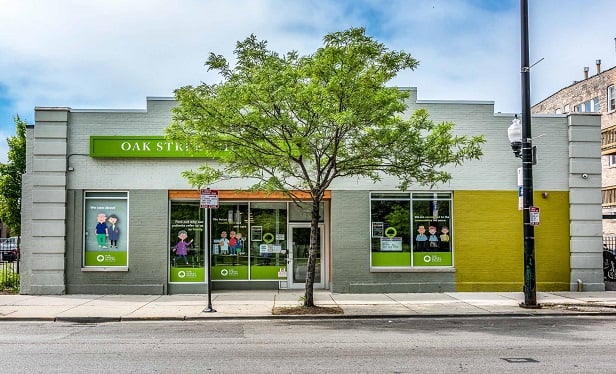

CHICAGO—Synergy Construction Group has sold a 6-facility Oak Street Health portfolio for $19.1 million, according to public records. The freestanding medical clinics were purchased by Turner Impact Capital on behalf of its Turner Healthcare Facilities Fund.

“After running a competitive bid process, we were able to procure an out-of-state fund buyer that was drawn to this portfolio for two reasons: the strong growth of the tenant, and the alignment with its social-impact investment strategy,” said Jon Morgan, co-founder and managing principal at Interra Realty, who brokered the deal with Director Colin O'Malley. “The social-impact strategy was ultimately what set them apart from the pack of other interested parties.”

Turner Impact Capital focuses on community-enriching infrastructure in the healthcare, education and workforce house sectors. The company, which was founded in 2014, seeks out deals that will provide a financial return while also providing measurable social and environmental benefits to the communities they enter.

Oak Street fits that bill. The company, founded in 2013, operates 40 clinics in medically underserved communities in Illinois, Indiana, Michigan, Ohio and Pennsylvania, with plans to grow in the near future.

“Ultimately, the seller felt that the buyer's mission-based approach was a strong match to understand the Oak Street Health model,” Morgan tells GlobeSt.com. “The seller also felt that the purchase would help the buyer subsequently understand the geographic markets and underlying patient base that Oak Street serves, ultimately giving them a better understanding of the economics to the tenant's business model.”

Turner Impact Capital is not alone in seeking out these kind of deals.

“A large segment of the investment market feels healthcare tenants are recession-proof, so there is a growing investment appetite for medical tenants like Oak Street Health, DaVita dialysis centers, Athletico Physical Therapy and Aspen Dental,” Morgan said.

The desire to do good and the desire to make smart investments is what Morgan said is driving this trend toward providing healthcare to in-need populations.

“Today, many retailers can better service their customers through the cloud than through traditional brick and mortar locations; there isn't a lot of stickiness to physical locations. The opposite is true with most medical retail tenants,” Morgan said. “Patients/customers have to come into a physical location to receive a treatment or procedure. There is a necessity for a long-term retail brick and mortar business model inherent in medical that can't relocate to an online-based platform.”

According to public records, this deal is the largest-ever portfolio sale of Oak Street-occupied properties. Each clinic is under a long-term, single-tenant net lease. The clinics range in size from 7,448 square feet to 10,460 square feet, and are located at 3433 W. Madison St., Chicago; 3210 Grand Ave., Waukegan, IL; 18 Chicago Ave., Oak Park, IL; 3046 W. 127th St., Blue Island, IL; 4900 Broadway, Gary, IN; and 5818 Columbia Ave., Hammond, IN.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.