Industrial development activity in the Baltimore-Washington corridor has dropped sharply in the past 10 years. Source: JLL Mid-Atlantic Research

Industrial development activity in the Baltimore-Washington corridor has dropped sharply in the past 10 years. Source: JLL Mid-Atlantic Research

WASHINGTON, DC—A decade of declining industrial development has had a profound effect on rental prices and availability in the Baltimore-Washington DC corridor, according to a report released by JLL.

Colin Sargis, research analyst, industrial, JLL Mid-Atlantic Research, says that a combination of a slower rate of new industrial development over the past 10 years, escalating rents caused by strong tenant demand and an availability crunch for users, has made areas such as Prince George's County and other Maryland locations north of Baltimore as viable options for at least some developers and tenants.

“Industrial supply constraints have pushed pricing to new heights for both tenants and investors, forcing them to explore market alternatives,” Sargis states in the report.

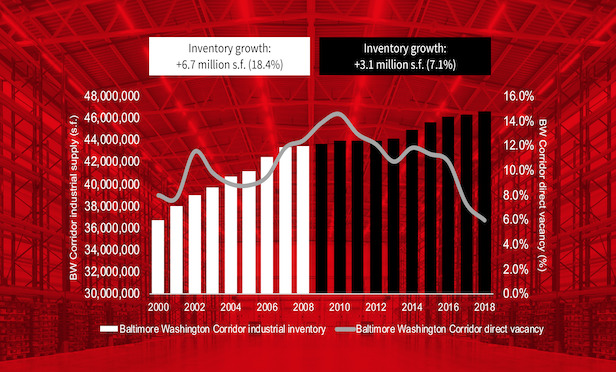

Over the past 10 years, the volume of development in the corridor has fallen 41.5% compared to 2000 to 2009. At the same time, robust tenant demand has boosted absorption rates by 28% to nearly 660,000 square feet annually. As a result, tenants are facing what JLL terms as an “availability crunch” as the direct industrial vacancy rate has fallen from its cyclical high of 14.5% to its current rate of 6%.

In response to this market dynamic, industrial rents have climbed 19.9% over the past eight years to $5.95-per-square-foot, triple-net, beyond their prior cycle peak of $5.63.

Sargis relates that continued limited land opportunities and higher rents have also pushed land pricing to new heights, further impacting future pro-forma rents.

He points to DCT's 2016 purchase of 7200 Dorsey Run Road, a raw piece of land in Jessup, MD, came at a land basis of $28 per FAR. In order to justify the development, Prologis (who recently acquired DCT) is asking north of $7.25-per-square-foot NNN in rents.

Some developers and tenants, who are unwilling to shell out the funds for the corridor's premium properties, are looking to other neighboring markets to invest or locate their operations.

North of Baltimore, Harford and Cecil counties, have quickly matured into viable industrial markets that offer the ability to access I-95 while providing a cheaper alternative to the corridor, the report notes.

At Principio Business Park, Trammell Crow developed a 1.1 million-square-foot speculative warehouse in 2017 at a land basis of $7 per FAR (one-quarter the land value of the corridor). With rents striking near $5.00-per-square-foot NNN, the development provides a nearly 30% rent discount to the corridor.

“As supply runs thin in the corridor, Prince George's County also acts as an alternative with similar access to highway infrastructure and population as the corridor,” Sargis states.

Developers have built more than 2.2 million square feet since 2014, with rents averaging $8.03-per-square-foot NNN. He adds that tenants with requirements in the corridor may look south to these vacancies if they can afford the DC premium especially as the rent gap between corridor and Prince George's County for new construction has shrunk from 19.3% in 2010 to just 10.7% today.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.