Tech is expanding beyond the normal hubs, says a recent report by Cushman & Wakefield.

Tech is expanding beyond the normal hubs, says a recent report by Cushman & Wakefield.

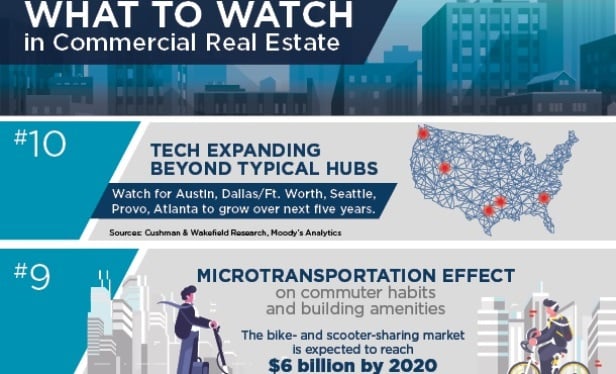

SAN FRANCISCO—Technology companies are having an ever-increasing impact on US cities, such as local economies and workforce development, physical space and everywhere else in between. From technology, micro-transportation, labor shortage, trade tensions and other trends, Cushman & Wakefield has pinpointed the top CRE trends to watch in 2019.

These trends include co-everything such as co-retail developments that are focused on entertainment, cultural and flexible space; co-living concepts, and co-working that could double before eventual consolidation. In addition, warehouse site selection is shifting to attract and retail workers, and lack of industrial space for occupiers seeking to grow is becoming a real issue. Finally, the bike- and scooter-sharing market is expected to reach $6 billion by 2020 in what is known as the micro-transportation effect. This is in tandem with the myriad choices of alternative transportation available in the Bay Area.

“San Francisco holds a unique place among the dozens of major cities in the United States navigating the nuances and impact of technology on their respective infrastructures,” Robert Sammons, senior director–Northern California research with Cushman & Wakefield, tells GlobeSt.com. “The city is not only an adopter of autonomous, electric and ridesharing vehicles, it is also a developer, with 80 companies taking up residence in the Bay Area.”

To be sure, the boom continues for the San Francisco market, thanks to its deep tech foundation including the hundreds of companies within the industry based here, a deep talent pool, proximity to venture capitalists and multiple institutions of higher learning including two of the best in the world: Stanford University and UC Berkeley.

In the initial period of the current economic expansion, it was all about home-grown start-up tech; some that grew rapidly and have since gone public, and others of various sizes that remain private. Home-grown tech continues to be an important driver of the tech expansion (Salesforce, Dropbox, Airbnb, Uber, Lyft and Twitter for a few examples), according to the Cushman & Wakefield report.

Tech has permeated every submarket of San Francisco but the South Financial District. The city's core has been changed most significantly. The up-zoning of the area allows for much larger office and residential projects along with the proximity to multiple mass-transit options. Cushman & Wakefield predicts growth will move due west to the Central SoMa submarket where up-zoning there will allow for a similar rebirth.

“Regarding tech expansion, we certainly are seeing big tech as well as start-ups looking to expand or relocate to less expensive markets, at least for some portion of their operations,” Sammons tells GlobeSt.com. “That said, tech, big or small, is hunting for talent. And that means hunkering down in the more expensive markets as well, such as the Bay Area, New York City, DC, LA, etc. Over the past year, tech continued to expand across the Bay Area where we even saw some record-setting figures as result, given the region's density of talent and funding, i.e., VC-backed companies, but certainly also due to other factors.”

Indeed, during the past two years, there has also been an in-migration of big tech headquartered in Silicon Valley and elsewhere, including Google, Facebook and Amazon causing a substantial tightening of the market. Specifically, Facebook has made a big move into San Francisco proper—having gone from having no space to almost 1.5 million square feet under lease in less than a year. Meanwhile, Salesforce has usurped Wells Fargo in the largest private sector tenant category.

“With the lowest vacancy rate of any major market in the United States at the end of the fourth quarter, it has become harder for big tech to expand further in a meaningful way, although many of them remain tenants in the market desirous of taking down additional large blocks of space,” Sammons tells GlobeSt.com. “There will be a gap of up to three to four years before additional major available inventory is added to the San Francisco market. That alone is likely to cause the big players to look elsewhere–Oakland, San Jose and beyond–for their space needs.”

With little new inventory coming online until at least 2022, it's going to be tougher to grow bigger in San Francisco which might result in advantage Oakland as Sammons says, thanks to new office development opening in its CBD during the next three years.

If there's one disadvantage to an otherwise-stellar San Francisco metro market, it's the cost of living which is double the national average. It comes down to housing more than anything else with the median existing single-family home price in the MSA currently at $986,000 according to the National Association of Realtors and a median rental price of $3,450 per month according to Zillow. Though inventory is growing at a faster pace today, it's still not enough especially for low and middle incomes. New housing is generally absorbed quickly, particularly those projects near walking or biking distance to a train transit node (Caltrain or BART) whether in San Francisco, the East Bay or the Peninsula.

“Another important piece of the puzzle is the tech component of many companies today, no matter the industry, is growing and therefore they too need qualified workers to perform these often highly skilled tasks,” Sammons tells GlobeSt.com. “As such, it's not just the big five or six tech companies most think of nor random start-ups competing for talent, but also big players in fields one may not consider tech, whether that be in professional services, retail, healthcare, etc. This phenomenon is also going to continue to drive markets all around the globe.”

Meanwhile, down on the Peninsula, it's a life sciences world except for the southern end closest to Silicon Valley where it remains almost all about an expanding social media firm in Menlo Park.

The Silicon Valley has been one of the strongest US markets throughout this most recent economic cycle. The Valley serves as the global center for high technology, venture capital, innovation and social media. It accounts for one-third of all US venture capital investment and that investment has helped this sprawling region become a leading hub and ecosystem for startups in high-tech innovation and scientific development.

It is home to many of the world's largest high-tech corporations including Apple, Google and Facebook. These three companies combined have accounted for an increase in R&D spending of roughly $20 billion per year since 2010. The major expansion of these companies has made it more difficult for other companies to find space; however, with its deep talent pool the proximity to the tech giants, the Silicon Valley is still where tech companies want to call home, says Cushman & Wakefield.

Silicon Valley also has world-class academic institutions in its back yard, including Stanford University, the University of California at Berkeley, Santa Clara University and San Jose State University. The net effect of so many attributes, a high quality of life and job opportunities means the region suffers from an overburdened transit infrastructure and some of the most expensive housing in the entire county.

Palo Alto and Mountain View have always been hot submarkets for tech startups due to the proximity to venture capitalists and access to transit. The lack of space to grow in those cities is causing companies to start to migrate south to Sunnyvale, Santa Clara and into the San Jose area, including downtown, says the report.

For example, Roku recently announced its move from Los Gatos to San Jose. It will occupy three buildings totaling 472,000 square feet at Coleman Highline, a campus currently under construction near the city's airport. San Jose has landed other major tech tenants this year such as 8X8, HPE, Bloom Energy and Micron Technology.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.