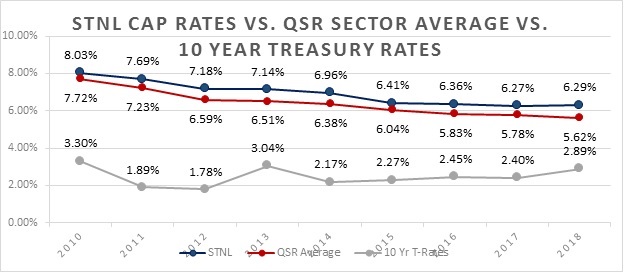

This premium to the STNL average is driven by their leases, locations, and insulation from ecommerce. The typical QSR lease is long (15 to 20 years), with no landlord responsibilities, and rental increases during the base term. QSRs usually operate in buildings with strong real estate fundamentals, good visibility from roads with high traffic counts. These factors not only help the tenant, but make the property attractive to investors. Ecommerce giants, such as Amazon, are not able to disrupt the QSR industry, as shipping prepared food is unlikely to take hold. The QSR industry is facing challenges from changing consumer preferences and rising labor costs, but the industry has started adjusting with the rise of self-service kiosks and expanded menus.

This premium to the STNL average is driven by their leases, locations, and insulation from ecommerce. The typical QSR lease is long (15 to 20 years), with no landlord responsibilities, and rental increases during the base term. QSRs usually operate in buildings with strong real estate fundamentals, good visibility from roads with high traffic counts. These factors not only help the tenant, but make the property attractive to investors. Ecommerce giants, such as Amazon, are not able to disrupt the QSR industry, as shipping prepared food is unlikely to take hold. The QSR industry is facing challenges from changing consumer preferences and rising labor costs, but the industry has started adjusting with the rise of self-service kiosks and expanded menus.

The cap rate of QSR properties can vary widely between tenants. Tenants such as Chick-fil-A and McDonald's will typically sell below a 5% cap rate while KFC and Church's Chicken are likely to trade in the 6+% cap rate range. Major factors driving this are guarantor, lease type, and location. Some QSR brands, such as McDonald's and Chick-fil-A, will provide a corporate guarantee behind some or all of their restaurant locations. This strong guarantee greatly reduces the risk for an investor and tends to drives the cap rate down. The type of lease will also have a measurable effect on cap rate. While both fee simple triple net leases and ground leases leave the investor with no landlord responsibilities, ground leases tend to trade at much lower cap rates. The last driving factor on cap rates is location. A signalized corner near a large anchor tenant location will typically trade at a premium with pricing fluctuating based on region. Properties in California have been in high demand, causing cap rates to remain lower than the rest of the country. Florida, another hot real estate market, sells at significantly lower cap rates than the regions immediately surrounding it.

The views expressed here are the author's own and not that of ALM's Real Estate Media Group. Read the full QSR Sector Report for more details.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.