In the final installment of this year's Influencers series, Real Estate Forum is putting the spotlight on the people and organizations that have helped to shape the field of Healthcare Real Estate. Don't miss your chance to nominate a Healthcare Influencer today!

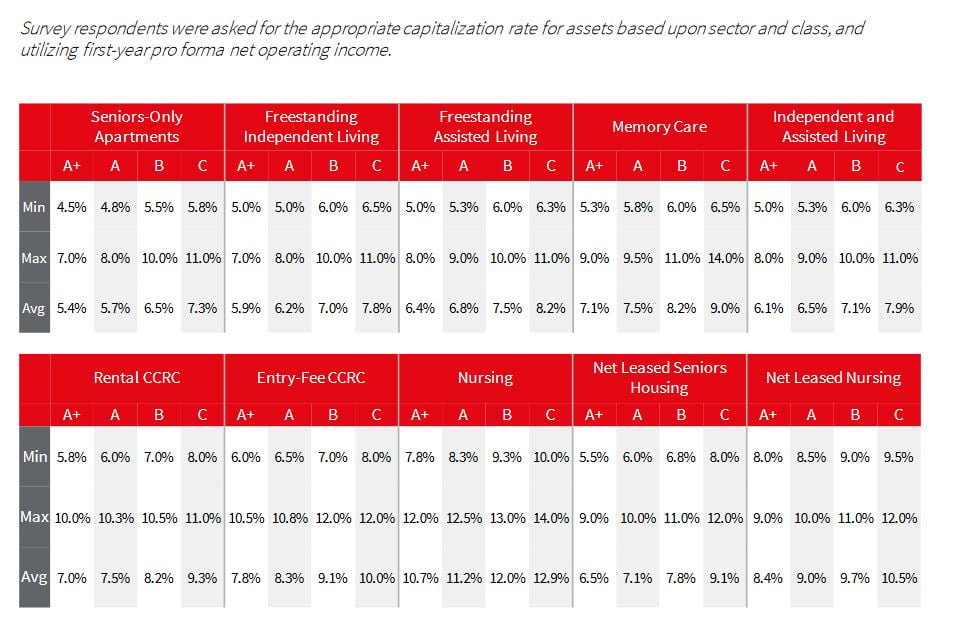

There is a school of thought that because senior housing is a management-intensive business its risk profile dictates that spreads should remain well above other asset classes. And indeed the sector is dealing with declining occupancy levels, rising operating costs and interest rates that are creeping up — factors that, all things equal, should drive up cap rates. But respondents in JLL's newly-released Mid-Year 2018 Seniors Housing Investor Survey, clearly don't subscribe to this theory; 57% of them predicted that senior housing cap rates will compress relative to other asset types. 11% predicted that spreads will increase while 32% said that spreads will remain about the same.

In short the senior housing sector has been, and still is, a seller's market as new capital sources try to enter the space and demand for quality assets exceeds supply. The sector is drawing investment and competition for product is heating up–all of which suggests that it is the returns that will be squeezed instead of the cap rates.

A More Mainstream Investment

Indeed there is speculation that the spread between core real estate, such as multifamily or industrial assets, and senior housing will tighten despite senior housing's historically higher cap rates.

One reason for this belief is the assumption that senior housing is becoming a more mainstream investment segment, and that transparency and competition will result in seniors housing capitalization rates falling relative to other asset classes, JLL said.

Valuations are Rising

The survey also signalled that valuations will rise for many of these subcategories within senior housing. Seniors-only apartments and age-in-place seniors housing (which is any combination of independent living, assisted living and memory care) are turning investor heads for their rising values, JLL said. 61% of respondents and 38.6% of respondents said they believe seniors-only apartment and seniors housing assets will see modest to significant value increases over the next 12 months, respectively.

Independent and assisted living facilities continued to be the most sought-after assets with 72% of respondents saying they were very or extremely desirable. Free standing independent living facilities were respondents' second favorite with 58% ranking them as very or extremely desirable. Freestanding nursing care facilities and entry-fee CCRCs ranked last with 71% and 66% of respondents ranking them as not so or not at all desirable respectively.

Three Month Marketing Time

Over one-third of survey respondents reported marketing time for seniors-only apartments to be three months or less, an indication of the limited supply and investor appetite, JLL said.

Independent and assisted living were anticipated to be marketed for three months longer on average. However, survey respondents reported the length of the marketing period for skilled nursing and CCRCs could be up to 12 months on average, due to a more limited buyer pool as well as the complexity of license transfers.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.