The commercial real estate industry is flush with capital and that bears out in the numbers. For the first half of 2018, global CRE transaction volume increased 13% year over year to $341 billion, according to Deloitte's 2019 Commercial Real Estate Outlook. The Americas' volume rose by 9% YOY to $132 billion and the US led the Americas' growth with a volume of $122 billion, for a +11% YOY growth rate.

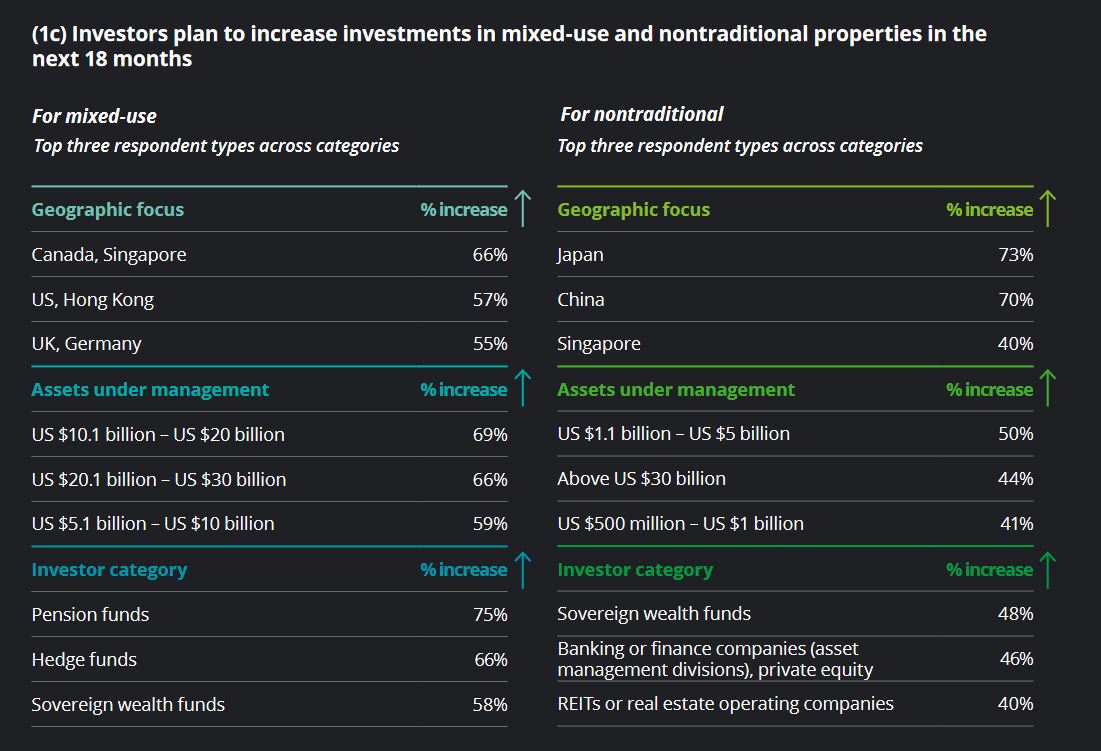

But real estate companies should not assume the flow will continue, especially if they are developing or investing strictly in traditional assets. Increasingly, investors are diversifying their portfolios by investing in newer and emerging business models and thematic categories, according to Deloitte. For example, it notes that over half of investors it surveyed reported plans to invest or increase investments in properties with flexible leases, and 44% plan to do so for flexible spaces. In general, survey respondents specializing in mixed-use and nontraditional properties plan to increase their capital commitment by a higher percentage than those focused on traditional properties. Specifically, under nontraditional properties, those surveyed are likely to increase investments in data centers and health care, including senior housing, facilities.

“Investors seem to realize that their investments should be tied to the changing nature of work and tenant preferences,” Deloitte writes. “As such, the new capital commitment is unlikely to flow entirely into traditional CRE.”

For companies looking to grab some of this newly-oriented capital, Deloitte has some suggestions.

Rebalance your property portfolio

Investors' capital commitment plans suggest CRE companies could have an advantage if they stay close to and demonstrate clarity on their core investment strategies—while at the same time balancing and diversifying their property portfolios, Deloitte writes. They would do this via joint ventures or mergers and acquisitions.

Companies can also leverage data-driven analysis for a more robust strategy around current market positions and to analyze how expansion into newer properties could complement their existing ones, Deloitte writes. “For instance, retail owners could conduct highest and best use analysis based on location, surrounding demographics, and other macro factors to repurpose some of their vacant assets into nontraditional uses such as data centers and senior housing and create new sources of revenue.”

It's all about the tenants

CRE companies should reimagine tenant experience by weaving technology throughout the tenant life cycle, Deloitte writes. “This can help strengthen tenant stickiness and therefore valuations.” Technologies abound to make this happen from augmented and virtual reality that allow potential buyers or tenants to have an immersive experience of a property, to the Internet of Things, artificial Intelligence and predictive analytics that help a company (re)develop and tailor existing or new buildings to suit changing tenant preferences.

These technologies also allow for smarter tenant repositioning and a more diverse tenant portfolio. “For example, some retail owners are now offering empty mall space to retail incubators or even co-sharing work spaces,” Deloitte writes.

Diversifying the investor base

REITs in particular stand to benefit from this strategy, as they can now take advantage of the separate Global Industry Classification Standard (GICS) of real estate and help generalist investors to better understand the nuances of REIT operations, Deloitte writes. “Companies can frame a targeted expansion strategy for generalist investors—such as pension, endowment, and foundation funds—who have traditionally under-allocated to REITs but are warming up to REIT investments.”

Commercial real estate firms can also use data insights to target investors from different countries. “For instance, our survey respondents from Canada (55%) are interested more in the Northeast region of the United States, while Chinese respondents (40%) focus more on the Sunbelt.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.