It costs nearly double to live in the downtown/University submarket than in other areas of Austin.

It costs nearly double to live in the downtown/University submarket than in other areas of Austin.

AUSTIN, TX—In the country's largest multifamily markets, living downtown is on average 28% more expensive than living outside it. Though it is widely understood that urban living is pricier than suburban living, the premium that downtown living commands ranges widely.

Called the central business district for good reason, downtowns often house the job center. And increasingly, downtowns are becoming culturally significant submarkets as well. These trends translate to higher premiums in some markets than others.

RealPage released a new report that takes a deep dive into the top five markets' urban cores, which ultimately affects pricing power over the rest of the market. The markets with the highest downtown premium apartments are Austin, Philadelphia, Houston, Chicago and Cleveland.

Austin serves as the prime example of this trend. It costs nearly double to live in the downtown/University submarket than it does to live in the rest of the metro. Austin has grown its apartment supply by more than 60,000 units this economic cycle, and the downtown/University submarket has seen the largest chunk of that. Though supply in the Texas capital has been remarkably spread out, inventory has grown by more than 30% here since 2010.

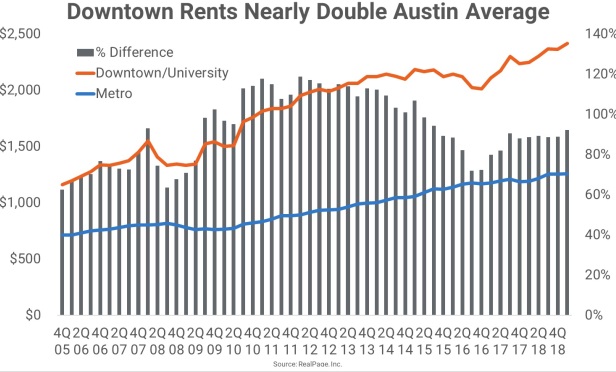

Like many other maturing markets across the nation, downtown Austin's allure has solidified during this real estate cycle as the urban core has added more live, work, play options. Even as early as 2005, living downtown was about 60% more expensive on average than everywhere else in Austin.

Yet that spread peaked in early 2012 as downtown rents were on average 119% more expensive than the rest of the market. Today, to live in the downtown/University submarket, which is more than 22,000 units, it will cost just shy of double the market average of $1,257 per month as of first quarter 2019.

One key differentiator for the downtown/University submarket is that it has a pipeline of built-in resident demand from University of Texas at Austin students. The submarket, which is roughly bounded by 38th Street to the north, Interstate 35 to the east and the Colorado River to the south and west, encompasses one of the largest public universities in the nation. While there is a lot of purpose-built student housing near campus, many Longhorns rent market-rate apartments in the downtown area to be close to campus and to take advantage of the nightlife the area offers.

Additionally, newly graduated students looking to put bachelor's degrees to use at the nearest job center needn't travel more than a few blocks south to reach the largest concentration of jobs in Central Texas. Though downtown's job prospects have always had opportunities in government and business services, more technology, creative and medical jobs have landed nearby during the last few years. The University of Texas at Austin's Dell Medical School opened in the submarket in 2016, bringing additional medical jobs to downtown.

Plus, downtown has serious cultural significance. From the city's most famous music venues and entertainment districts such as 6th Street, 2nd Street and Red River to the state capital and museums, downtown is the epicenter that embodies Austin's weird vibe. Events such as SXSW, the interactive film and music festival founded in 1987, and other events at the Austin Convention Center keep a steady stream of visitors flooding into Austin.

Being the economic and cultural center of the metro makes downtown Austin a highly desirable area in which to live–especially considering that accessing the area from other parts of the metro can be cumbersome. With only one primary route into the area–Interstate 35–commute times in Austin are long and increasing due to overcrowded road infrastructure. The average one-way commute time in Austin is about 25 minutes, according to the Census Bureau. Living close enough to a job center to negate a commute commands a premium for landlords.

The product built in 2010 and later in the downtown/University submarket is 94.8% occupied, the softest figure of all other age classes. Rent growth, however is pulling an above-average 6.8% in the 2010-and-older category, and 8.5% in class-A product. In the downtown/University submarket as a whole, rent growth stands at 7% annually. Demand has outpaced supply for the last four quarters, and about 370 units are set to be completed in the submarket in the next year.

Considering that the downtown/University submarket is the metaphorical heart of Austin, it stands to reason that renters are willing to pay 92% more than the market average to live there.

“Austin's luxury apartment inventory isn't limited to the urban core,” Greg Willett, Real Page chief economist, tells GlobeSt.com. “There are lots of fairly expensive high-end communities in downtown-adjacent areas and out in suburban settings like Cedar Park, Round Rock and Georgetown. To some degree, then, it's perhaps surprising that typical rents in the downtown-University submarket are so much higher. A key influence on the rent achievement posted in the urban core is that so many of the class-A properties are high-rise towers.”

Willett says typical monthly rents in downtown's towers are nearly $3,000. In contrast, the monthly rents in urban core mid-rise properties are in the range of $1,800 to $2,000, about the same pricing for upscale mid-rise buildings elsewhere in the metro.

“Metro Austin's apartment construction during the past few years has been spread out across many neighborhoods,” Willett tells GlobeSt.com. “While there's been meaningful building in the urban core, downtown hasn't added a giant block of projects all right on top of each other to the degree seen in some other metros. That lesser concentration of building has allowed the new product in the downtown-University submarket to maintain stronger rent growth, viewed relative to the performances of urban core luxury projects in many other cities.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.