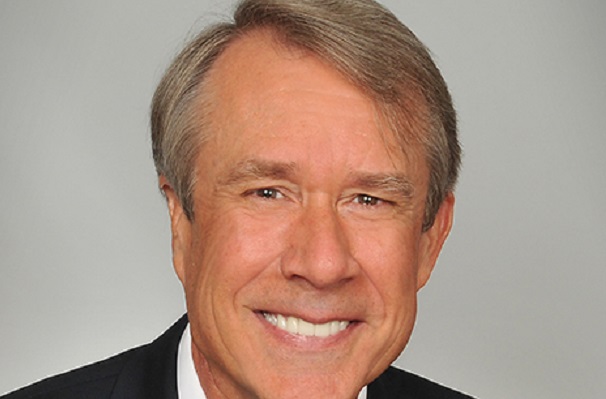

MIAMI, FL—With approximately 2.5 quintillion bytes of data created each day, the data center has become a key commercial real estate asset class. Experts such as Mike Bedke, a partner with DLA Piper, expect to see technology continue to fuel the sector's growth.

“The entire proptech sector and its influence is in the nascent stages,” Bedke tells GlobeSt.com. “Even without considering the impact of 5G, 3D printing, AI, IoT, drones, autonomous vehicles, smart homes, wearable technology and the like, all aspects of business and our daily lives are unquestionably becoming more reliant on technology.”

The efforts to increase productivity will only continue, he adds, regardless of one's view as to whether Moore's Law, (the belief that processor speeds will double every two years), will continue to apply in the future.

The movement of data to the cloud is another trend that favors data centers. This year, tech giants are expected to invest billions into commercial real estate for data centers alone, creating significant opportunities for CRE developers whether near or far from tech hubs.

“Data centers are found across the United States and are always controlled environments,” Bedke says. “They have limits on temperature ranges, humidity levels, and access for security purposes. These facilities may be just a room or two in an office setting or they may take up an entire floor. We are seeing more activity than ever with respect to large, campus-like data centers but the 'average' is about 150,000 square feet.”

Site Selection Factors

A key driver when looking for data center locations is the availability of cheap and reliable sources of power. A plentiful supply of water is also important for cooling purposes. Other considerations include an area where land is relatively inexpensive and that is not susceptible to natural disasters.

“An area with an educated workforce is another factor to be considered. While Northern Virginia, California and other areas along the coasts have seen a lot of data center development, there has been a bit of a migration to the Midwest and Mountain West. Illinois, Iowa, Ohio, Colorado, Nevada and Utah are seeing an influx of data centers,” says Bedke.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.