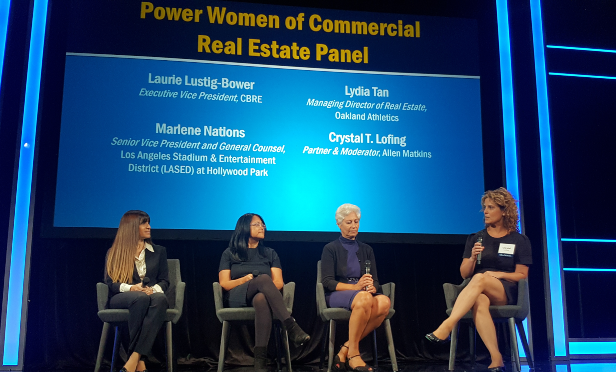

Regulation and particularly new rent control laws could push some multifamily investors out of the state, while others are hoping to adjust to rent increase restrictions. Laurie Lustig-Bower, an EVP at CBRE, discussed multifamily investment trends in California at the Allen Matkins View From the Top conference earlier this week. Lustig-Bower spoke on the Influential Women of Commercial Real Estate panel, focusing on her specialty of multifamily, and said increasing regulation is the biggest fear for investors in the state.

Regulation and particularly new rent control laws could push some multifamily investors out of the state, while others are hoping to adjust to rent increase restrictions. Laurie Lustig-Bower, an EVP at CBRE, discussed multifamily investment trends in California at the Allen Matkins View From the Top conference earlier this week. Lustig-Bower spoke on the Influential Women of Commercial Real Estate panel, focusing on her specialty of multifamily, and said increasing regulation is the biggest fear for investors in the state.

"On the horizon is rent control. We think the state is going to pass sweeping rent control," Lustig-Bower said on the panel. "This is very concerning to a lot of investors, and some will watch their portfolio lose value." Lustig-Bower says that some rent control laws are capping rents at 10% annual increases. That rent cap will allow investors to continue to be active in the market. There are also continued efforts to remove Costa Hawkins. Although it failed in November, Lustig-Bower expects it to come to the ballot again. If efforts are successful, Lustig-Bower says landlords will not be allowed to raise rents even when an apartment unit turns over. "That will put a lot of pressure on the market. I think the market will continue to be steady in the next few years," she added.

➤➤ Join the GlobeSt.APARTMENTS (formerly RealShare) conference October 29-30 in Los Angeles. The event will analyze the opportunity in the emerging trends and conditions of the multifamily market. Don't miss out on joining the 1000+ of the industry's top owners, investors, developers, brokers and financiers as they gather for THE MULTIFAMILY EVENT OF THE YEAR! Click here to register and view the agenda.

While investors are concerned about rent control regulations, the current market is healthy and active. "Multifamily is very strong and has been for many years," said Lustig-Bower. "There is a shortage of housing, and that will put pressure on rents to continue to go up. But, they will go at a moderate pace." Most apartment properties are trading at a 3% or 4% cap rate, and rarely will a property trade over 5%.

While demand is strong, new construction deliveries could dampen rental growth. "In some markets with a lot of development, rents may be flat as new supply is delivered," said Lustig-Bower, adding that even with slower rent growth, "for investors, cap rates will continue to stay low."

At the end of the panel, Lustig-Bower also gave career advice to others looking to build a career in commercial real estate. "You should find something that you are passionate about. Have a conversation with yourself about where you want to be in five years," she said. At the start of her career, she followed that same advice and wrote herself a business plan. A year later, she closed her first major deal and started to build the team she has today.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.