Source: The Department of Revenue

Source: The Department of Revenue

PHILADELPHIA—Mayor Jim Kenney is pointing to the latest Department of Revenue data to counter ads and complaints from some City Council members about the impacts of his highly controversial beverage tax on the city's economy.

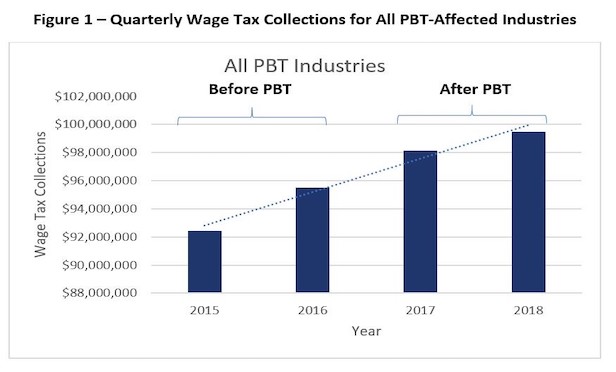

The Department of Revenue announced on Monday that wage tax collections from beverage-related businesses have demonstrated continued growth in the two years since the inception of the Philadelphia Beverage Tax.

Wage tax collections have steadily increased by 2.5% per year and have not been affected by the PBT, for 24 industries potentially affected by the tax, including supermarkets.

In fact, the pace of growth in collections for those sectors that was seen in two years prior to the tax was exceeded in the two years since inception of the PBT, city officials noted. Wage Tax collections for one key sector—supermarkets —have grown nearly 3% each year since the tax took effect.

The Department of Revenue statistics also show the top four industries potentially impacted by the tax and those more broadly affected all show growth in wage taxes from 2016 – 2018. The only decline observed is due to a large supermarket chain closing in 2015 before the PBT was introduced, according to city officials.

Overall total wage tax collections for the four industry sectors—full service restaurants, concessionaires, supermarkets and take-out restaurants—increased from $53.8 million in 2015 to $59.5 million in 2018, which calculates out to an approximately 3.4% annual increase.

“As the beverage industry pours some of its vast profits into advertising aimed at defeating the beverage tax, I urge residents to ignore their rhetoric and see the reality of this new data,” says Mayor Kenney. “This sector of our economy was strong before the tax and is just as strong, if not stronger, since the tax.”

The mayor added, “At the same time, the PBT has generated funds for crucial investments in PHLpreK, Community Schools and Rebuild. That is the reality — and it will lead to a stronger Philadelphia for years to come.”

In its first two years, the Philadelphia Beverage Tax has generated nearly $200 million, allowing more than 4,000 three- and four- year old children to access high quality early education, increasing to 5,500 seats by FY 2023. The PBT has led to the creation of 12 Community Schools serving 6,500 students.

In its first year, the beverage tax created 275 new living wage jobs in early education and 120 summer job and career exposure experiences for students.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.