JLL/ Case Equity Partner's SFC rendering by Lamar Johnson Collaborative

JLL/ Case Equity Partner's SFC rendering by Lamar Johnson Collaborative

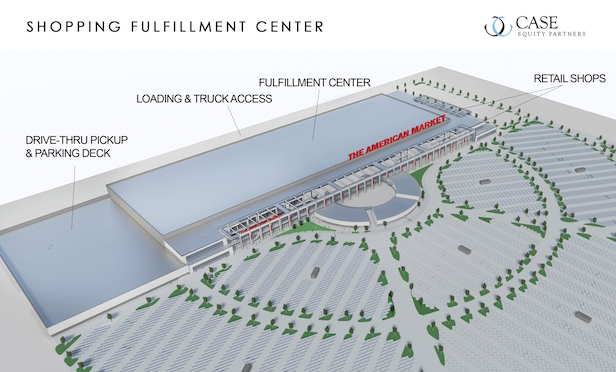

NEW YORK CITY—Case Equity Partners has combined the news of both the shuttered department stores and the demand for fulfillment warehouses to create a new retail solution. The real estate investment firm's managing partner, Shlomo Chopp, has even filed a patent application for what their company has coined “shopping fulfillment centers” or SFCs.

Based in New York City, Case Equity is buying retail properties with vacant anchors focused in the Mid-Atlantic to bring to life this concept. JLL brokers in Chicago, Larry Kilduff and Janice Sellis, are representing the real estate company in their acquisitions.

In a GlobeSt.com interview, Chopp describes the centers: Imagine a vacant 100,000 square-foot department store, like a former Sears. Ten small retailers could lease the front 30,000 square feet in a highly curated, experiential environment. The rear 70,000 square feet would serve as a warehouse and fulfillment center for the onsite stores, digital customers at home, and satellite stores. As the group of retailers would be smaller, they wouldn't require the large-scale Amazon-like industrial properties. Their warehouses would be less square footage, on-site and closer to the customer.

Shlomo Chopp, managing partner at Case Equity Partners

Shlomo Chopp, managing partner at Case Equity Partners“The shoppers never have to worry that their product isn't in stock and they can touch and feel prior to ordering,” Chopp says describing the omni-channel experience. Shoppers either walk out of the store with their product, order it from home and pick it up at the store, or buy it in the store and have it delivered to their homes.

Case Equity envisions an immersive, shopping and lifestyle center in the front with a high tech robotics fulfillment center in the rear. There is no upfront cost to the retailer except designing a retail store, similar to a “pop-up” location. The SFC would provide the logistics infrastructure. This would track and manage inventory, deliveries and returns. Thus, the age-old risks for retailers of leasing out space—guessing and hoping their sales will be high enough to make the rent is greatly reduced. In this new form of retail, Chopp says real estate landlords are not about leasing space but more about maximizing shoppers.

With the onsite fulfillment centers, Case Equity also anticipates that the costs and inconveniences associated with returned merchandise will greatly decrease. It's not just the “glitz and glamour” of “experiential retail” that many brands have been trying to market, according to Chopp. He says it's also functionality that allows for the best experience: convenience.

“As a real estate investor considering my options, retail scared me as retailers are experimenting and on shaky grounds, and industrial is way too frothy as a result of leases with e-commerce companies, many whom have yet to show a profit,” says Chopp. He points out both industries are missing the fact that the two largest retailers, Walmart and Amazon, have one thing in common—logistics superiority. Thus, thinking outside the box, Chopp says he created the SFC.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.