MIAMI—The greater Miami area is experiencing the highest level of construction activity in a decade, but is managing to post mainly positive absorption numbers due to strong tenant demand.

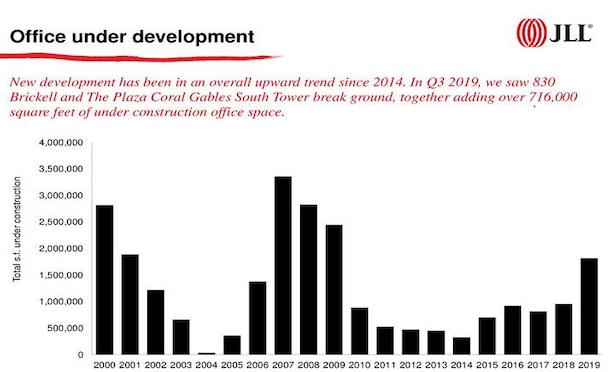

In its third quarter report on the office market for Miami-Dade counties, brokerage firm JLL reports that the market is seeing nearly 1.8 million square feet of new office product under construction, including 830 Brickell, which is the first tower to rise in Brickell in more than a decade. The project, which secured tenant WeWork for nine floors, along with The Plaza Coral Gables South Tower, accounts for part of the 716,000 square feet of office space under construction in Miami's urban core at the moment.

Despite the heady construction levels, the Miami CBD posted negative absorption of 1,078 square feet primarily due to SunTrust vacating floors two through four at 777 Brickell, ultimately downsizing and now occupying the ninth floor at the property.

The suburban markets posted approximately 56,000 square feet of positive absorption. This was for the most part due to the new Optimum development in Aventura delivering this quarter. The 44,293-square-foot office building is nearly fully occupied thanks to strong pre-leasing, JLL reports. The regional office vacancy rate stood at 15.5% at the end of the third quarter.

Year-over-year average rents jumped 5.0% to $41.11-a-square-foot. Among the buildings with the largest rent hikes includes 800 Brickell, where average rents went from $42.00-a-square-foot to $47.00-a-square-foot during the same period, an increase of 11.9%, JLL states in its report. The Miami CBD had a year-over-year increase of 0.2%, the suburbs saw average rents rise 10.0%.

Suburban properties are now seeing asking rent appreciation that is approaching levels sought for CBD properties, JLL notes that the Optima Onyx Tower in Aventura has asking rents that have now reached $60.00-per-square-foot.

Looking forward, JLL predicts, "Miami is on track to close the year with strong absorption numbers. And thanks to known leases yet to see tenants move in this only reinforces the rosy outlook. As new projects complete, it will be interesting to see how rents react."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.