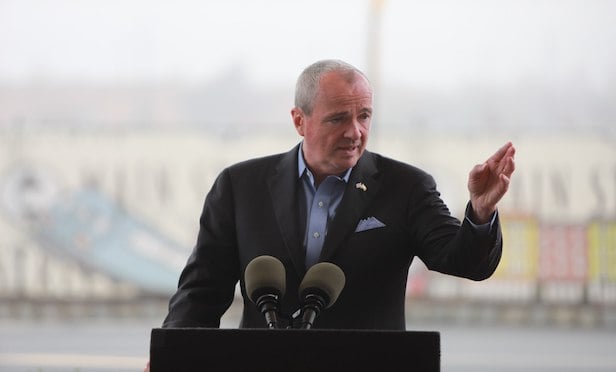

NEWARK, NJ—New Jersey Gov. Phil Murphy signed an executive order earlier this week that mandates the creation of a public bank within one year.

Executive Order No. 91 creates the Public Bank Implementation Board whose objectives will include assessing capital needs for New Jersey's small businesses, students, and local infrastructure and affordable housing projects.

The board will conduct at least three public meetings to better understand how the state can better reduce those capital needs, with a special emphasis on supporting low-income and minority populations; enhancing the coordination and services of state authorities; identifying how a public bank can strengthen the capacity of local financial institutions and non-profit entities; develop a business plan for a public bank that determines capitalization needs and outlines a governance and operation structure; and consults with experts or other knowledgeable individuals in the field of public banking.

"Leveraging state resources to provide greater access to capital for our communities, small businesses, municipalities, and students is an important component of building a financially inclusive New Jersey," said Gov. Murphy. "With the creation of this implementation board, I am proud to take the first step toward ensuring that our taxpayer dollars are invested here in New Jersey."

The board will be made up of 14 members, chaired by Commissioner of Banking and Insurance Marlene Caride, and includes four public members. The board will hold its first meeting within 30 days.

Department of Banking and Insurance Commissioner Caride says, "This board will conduct the research necessary to determine the path forward for a public bank designed to provide access to capital that will allow us to improve our infrastructure, revitalize our communities, to assist small businesses, and provide residents with access to higher education loan financing."

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.