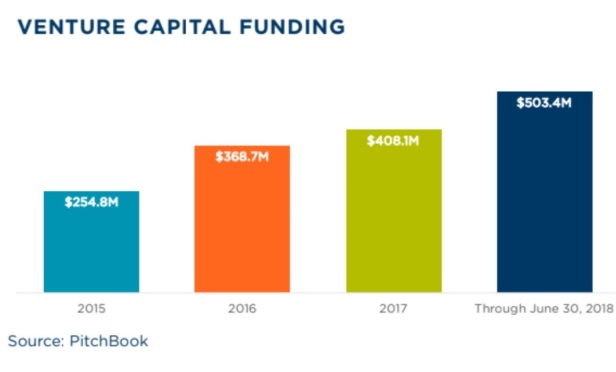

Venture capital funding has steadily increased since 2015, according to research by PitchBook.

Venture capital funding has steadily increased since 2015, according to research by PitchBook.

PORTLAND, OR—The impact the tech sector has had on commercial real estate appears to be in one fell swoop but in actuality has been building since the financial crisis of 2008. The trend of start-ups and tech companies occupying large spaces in metropolitan areas is occurring all over North America and especially in tech-vital cities. So says Cushman & Wakefield's annual report, Tech Cities 2.0, that identifies existing and emerging tech centers increasingly driving the North American economy and impacting the commercial real estate sector.

A follow up from last year's inaugural Tech Cities 1.0 report, this year's research reviewed all major North American markets, combining employment, occupations, venture capital investment and demographics statistics, and groups the top cities into three categories based on how important the tech sector is to the local economy and real estate market: tech is a critical component of the local economy and CRE market, tech is a key driver of the local economy and CRE market, tech is important to the local economy and CRE market, but of course there are other important sectors as well.

“As tech companies continue to dominate headlines and grow, a key question is how this affects commercial real estate. Building upon our inaugural Tech Cities report from last year, Tech Cities 2.0 offers new data and a further in-depth analysis of the marketplace,” says Revathi Greenwood, Cushman & Wakefield's Americas head of research. “Tech is no longer limited to just traditional technology companies–media companies, retailers and even law firms are competing for the same spaces and talent as traditional tech companies. While the result can be seen in nationwide trends, we've identified key insights that impact companies across every industry.”

Ken McCarthy, Cushman & Wakefield's principal economist and applied research lead for the US, says Tech Cities 2.0 demonstrates the profound impact the tech sector has had on commercial real estate.

“Although we expect established markets like Silicon Valley to see continued investment, new tech hubs are emerging across North America, from Provo to Philadelphia, sustaining a period of tech-driven economic growth unseen since the dot-com boom of the late 1990s,” McCarthy says. “If Silicon Valley is the brains of the tech sector, then New York City is the creative center.”

The tech industry has changed the way its companies and also those traditionally non-tech firms approach commercial real estate, says Robert Sammons, Cushman & Wakefield's senior director, Northern California research.

“Both start-ups and big tech companies have recognized they need a footprint in the central cities to keep attracting Millennial workers, and as a result, they are taking large chunks of high-rise buildings and trophy assets in dense urban areas, in addition to keeping their sprawling campuses in the suburbs,” Sammons said.

As well, he added that tech companies are driving demand as they continue to hunt for space and grabbing it in certain hot markets when they can find it.

“With unemployment at 4% or lower in each of these markets, tech companies of all sizes are in a war for talent and must do their utmost to hold on to and recruit employees–and that means the best salaries, the best incentives, the best space and the best location,” he says. “That last point has generally meant an urban or even suburban location that is mixed use, walkable, bikeable and near mass transit.”

Portland falls in the second category, tech is a key driver of the local economy and CRE market, with tech tenants a driving source of demand downtown. This activity has been driven by both expansion of existing companies located in downtown as well as suburban tech firms seeking better amenities to accommodate workforces, says Holly Huber, senior research analyst for Cushman & Wakefield's Portland office. She points to the example of Autodesk moving into an adaptive reuse in the close-in eastside submarket from the suburban Kruse Way submarket this past quarter. But that is not the only story.

“The real Portland tech story is in venture capital funding and its startups,” Huber tells GlobeSt.com. “Portland may not be infused with Fortune 500 tech headquarters like San Francisco or Silicon Valley, although it does serve as headquarters to several marquee apparel/athletic companies, but the likes of Jama Software, a Portland startup, growing their business in downtown Portland and recently being awarded $200 million in their second round of funding is the epitome of Portland tech and showcases its innovation and entrepreneurial spirit. While we have experienced in-migration from other markets, the future of Portland isn't necessarily all about the big players but rather the boom of startups, like our restaurant scene, Portland is known for growing local business.”

AWS Elemental, now owned by Amazon and formerly known as Elemental Technologies, is another proven success story of a local startup growing its headquarters here.

For more information on real estate technology, join GlobeSt.com at RealShare Apartments in Los Angeles from October 29-30, 2018. This year, GlobeSt.com and CRETech are coming together to present two highly engaging sessions that highlight cutting-edge technology solutions at RealShare Apartments. These interactive and entertaining discussions will provide key takeaways and practical insights from top technology innovators and top adopters in the multifamily industry. Register for RealShare Apartments.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.