This is the web version of a feature that originally appeared in Real Estate Forum magazine. To see the story in its original layout, click here.

This is the web version of a feature that originally appeared in Real Estate Forum magazine. To see the story in its original layout, click here.

Technology. It has long been a foreign word in commercial real estate, an industry that's been one of the slowest adopters of innovation. But that is all changing.

New real estate technology companies are emerging to disrupt (or, revolutionize) every corner of the commercial real estate industry, from property management and marketing to financing and brokerage. While most of the technologies can be utilized across asset classes, the multifamily market in particular is getting a bulk of the tech boost. These new technology platforms and products are making it easier to do both the big things, like develop and buy or sell a property, to the important day-to-day tasks, like collecting rent payments and tracking energy consumption.

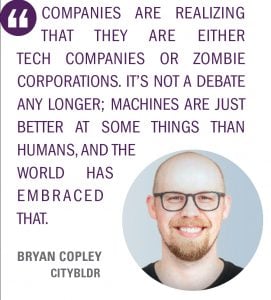

CityBldr, a Seattle-based tech start-up launched by Bryan Copley and Devyn Cairns, is aiming to streamline the development process, using machine learning to determine the best use of a development site and to forge partnerships between stakeholders. “Devyn and I started CityBldr when we realized that there was no efficient marketplace that allowed property owners to connect with investors, builders and developers,” explains Copley, who is CEO at the firm.

This technology has been a success, especially considering the demand for more housing options. Copley says that this demand, combined with the efficiencies technology provides to developers, has given hope that the supply-demand imbalance can addressed. “Across the country, people are increasingly moving to the city and there aren't enough homes. Builders looking for sites are frustrated,” he says. “People looking for homes are frustrated. City planners and officials trying to mitigate the imbalance in supply and demand are frustrated. The number of homeless living in cities is growing yearly.”

All of these problems can be traced to a lack of housing, he explains. “So CityBldr comes along and says it can optimize cities to create tens of thousands of units of housing and people want to know more,” Copley relates. “It's an issue that unites the left, the right and center. Almost everyone wants to see more housing built.”

The multifamily market has seen significant tech integration, but on the consumer side, much of the process is dated and lacks a tech tool. Online payment tracking platform PYMNTS, for example, reported that 80% of rental payments are paid through cash or check. In addition to being slower than online payment tools, analog forms of payment are also less secure than digital ones. It's also less convenient, especially for millennials, who account for 61% of all online payments. Instead, most of the technologies disrupting the multifamily market are those built for all CRE asset classes.

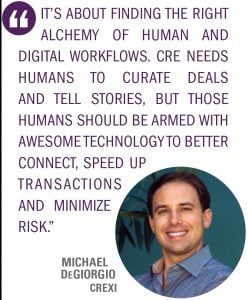

For buying, selling and leasing assets, CREXi has emerged as a digital commercial real estate marketplace for all asset classes, and multifamily is a core asset of the site. Michael DeGiorgio launched the platform to create efficiencies in the exchange process. “I was frustrated after seeing technological advances in nearly every other industry—including residential real estate, which had begun to rapidly innovate at the time—while commercial real estate went largely ignored from a technological standpoint.”

Though many said the reason was that the industry was resistant to change, DeGiorgio didn't believe that to be the case. “Demand for smart advancement from brokers and investors was there, they were using technology to bank, shop, travel, buy stocks and more, but the supply of good commercial real estate technology platforms was lacking and I believed someone needed to build a great platform to support this great industry. That's what we set out to do.”

While the industry has been slow to adopt technology in general, brokerage in particular has eschewed new technologies. That isn't surprising, though, considering that brokerage has been a relationship-based enterprise. Despite that, CREXi has seen rapid adoption. “The support has been overwhelming,” adds DeGiorgio. “Our platform was designed to make commercial real estate brokers and buyers more effective and allow them to do more transactions with less required resources. Our vision has been embraced and adoption from the brokerage community has been humbling.”

Then, there is Measurabl, a new software company that helps building owners track sustainability data and meet energy benchmark goals. Sustainability is becoming a standard for many property owners and building tenants, including multifamily renters. Matt Ellis launched the company with Lance Onken after the two met at the University of California, San Diego as college water polo teammates. Ellis has a background in real estate, while Onken has a tech background, and the marriage of the two enabled them to create a highly efficient technology for building owners to tackle the wild west of suitability.

“When we started, the first feature set that we built was around simplifying the annual sustainability burden. That required collecting qualitative and quantitative information and producing annual reports, which had a lot of complex calculations in them,” says Onken who is the firm's CTO. “We solved that problem, but that was only as good as the data you had to put into the equation.”

To counteract the multitude of human errors, he explains, Measurabl set out to automate the data collection from utility companies and “build upstream. It felt like people were waiting for us to come along. As soon as we were there, people wanted to tell us their problems and see if we could help solve them.”

Measurabl used common consumer software programs like TurboTax as a model for its software, focusing on ease of use. As a result, the technology has been quickly embraced. “We were agile because we were a start-up, and I think that was a breath of fresh air in an industry that might have otherwise been a little tech-averse,” says Onken. Measurabl's took the approach of a software-as-service platform. “So it may not solve your need particularly, but the general platform would iterate quickly and solve a lot of problems. It was a new take on getting software to the market.”

At its core, technology should both create efficiencies in workflow and be easy to use and learn. While these technologies are all focused on a different segment of commercial real estate, that is the commonality among them. “We talked to our customers and had early adopters before we even had a product, and we included their voice into the product,” Onken recalls. “I know that is common now, but we really took that to heart. It is presumptuous to build software that you think will solve someone else's problem. It's more effective to work together to see if you can come up with a solution.”

CREXi has adopted a similar strategy of relying on customer feedback and then evolving or updating the platform appropriately. “Brokers are often in our office providing product feedback and advice, which we listen to closely and incorporate into the platform,” says DeGiorgio. “Our product can help make less experienced brokers good, and good brokers great.”

These tools have been quickly embraced by the real estate community. While they represent some of the top innovations available, they don't negate the question of why it's taken so long to get here. CityBldr's Copley says there are “myriad reasons, but none larger than data fragmentation, which is the first problem we're solving.”

DeGiorgio adds, “That's a question that I don't think has a perfect answer.” The reasons are vast. It could be that the right tools haven't been available or haven't solved the right problems. Or it could be that “younger demographics entering the workforce are demanding more technology integration or moving into leadership positions where they are able to implement these systems in-house.”

Onken agrees that there is an amalgam of reasons, but says that access to the right tools—those that create value—is a major reason why technology is finally having its heyday. “It is about having the availability of the tools to allow change,” he says. “Technology will fundamentally change workflows. When you talk about adoption of new technology, you are talking about changing user behavior. You have to prove your value with technology to influence change and change user behavior.”

CREXi's DeGiorgio adds that the nature of commercial real estate has made the creation and adoption of technology difficult. “Commercial real estate lacks the homogeny of many other products or assets,” he says. Each transaction takes on a life of its own and there aren't always one-size-fits-all solutions to solve industry pain-points. “Buying a flight, a car, a hotel room, or shares of stock online is fairly straightforward and consistent. However, a commercial property has structural nuances, different lease structures, variable income streams, and colorful personalities involved. It's a tricky asset class to commoditize and several variables need to be accounted for to standardize and digitize.”

Looking ahead, however, technology is rapidly penetrating the industry, and as a result, these platforms are in expansion mode. CityBldr is in the midst of raising and deploying a $100-million opportunity fund targeting the acquisition of underutilized urban, multifamily-zoned, transit-oriented properties, which is available through the new tax plan. The tech company is also building the platform itself, which Copley says is “the world's first machine-learning driven real estate arbitrage index.”

CREXi is focused on building a platform and creating products that can best serve the brokerage community. “We have a robust product roadmap,” says DeGiorgio. “We will continue to advance our core offering to better serve brokers and sellers while rolling out groundbreaking enhancements to the demand/buy-side experience. Those include offering research and unique proprietary insights including capital flows, transactional velocity, behavioral analytics, value metrics, and more. There are other services that live within the CREXi ecosystem, which we'll explore. Without trying to do everything, we want to service our customer's needs and will expand where appropriate in order to do so.”

Measurabl's growth targets are focused on how to best integrate data into the platform, while making that data easily accessible to users. “We are building features, adding integrations and making the platform actionable,” Onken explains about the company's growth goals. Because its core mission revolves around investment-grade data, it makes that data part of every real estate transaction. “As a technologist, I look back at the companies that have come along over the past 10 years, and they all create a mobile workforce. Keeping Measurabl in sync with how technology is changing the dynamics of the workforce is important because that is going to be a big driver of change in the real estate industry.”

While technology integration is still new, it is coming and it is coming fast. All of these tech leaders said that the days of a tech-free industry are over. “CRE technology is finding the right alchemy and sweet spot of human and digital workflows,” says DeGiorgio. “When entirely manual, the commercial transaction can be inefficient, opaque, asymmetrical, illiquid and slow. If entirely automated, deals may collapse or trade at heavy discounts to account for uncertainty and heightened risk.

“Commercial real estate is a human business and needs humans to curate deals and tell the story,” he continues. “However, those humans should be armed with awesome technology to better connect supply-and-demand, and speed up and de-risk the transaction. Technology will continue to integrate across the industry, but will not and should not replace human expertise much like technology made doctors more powerful and efficient without eliminating the importance of the human touch.”

Yet all companies today are tech companies—because all companies need technology at the cornerstone of business operations to achieve success, even if technology isn't the primary product of the business. “All companies are realizing that they're either tech companies or zombie corporations,” says Copley. “It's not a debate any longer—machines are better at some things than humans and the world has decided to embrace that. Real estate is following suit, and the trend will only continue to accelerate.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.