Laurel Davis. Photo by Karen Elliott Greisdorf

Laurel Davis. Photo by Karen Elliott GreisdorfWASHINGTON, DC–Fannie Mae recently added a REMIC structure to its credit-risk transfer program and REITs responded far beyond expectations last week to the inaugural offering, Laurel Davis, Vice President for Credit Risk Transfer at the GSE tells GlobeSt.com.

She reports that 22% of the investors in the first and second tranches were REITs and on the B1 tranche, almost 20% were REITs. Year to date, not counting this issuance, 9% of the investors in the first tranches have been REITs and only 3% have invested in the B1 tranche. “I was not expecting to see such a dramatic increase so quickly,” Davis says.

Pricing ended up in the middle of its range, which was another pleasing development, she notes, especially considering the tougher market backdrop of the last month.

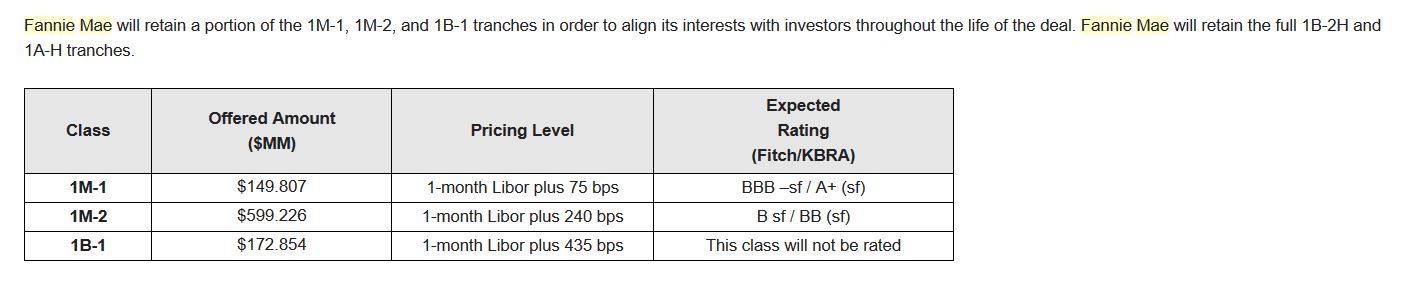

The offering, CAS Series 2018-R07, is a $922 million note that is the seventh and final credit-risk sharing transaction under the Connecticut Avenue Securities (CAS) program for the year. The CAS program shares credit risk on its single-family conventional guaranty book of business.

Adding The REMIC Structure

Earlier this year Fannie Mae signaled it would be taking this step in the near future. The GSE had been working for more than a year on a way to convert its CAS program to issuing it as a REMIC, or a real estate mortgage investment conduit. It had been a goal of the program from the beginning, Davis says.

It was important, to state the obvious, that Fannie Mae didn't cannibalize its MBS market in the process so what the GSE is doing is taking a REMIC election on the loans as it acquires them from the lenders and securitizes them into an MBS. “It's really just a tax selection–nothing special,” she says. “But what it does is give us the building blocks we need to issue CAS deals as REMICs.” Once the CAS notes are REMIC eligible they become debt for tax purposes.

Attracting REITs

Prior to this, the B1 class didn't have this tax treatment, which meant REITs couldn't buy it, nor could international investors as it was subject to US withholding tax. The deals are structured specifically to met the REIT asset tax test, Davis says, which the prior tax structure did not. “We've seen a number of REITs that have dipped their toes into the program knowing that there were some constraints. We've talked to plenty of others that were interested in investing in mortgage credit, especially if they were already investing in agency MBS. “It's a nice strategy for them to be able to invest in the rate side of the product through the MBS and then the credit side.”

Other than this change, the program remains consistent, which was another goal of the GSE as it added this enhancement to CAS' structure, Davis says. “All of the offered notes look the same as they did before — the capital structure, the cash flows, the deal term are all unchanged from prior deals. It was important to us to maintain the liquidity of the program.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.