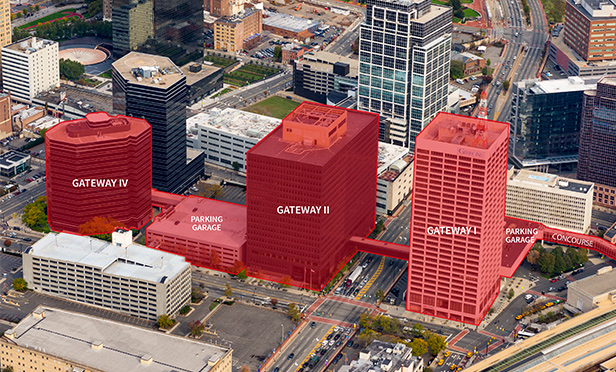

Gateway Center, Newark, NJ

Gateway Center, Newark, NJNEWARK, NJ—A joint venture among Garrison Investment Group, Axonic Capital, Taconic Capital Advisors and Onyx Equities has acquired One, Two and Four Gateway Center in Newark, NJ. Prudential Financial, which has kept its global headquarters in Newark since its founding more than 140 years ago, will participate as a co-investment partner. The 1.6 million square-foot transaction represents New Jersey's largest office deal of 2018, and brings back together under a single owner one of the state's busiest office complexes.

“We are honored and thrilled to be part of Newark's renaissance in such a significant way. Gateway Center is now positioned to become Newark's greatest amenity, and arguably New Jersey's most important center of commerce, talent and connectivity,” says John Saraceno, managing principal and co-founder of Onyx Equities. Increased residential investment in Newark and Harrison coupled with an uptick in corporate relocations to Newark sparked the joint venture's interest in the Gateway Center opportunity.

The partnership has aggregated the first majority interest in Gateway Center's recent history. The partnership is planning a multimillion-dollar modernization plan that it hopes will create a more vibrant retail concourse. Approximately 60,000 people pass through the 1,400 linear-foot concourse each week, including PATH, NJ Transit and Amtrak commuters, Gateway employees, neighboring employees, visiting clientele, Prudential Center spectators, and students from the New Jersey Institute of Technology, Rutgers University Newark and Seton Hall University.

The improvement plan will reinvent the concourse as a destination, the joint venture says, and will spur significant demand from retailers and corporate office users who prioritize access to transit and a talented, diverse workforce.

“We echo Onyx's excitement regarding the Gateway Center acquisition” says Eric Rosenthal, managing director of Garrison Investment Group. “We look forward to contributing to Newark's positive momentum while repositioning the iconic campus.”

Onyx Equities will serve as the operating arm, overseeing asset and property management, tenant relations, leasing and construction. Adam Karafiol and Matthew P. Flath of Onyx will lead office and retail leasing efforts. A Jones Lang LaSalle team of Tim Greiner, Blake Goodman and Colleen Maguire has been assigned as agent for Gateway One and Two. An RKF team of Glenn Beyer, Jerry Rockoff, and Rob Mackowski has been assigned as retail agent. Gensler was selected as project architect, led by Dana Nalbantian. Rebranding and marketing assistance will be provided by Real Estate Arts, led by Michael Goodgold.

“We are excited to be part of this incredible team whose focus is to create a unique and inviting experience for tenants and visitors at the Gateway Center and bring the Gateway Center back to prominence in Newark,” says Blake Goodman, executive vice president at JLL.

JLL's capital markets group led by managing directors Thomas Walsh and Joseph Garibaldi served as investment sale broker in the transaction. Aaron Appel, vice chairman; Max Herzog, Jonathan Schwartz and Adam Schwartz, managing directors; Marko Kazanjian, vice president; and Sean Bastian, analyst, all with JLL, advised the partnership on the acquisition loan.

“Well-capitalized and united ownership will provide the key ingredients in the Gateway Complex reclaiming its reputation as one of the best transit-oriented office portfolios in the Northeast,” says Walsh.

Correction, 1/11/2019, 3:49 p.m.: Because of incomplete information provided to GlobeSt.com, an earlier version of this story omitted the names of several JLL employees who advised the partnership on the acquisition loan.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.