BETHESDA, MD—With a 2017-enacted master plan as their guide, developers have formulated plans and broken ground on a host of new office and residential projects that will have far-reaching impacts on this market.

Within the next five years, new office and residential developments will continue to be delivered in this market on a rolling basis. Four new office towers, two reaching almost 300-feet tall and several multifamily developments, are set to deliver over the next five years, which will transform Bethesda's skyline, according to a new report released by JLL Research.

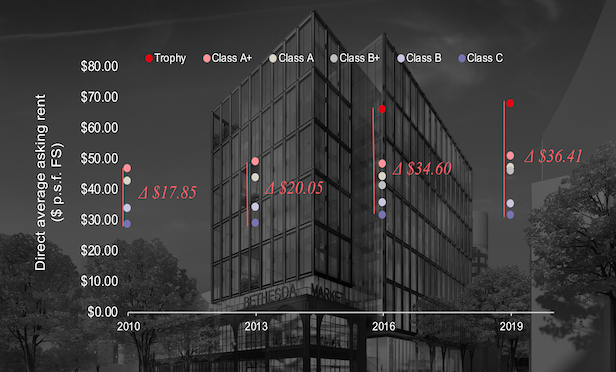

With new construction driving change, office asking rents across asset classes have seen dramatic stratification. The introduction of true trophy construction availabilities has created a new ceiling for rents in the high-$60's-per-square-foot to low-$70-per-square-foot (FS),” says Russell Brunner, research analyst, Suburban MD, JLL Research. “At the bottom of the market, in Class C and B- assets, asking rents hover in the low-$30's-per-square-foot (FS). The wide range that has been created has almost doubled the delta between the top and bottom of the market with a 47% increase from 2010 to 2019.”

The JLL report also notes that former best-in-class assets, which are now B+ and A+ properties due to the introduction of new trophy product, have pushed their rents to new heights in response to continued demand within this market segment. Since 2016, more than 72% of leases larger than 10,000 square feet have been signed for top-of-the-market assets with 22% signing for Class A+ and B+ assets and 50% signing for trophy assets—a sum of 1.6 million square feet in tenant demand.

Many of the mainstays in the Class A+ asset class, broadly composed of prominent Class A assets that have been built or significantly upgraded since 2000, are now asking and achieving rents above $50 per-square-foot (FS). That is a significant increase since 2016 when rents averaged $48.33-per-square-foot FS and 2010, when rents averaged in the mid-$40s-per-square-foot FS.

Class B+ properties, which have undergone recent renovations that have delivered enhanced tenant amenities, refinished lobbies and shared spaces, are commanding an average asking rent in the mid-$40s-per-square-foot growing from the mid-$30s-per-square-foot in 2010.

JLL's Brunner says looking forward, there are number of questions pertaining to potential drivers and headwinds facing the Bethesda market.

“First and foremost, to what extent will new higher rents persist across asset classes? Several Class B+ buildings have lingering large-block availabilities, which could potentially prevent owners from pushing rents higher in that market segment, should demand not keep up. Additionally, will congestion and pricing cause Bethesda tenants to explore and relocate to other submarkets?

He notes that Abt Associates relocated to North Bethesda in 2018 and the American Occupational Therapy Association recently signed a lease to join them in North Bethesda.

“With high quality, more affordable office space in North Bethesda and along Rockville Pike across all asset classes, time will tell whether these examples turn into a broader trend,” Brunner states.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.