Source: Cushman & Wakefield's Legal Sector Advisory Group

Source: Cushman & Wakefield's Legal Sector Advisory Group

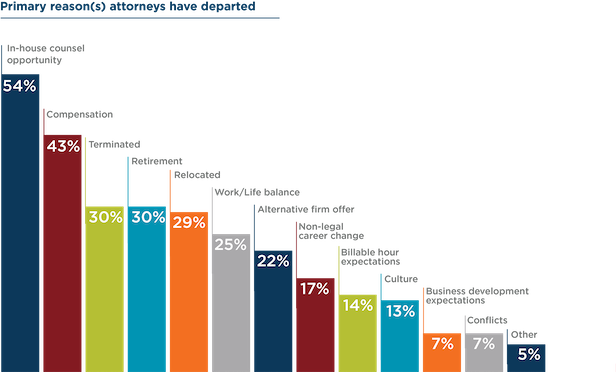

CHICAGO—Law firms nationwide are engaged in a fierce battle with their competition for talent, particularly millennial talent, according to a report authored by Cushman & Wakefield's Legal Sector Advisory Group in partnership with ALM Legal Intelligence and Law.com.

The report features the findings of the “Sixth Annual Bright Insight Legal Sector Benchmark Survey.”

Another major trend in the legal sector is continued pressures to grow profits and control expenses, which has led many firms to cut back or reconfigure space for greater efficiency.

“Legal sector change is occurring at lightning speed,” says Sherry Cushman, executive managing director and leader of Cushman & Wakefield's Legal Sector Advisory Group.

She adds, “One of the key drivers of this change is the growing prevalence and influence of the millennial generation, which has a different set of priorities, expectations and way of working. This, combined with technology expansion, has led to a fundamental shift in the way law firms think about real estate and working in general.”

A total of 20%. of law firms are currently calculating and tracking the per-equity-partner costs for bricks and mortar, up 11% from the previous year. The survey also found that 14% of the law firm respondents noted they had already shifted to single-size offices for all attorneys. Another 8% are also sharing offices with two associates or plan to in the future.

The report notes that the average percentage of gross revenue spent on real estate has fallen to under 6% in the past four years, even as rental rates for office space have gone up in most major markets during the same time frame.

Law firms are offsetting increased rental rates through “densifying their real estate” by giving back excess space and decreasing per attorney space ratios to a ratio today that calculates out to under 600 square feet per attorney. In 2018, the national average of space reduction when a firm relocated to new space was 29.7%.

The trend line in terms of square-footage per attorney looks to be on the decline. In the survey of architects included in the report, 78% of respondents stated that more firms will “achieve a below-500-square-feet-per-attorney ratio in the next decade,” up from 70% last year. In addition, significant real estate rightsizing and downsizing—including a reduction in warehousing growth space—will take place in coming years. “Six years of statistics support the idea that continued densification of legal sector real estate is not just a trend, but a reality,” the report states.

A trend culled from the survey was that architects expect that in the next decade the most significant changes in law firm workplace design will be:

• more single-size, smaller attorney offices;

• expansion of hoteling strategies;

• greater focus on wellness;

• increased collaborative spaces;

• hospitality integration;

• continued space densification

• interior attorney offices and open plan for attorneys;

• increased building and neighborhood amenities; and increased technology costs.

“The fact that equity partners share the large financial impact of real estate over time calls for an even greater need to build internal consensus,” Cushman said. “As part of effective business and profit strategies, firms must evaluate how excess square footage, high inefficiencies and per-attorney occupancy rates—combined with increased rental rates—will impact the firm and each equity partner financially.”

She adds, “In addition, with continued technology advancements, the younger generation doing more and more of their own work, as well as partners using technology on a broader basis, future investment in technology will continue to increase, while real estate costs will trend downward.”

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.