CHICAGO—The City of Chicago's office market, bolstered by a strong local and national economy, ranked among the top five in the US in terms of new construction, according to a report released by commercial brokerage firm Avison Young.

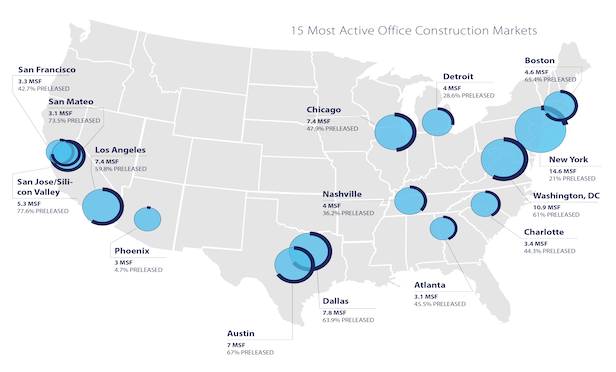

Chicago tied with Los Angeles for the fourth most active office construction market in the US with 7.4 million square feet under construction, according to Avison Young's Mid-Year 2019 Global Office Market Report.

In Chicago, nearly half (47.9%) of that space is pre-leased. New York ranked as the top market, with 14.6 million square feet (21% pre-leased) followed by Washington, D.C. with 10.9 million square feet (61% pre-leased), and Dallas, with 7.8 million square feet (63.9% pre-leased). Los Angeles has 59.8% of its 7.4 million square feet of office space under construction pre-leased.

"Chicago has seen a significant office construction boom in recent years, particularly in the West Loop and Fulton Market areas," says Jeff Lindenmeyer, a principal in Avison Young's Chicago office. "This continues to create opportunities for tenants, but also raises issues for landlords in competing submarkets, where many financial services firms and law firms have vacated to move into the new buildings. Many of those landlords are going to have to reposition their buildings to attract new tenants."

Lindenmeyer notes that the Chicago office market is not without some headwinds going forward. "There is a lot of uncertainty permeating the market, however, given the upcoming election and the inversion of the yield curve, which has raised concerns about a downturn," he says. "Certain tenant sectors are creating the absorption necessary to maintain positive momentum for new and redeveloped buildings as we head into 2020."

According to Avison Young research, there are currently 16 properties under construction within Chicago's CBD. The new construction is being absorbed in Chicago's office market as tenants focus on the efficiency of the buildings and the value seen in their respective locations.

"What tenants are doing is right-sizing, adjusting their approach to work flow, and going into more efficient spaces," notes Lindenmeyer. "With a smaller footprint, they can afford the higher rents in the new buildings."

Office vacancy in the top five largest markets were flat or improved in the second quarter. New York posted a 9.8% vacancy rate, Philadelphia had a 8% vacancy rate, Washington, DC registered a 13.9% rate, Chicago came in at 13.1% and Dallas had a 16.5% rate. The lowest overall office vacancy rates were in: San Francisco (2.1%); Gainesville, FL (4%), Savannah, GA (4.6%), Austin (5.1%) and San Mateo, CA (6.3%).

Downtown office markets outperformed suburban locations, as overall downtown vacancy fell 70 basis points to 10.4% in the second quarter, while suburban market vacancy improved 40 basis points to 12%.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.