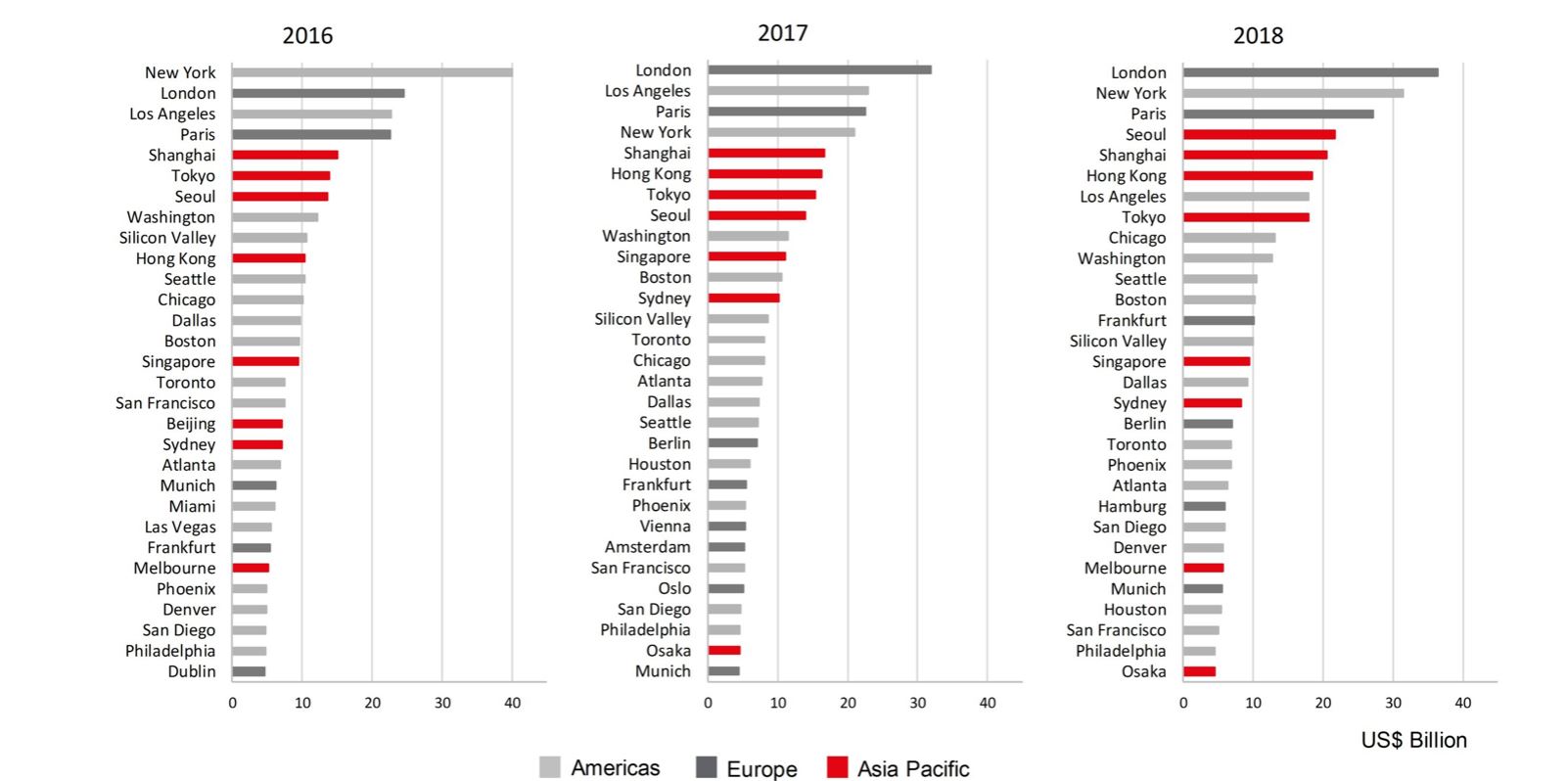

London remains the largest commercial real estate investment market in the world after knocking New York from its perch in 2017, according to a new survey by JLL. Overall, global CRE investment volumes totaled $733 billion last year, up 4% from 2017 and clocking in at the best annual performance in a decade. However JLL projects 2019 investment volumes will be approximately 5 to 10% below the 2018 total, driven by investor caution and selectivity.

Recommended For You

Many investors are still favoring the same cities to which they have always gravitated—cities that are well-established and have high levels of transparency. London, New York, Paris, Seoul, Hong Kong, Tokyo, Shanghai, Washington DC, Sydney, Singapore, Toronto and Munich have appeared in the top 30 ranking every year for the past decade and account for 30% of all real estate investment. “Investors remain focused on gateway cities, despite tight pricing,” said Richard Bloxam, Global Head of Capital Markets. “Many are looking at alternative or emerging locations, as well as varying real estate property types within these cities, rather than exploring other less familiar cities.”

However, at the edges, some investors will consider a widening range of cities in their strategies in 2019, JLL predicts. This will be a risk mitigation play: secondary cities in established transparent markets, such as Osaka and Atlanta, are likely to attract more attention, as opposed to moving into entirely new countries.

The report also notes that many investors still have an appetite to invest outside of their home markets with cross-border purchases accounting for 31% of activity in 2018, close to the 10-year average.

“In a year when investors have had to deal with increasing populism, protectionism and political uncertainty, the appeal of real estate as an asset class has continued to increase,” Bloxam said.

Expectations for 2019

That appeal will continue to fuel investment activity momentum into 2019, as real estate continues to look attractive in comparison to other asset classes, JLL said. Fundamentals in real estate remain compelling, despite historic low yields, as robust corporate occupier fundamentals across most markets are leading to positive returns, it said. For that reason, while investment activity may slow, it will move only marginally from its current high.

JLL also found that asset classes such as student housing, senior living and multifamily have continued to attract more institutional money in 2018 and this is likely to continue in 2019.

Industrial, not surprisingly, now accounts for 17% of all investment, up from 10% in 2009.

In gateway cities, the office sector tends to account for a higher proportion of investment volumes—68% in 2018, compared to 51% in global volumes.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.