NEW YORK CITY—Over the last few years debt funds have become an increasingly important part of the commercial mortgage lending landscape. This year, these alternative lenders hit a milestone: for the first half of 2019 they represented a larger share of the commercial mortgage markets than the life insurance companies, according to Real Capital Analytics.

This milestone is even more striking when it is put into historic context. Coming out of the Great Recession, RCA's Jim Costello writes, life company lenders were the only source of capital available for many commercial property investors, aside from the agencies.

Too Much Risk?

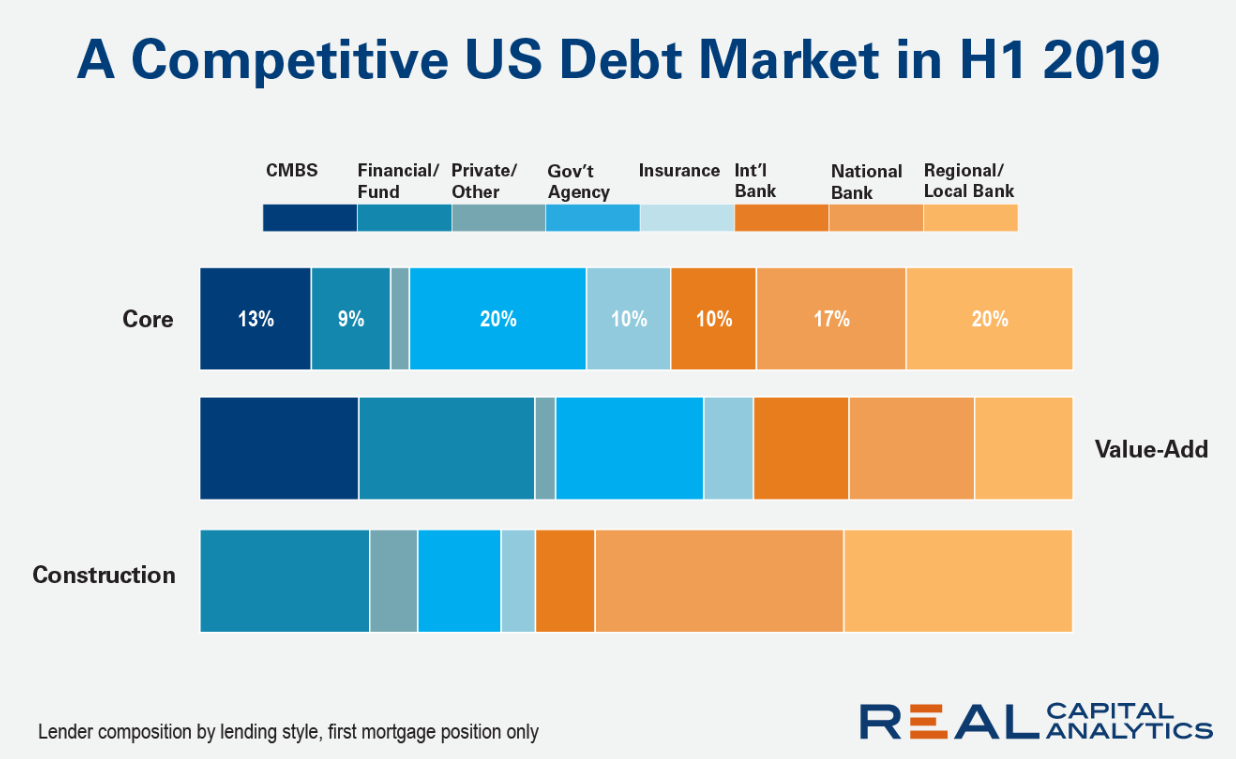

Life insurance companies still represent a larger share of lending for core investment strategies than do debt funds, but the levels are close, RCA notes: a 10% share for life companies vs. 9% for debt funds. It is in the riskier investment styles, however, where debt funds are more competitive, allowing them to capture more market share than insurance company lenders this year.

One question to ask as debt funds continue to gain market share is whether they will introduce too much risk into the financial system, much like the CMBS originators did in the early 2000s.

Costello notes that the debt funds are not taking on the same sort of risks of the CMBS originators in the last cycle. Rather, they are taking on new types of risks. "Importantly, these debt funds have skin in the game that the CMBS market did not in the last cycle," he writes.

Pricing Support

Perhaps just as importantly, he adds, the competition in the debt markets has supported pricing over a time of growing uncertainty. "Rather than test the waters in the sale of an asset, investors can refinance assets in the current market." Indeed RCA reports that the value of refinancings represented 42% of the capital flowing to commercial real estate in the first half of 2019 versus a 38% share for the acquisition of assets.

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.