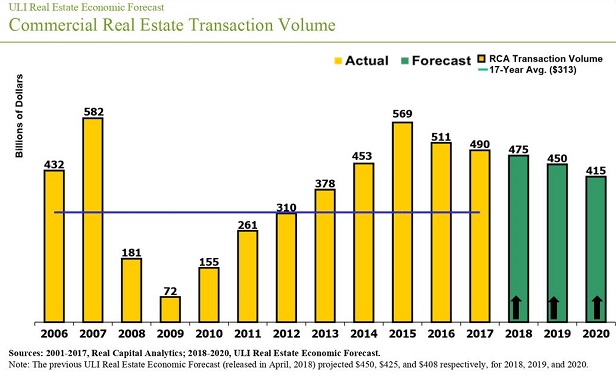

The forecast predicts that CRE transaction volume will continue to decline this year following the drops in 2016 and 2017 from the post-recession peak of $569 billion. This year volumes are expected to clock in at $475 billion. Next year they are predicted to be $450 billion and $415 billion in 2020.

Still, these levels are substantially above the 17-year annual average of $313 billion.

CMBS

CMBS issuance has rebounded since a low in 2009 but at a much lower level than pre-recession levels. CMBS issuance is expected to be $90 billion in 2018, $88 billion in 2019, and $80 billion in 2020.

Compared to the forecasts of 6 months ago, the current forecast for transaction volume is expected to be higher in all three forecast years, while the forecast for CMBS issuance remains essentially the same.

Pricing and Returns

The RCA Commercial Property Price Index (CPPI) has had some recent high growth years. Prices are expected to continue to grow, although at slowing rates in the next three years, at 6.0% in 2018, 5% in 2019, and 4% in 2020.

Equity REIT total returns, according to NAREIT, were positive for the ninth straight year in 2017 at 5.2%, but below the 20-year average of 10.8%. Future returns are expected to remain positive yet remain below the long-term average, at 4% in 2018 and 2019, and 4.2% in 2020.

Total returns for institutional-quality direct real estate investments, as measured by the NCREIF Property Index (NPI), dipped to 8.0% and 7.0% in 2016 and 2017, respectively, after six years of above long-term average returns. This moderation is expected to continue over the forecast period, to 6.5% in '18, 6.0% in '19, and 5.0% in '20.

NCREIF total returns in 2018 for the industrial, apartment, office, and retail sectors are expected to moderate relative to returns in 2017. By property type, 2018 returns for the industrial sector are forecast at 11.4%, followed by office returns and apartment returns both at 6%, and retail returns at 4.5%.

By 2020, all sector returns are expected to further moderate, with industrial returns forecast at 7.2%, apartment returns at 5%, office returns at 4.0%, and retail returns at 3.9%.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.